The recession brought on by the global spread of COVID-19 has been nothing short of devastating. Unemployment in the U.S. has skyrocketed, and entire industries have gone into complete shutdown mode. Yet, the potential for a large and rapid recovery remains, as all 50 states have now opened to at least some degree.

Some American cities are better positioned for a swift economic recovery than others. To help determine the likely winners, GOBankingRates analyzed health and economic data to sort out the recovery potential of the 100 largest U.S. cities by population.

Factors evaluated by GOBankingRates included a city’s percentage rise in unemployment, its top three industries, COVID-19 infection rates, household poverty rates, and foreclosure rates, with national averages used for comparison.

Cities with strong economic foundations, particularly in terms of household poverty and foreclosure rates, ranked highly, as did those with large jumps in unemployment, as they have the highest potential for recovery. Cities with low rates of infection were also ranked more highly in terms of recovery potential.

Although higher unemployment offers more room for recovery, some cities where employment remains relatively strong, such as Anchorage, Alaska, also scored well in the survey, as its wealth and low case counts keep it primed for a comeback.

Although the specific factors for recovery vary from city to city, each of these 50 municipalities has the potential to recover nicely from the current economic crisis. The data provides a good picture as to which cities and states are ready to fight back and which ones are least prepared for the recession.

graphiknation / Getty Images/iStockphoto

1. Atlanta

As a city with nearly 500,000 residents, Atlanta’s diverse economy has helped protect it against the economic downturn. Just 13.2% of its households are below the poverty line, which isn’t a high rate for a city of this size.

culbertson / Getty Images/iStockphoto

2. St. Paul, Minnesota

The capital city of Minnesota has fought off the economic crisis of 2020 fairly well. While the national average change in unemployment from January to May was 308.33%, St. Paul weathered the storm with a 196.77% rise in unemployment.

Checubus / Shutterstock.com

3. Minneapolis

Like its sister city St. Paul, Minneapolis has suffered less than other cities through the coronavirus crisis, with a 196.77% rise in unemployment. However, Minneapolis might be even better positioned for a recovery, as just 10.3% of city households lie below the poverty line.

TrentGarverick / Getty Images/iStockphoto

4. Columbus, Ohio

Columbus may be primed for a quick recovery out of the current recession because it has already survived relatively well. The rate of foreclosure in Columbus is well below the national average, as is the growth in its unemployment rate.

benedek / Getty Images/iStockphoto

5. San Antonio

For a larger city, San Antonio has done admirably well at fending off cases of COVID-19. Although its population is approaching 1.5 million, the city only has a rate of infection of 221.19 per 100,000 residents, well below the national average rate of 671.52.

Sean Pavone / Getty Images/iStockphoto

6. Denver

The Mile High City had a higher-than-average percentage jump in unemployment from January to May 2020, but it began from a very low base of just 2.7% pre-pandemic. That puts the current unemployment rate in the city at just 12.1%, a full 2.6% below the current national average of 14.7%.

benkrut / Getty Images/iStockphoto

7. Des Moines, Iowa

Des Moines has one of the lowest percentages of households living below the poverty line, at just 10.3%. Compared with the national average of 13.1%, Des Moines is better positioned economically for a quick recovery out of the current recession.

sdominick / Getty Images/iStockphoto

8. Pittsburgh

A combination of a low infection rate of 171.20 per 100,000 residents and a smaller-than-average unemployment jump of 213.46% position Pittsburgh to make a quicker recovery from the coronavirus pandemic than many other cities.

Davel5957 / Getty Images/iStockphoto

9. Louisville, Kentucky

The annual Run for the Roses may have been postponed until September, but Louisville is better positioned than many cities in terms of an eventual economic recovery. The city’s foreclosure rate of 1 in every 5,204 is about one-third of the national average.

TriggerPhoto / Getty Images/iStockphoto

10. Kansas City, Missouri

Kansas City’s relatively low 202.7% spike in unemployment helps its positioning to recover after the coronavirus epidemic, but its case rate may be the biggest contributing factor. With just 123.52 cases per 100,000 residents, Kansas City has resisted the virus at a much greater rate than the national average of 671.52 per 100,000.

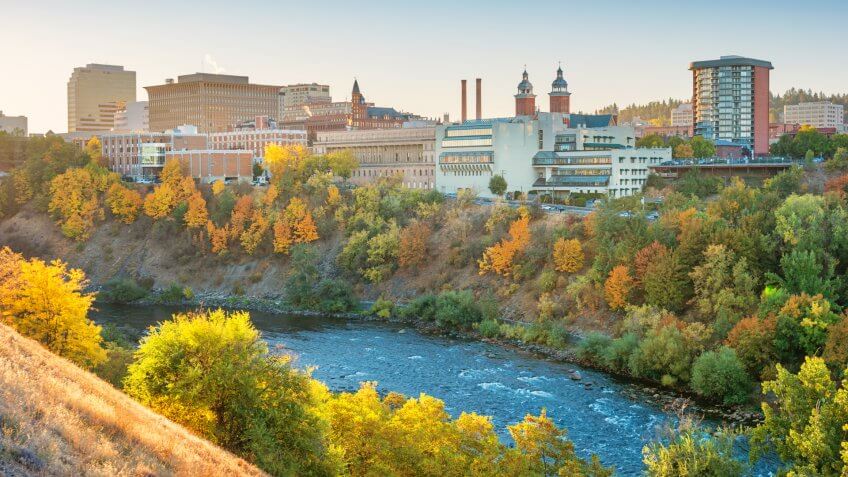

benedek / Getty Images/iStockphoto

11. Spokane, Washington

Spokane has the edge on many cities in terms of recovery, as three main factors work in its favor. First, it has a relatively low COVID-19 infection rate of 161.86 per 100,000 residents; second, its unemployment rate “only” jumped a relatively low 172.41% from January through May 2020, compared to the nationwide average of 308.33%; and lastly, its foreclosure rate remains low.

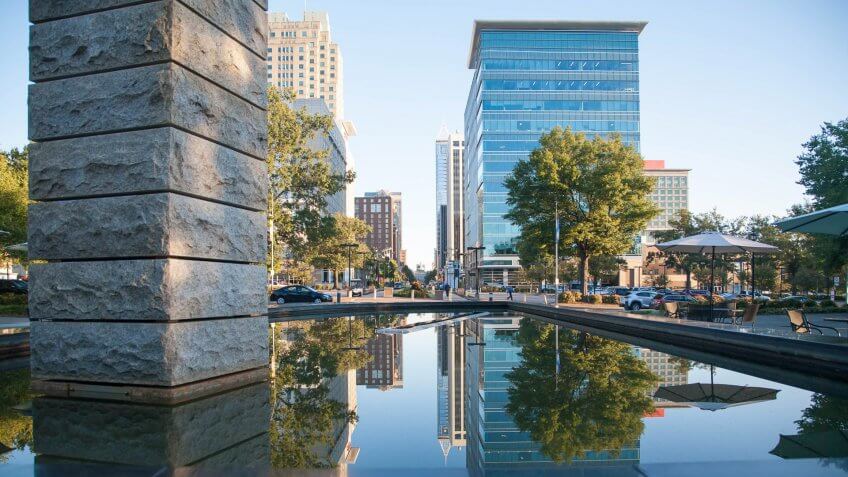

RiverNorthPhotography / Getty Images

12. Lincoln, Nebraska

Lincoln might be one of the success stories of America’s heartland when it comes to recovering from the coronavirus recession, as it’s poised to be one of the quickest to rebound. Even though its unemployment rate rose by a slightly below-average 244.44%, the rate itself is still in the single digits, at just 9.3%.

Sean Pavone / Getty Images/iStockphoto

13. Charlotte, North Carolina

Charlotte remains ready to reignite its economy primarily because it is a relatively wealthy city. Just 11.2% of Charlotte households live below the poverty line, and the foreclosure rate remains well below the national average.

SeanPavonePhoto / Getty Images/iStockphoto

14. Birmingham, Alabama

Birmingham has a relatively low foreclosure rate and its primary employer is government, which can both be catalysts for the city to get back on track rapidly as the economy turns.

DenisTangneyJr / Getty Images/iStockphoto

15. Buffalo, New York

Buffalo is in a similar position to its southern cousin Birmingham in terms of its potential for economic recovery. Like Birmingham, the foreclosure rate in Buffalo is quite low, and the city’s primary industries are not trading, transportation and utilities, as in many other cities. Rather, Buffalo’s economic engine keys on education and health services, both of which are essential and important contributors to economic recoveries.

Sean Pavone / Getty Images/iStockphoto

16. Tampa, Florida

Tampa hasn’t suffered as badly as many other cities, as its COVID-19 infection rate has only been 266.27 per 100,000 residents.

Manny Chavez / Getty Images/iStockphoto

17. Sacramento, California

Sacramento has one of the lowest rates of COVID-19 infection in the entire country, with just 116.42 residents afflicted per 100,000 population. That makes for a total COVID-19 count of only 1,794 in the entire county. Of course, that only reflects the people who have been tested.

pisaphotography / Shutterstock.com

18. Jacksonville, Florida

Jacksonville is another city that has a good combination of low foreclosure rates and low COVID-19 infection rates. Both of these factors make Jacksonville more likely to bounce back rapidly from the current crisis.

EddieHernandezPhotography / Shutterstock.com

19. Oakland, California

The former home of the NBA’s Golden State Warriors has very few residents living below the poverty line, at just 10.1% versus the national average of 13.1%. Oakland has also done a good job limiting transmission of the coronavirus, with far fewer residents infected than in the average U.S. city.

©Shutterstock.com

20. Colorado Springs, Colorado

Colorado Springs is in a similar boat to Oakland when it comes to resilience to the recession. The home of the U.S. Air Force Academy has both a low infection rate and a small percentage of households living under the poverty line.

Sean Pavone / Shutterstock.com

21. Oklahoma City

Oklahoma City has had a steep rise in its unemployment rate, but its low rate of infection could help it recover more quickly than other cities. At just 207.3 cases per 100,000 residents, Oklahoma City is far below the national average rate of infection.

Roschetzky Photography / Shutterstock.com

22. Austin, Texas

Austin’s relatively low rate of households living in poverty should give it an economic leg up when the recession begins to turn. Only 11.5% of households fall below the poverty line, as opposed to 13.1% of homes across the country.

bobcooltx / Shutterstock.com

23. Fort Worth, Texas

Fort Worth is in a similar economic position to its sister city Austin. Both cities have a relatively small percentage of households living under the poverty line. However, Fort Worth has an additional leg up because it has an extremely low foreclosure rate as well.

©Shutterstock.com

24. St. Petersburg, Florida

Sunny St. Petersburg has done a great job of fighting off the virus, with only 244.96 cases per 100,000 residents. It’s also got a lower-than-average 12.5% of its residents living under the poverty line.

DenisTangneyJr / Getty Images/iStockphoto

25. Aurora, Illinois

Aurora is primed for a rapid economic recovery due to two main factors. First, only 9.3% of its residents live under the poverty line, one of the best rates in the country. Aurora also benefits from a very low rate of foreclosures.

Vito Palmisano / Getty Images/iStockphoto

26. Nashville, Tennessee

Nashville’s unemployment rate has skyrocketed from January to May, but it still is primed for a quick recovery from the recession. For starters, the unemployment rate before the COVID-19 crisis was a very low at 2.8%. The city also benefits from an extremely low foreclosure rate.

DenisTangneyJr / Getty Images

27. Madison, Wisconsin

The home of the University of Wisconsin-Madison stands tall in the fight against the COVID-19 recession thanks to low infection rates and relatively wealthy households. The case rate in Madison is 178.48 per 100,000, while the percentage of households living below the poverty line is just 11.1%.

Kyle Sprague / Shutterstock.com

28. Portland, Oregon

With one of the lowest foreclosure rates in the nation, Portland is fighting the good fight against the current recession. A low rate of COVID-19 infections is helping defend the city against further economic deterioration as well.

benedek / Getty Images

29. Oxnard, California

Oxnard is part of the wealthy Oxnard-Thousand Oaks-Ventura metropolitan statistical area, which accounts for the extremely low rate of household poverty at just 8.7%. Oxnard also has a low rate of COVID-19 transmission, which may help it recover more quickly from the pandemic.

Davel5957 / Getty Images

30. Tulsa, Oklahoma

Tulsa’s moderate foreclosure rate and relatively low number of cases are helping to defend against the city’s steep jump in unemployment during the current recession.

CrackerClips Stock Media / Shutterstock.com

31. Orlando, Florida

As one of the world’s tourism meccas, it’s perhaps no surprise that the unemployment rate in Orlando has had a considerable jump during the crisis. However, the city has done a good job at containing infections, which should help it recover more quickly than many other cities.

April Ann Canada / Getty Images/iStockphoto

32. Raleigh, North Carolina

Sir Walter Raleigh’s namesake city is doing a great job of positioning itself for an economic rebound from the current recession. The city boasts one of the lowest foreclosure rates in the nation, and only 8.6% of its residents live below the poverty line, far below the 13.1% national average.

Sean Pavone / Getty Images

33. Wichita, Kansas

Wichita is banking on its success in containing the coronavirus to help it recover quickly from the pandemic. The city’s infection rate of 148.75 per 100,000 residents is far below the national average.

JMcQ / Shutterstock.com

34. Anchorage, Alaska

Employment in Anchorage has held up nicely, with its unemployment rate rising by only about half that of the national average. Thanks to quirks in routing and the overall decay in global transportation, Anchorage actually became the busiest airport in the world on certain days during the crisis, likely helping the unemployment picture. The city also has very few households living under the poverty line.

christiannafzger / Getty Images/iStockphoto

35. Boise, Idaho

Boise has three weapons in its arsenal as it fights to come back from the recession. In addition to having one of the lowest foreclosure rates in the country, Boise has relatively few households living under the poverty line and a low rate of coronavirus infections as well.

Art Wager / Getty Images

36. San Diego

Sunny San Diego has managed to keep its coronavirus infection rate relatively low, at 287.44 cases per 100,000 residents. Low home foreclosure rates and households living under the poverty line form a good backdrop for a strong economic recovery from the recession.

JoMo333 / Shutterstock.com

37. Chesapeake, Virginia

Just 8.2% of households in Chesapeake live under the poverty line, far below the national average of 13.1%. Coupled with low foreclosure rates and a relatively low COVID-19 infection rate, Chesapeake may be one of the cities making a fast recovery from the recession.

Jon Bilous / Shutterstock.com

38. Miami

Miami is a global tourism hotspot, so naturally, its unemployment rate has gone up significantly during the COVID-19 pandemic. However, the city has a very low foreclosure rate, suggesting that it can make a big comeback when tourism resumes.

Arina P Habich / Shutterstock.com

39. Aurora, Colorado

Aurora has one of the lowest foreclosure rates in the country, and that may be due — at least partially — to the wealth of the community. Just 8.5% of residents live under the poverty line in Aurora, helping to defend the city against economic downdrafts.

MattGush / Getty Images/iStockphoto

40. Anaheim, California

Like other cities with tourism as a major industry, Anaheim has taken a hit in terms of unemployment. Yet, the home of Mickey Mouse is a relatively wealthy community, with just 10.2% of residents living below the poverty line. A lower-than-average COVID-19 infection rate should help the city bounce back rapidly as the economy turns.

Sean Pavone / Getty Images/iStockphoto

41. Tacoma, Washington

The combination of low household poverty rates and a below-average infection rate may keep Tacoma primed for a quick recovery from the current crisis.

Sherry V Smith / Shutterstock.com

42. Virginia Beach, Virginia

Virginia Beach has one of the lowest rates of household poverty in the nation, with just 7.1% of residents living under the poverty line. Additional factors that can help this city get on its feet quickly are its low foreclosure rate and its low case count of 899 infections, a rate of just 199.69 cases per 100,000 residents.

Alex Potemkin / Getty Images

43. San Francisco

Early lockdowns in California have helped San Francisco keep its case rate to just 334.2 per 100,000 residents, about half of the national average. Low foreclosure and household poverty rates provide economic buffers to help the city recover more rapidly than many others.

NicolasMcComber / Getty Images/iStockphoto

44. San Jose, California

San Jose benefited even more from the California lockdown than its sister city San Francisco, with a case rate of just 166.7 per 100,000, about one-quarter of the national rate. The wealthy city also has an exceedingly low rate of household poverty, at just 7.7%.

aimintang / Getty Images

45. Plano, Texas

Plano was America’s most affluent city back in 2008, and its continuing wealth has helped defend it against the COVID-19 recession. Plano has an extremely low foreclosure rate and one of the lowest household poverty rates in the entire country, at just 6.5%.

carterdayne / Getty Images

46. Seattle

Seattle’s path to recovery is primarily wealth-based. The city has a low foreclosure rate, and just 8.9% of its households live beneath the poverty line. COVID-19 cases are below average as well.

Sean Pavone / Getty Images/iStockphoto

47. Grand Rapids, Michigan

Grand Rapids has struggled with unemployment during the COVID-19 crisis, but pre-pandemic, only 2.9% of the city’s workers were without jobs. Both household poverty and foreclosure rates are well below the national average.

alacatr / Getty Images/iStockphoto

48. Reno, Nevada

The Biggest Little City in the World remains poised for a rebound when the pandemic passes and tourism resumes. The city benefits from low household poverty and foreclosure rates.

Kit Leong / Shutterstock.com

49. Las Vegas

Las Vegas is the entertainment capital of the world, so it’s no surprise that it has suffered mightily in the employment department during the pandemic. But things are starting to turn. Its casinos and hotels are already coming back online, and the city has a solid economic backdrop, with relatively low foreclosure and household poverty rates.

zorazhuang / Getty Images/iStockphoto

50. Honolulu

Honolulu shut its doors to even domestic tourists when the coronavirus hit, making its unemployment rate skyrocket. Yet, the closure has had its intended effect, with COVID-19 cases at a shockingly low rate of 51.12 per 100,000 residents. The wealthy city sees only 9% of its residents living below the poverty line, so when tourism returns, the city will bounce back in a big way.

Methodology: To find cities best prepared to “reignite” their economies and job markets, GOBankingRates used the U.S. Census Bureau’s 2018 American Community Survey to find the 100 largest cities in the United States in terms of population that had either a unique metropolitan statistical area or county associated with them that did not overlap with other cities. Once these 100 cities were isolated, GOBankingRates first had to determine how “reignite” would be defined. GOBankingRates decided that in order for a city to reignite its economy, a city/MSA had to have seen a significant increase in unemployment and the state’s top industries also had to see equally significant unemployment, with the assumption that big losses equal big opportunity for recovery.

The first thing GOBankingRates collected was both the January 2020 and April 2020 unemployment rate for each city’s MSA as sourced from the corresponding MSA’s Employment and Unemployment (Monthly) News Releases from the Bureau of Labor Statistics. These two rates were then compared to give (1) the percent change in unemployment from January to April, with the highest rise in unemployment being best. GOBankingRates then found the (2) national unemployment for each non-farm industry as sourced from the Current Population Survey conducted by the Bureau of Labor Statistics and applied the same comparison and scoring as above. Next, GOBankingRates found the percent of the labor force each industry employs in each state as sourced from the Bureau of Labor Statistics Table 3. GOBankingRates then identified each state’s largest three industries in terms of employment, took each industry’s score from factor No. 2 and multiplied it by the percentage of the workforce it employs in each state to get scores for factors No. 3-5 representing the impact of unemployment in each state’s top three industries.

Finally, GOBankingRates found (6) each city’s county COVID-19 data in terms of COVID-19 cases per 100,000, as sourced from Johns Hopkins University & Medicine Coronavirus Resource Center; (7) the percent of each city’s county living below the poverty line, as sourced from the U.S. Census Bureau; (8) and the foreclosure rate for each city, as sourced from RealtyTrac. These factors were considered indicators of high potential for quick recovery if they were low (i.e., fewer COVID-19 cases per 100,000, fewer households below the poverty line and a lower foreclosure rate).All factors were then scored and combined with the highest score being best to determine rankings.

All data was collected June 16-19, 2020, and is up to date as of June 19, 2020.