Even though several states have begun phased reopening plans to keep the economy moving despite the coronavirus pandemic, some American employees would like to continue working from home full-time, despite it costing them money, a new CreditCards.com survey found.

In fact, more than one-third of respondents who were given the opportunity to work from home said they don’t want to return to their workplace when state and federal restrictions lift – or at least this is the sentiment from workers in late May when the survey took place.

Post-coronavirus work from home opportunities is in high demand for some American employees. (iStock)

Although working from home may have its perks according to some respondents, the task has hiked up regular monthly expenses by $108 on average for employees, CreditCards.com found. These additional costs have reportedly gone to gas or public transportation, groceries, clothing or dry cleaning, childcare, utilities and restaurants.

The expenses that increased the most were groceries and utilities, which went up to $182 and $121 on average per month, respectively. On the opposite end of the spectrum, employees who work from home were able to save $34 on childcare on average per month followed by $33 on gas or public transportation, $27 on restaurants, and $4 on clothing or dry cleaning.

“Surprisingly, average expenses have gone up for people working from home, but it’s a tradeoff most are very happy with,” said CreditCards.com’s Industry Analyst Ted Rossman about the survey’s findings. “Most workers seem content to skip the commute and potentially work in their pajamas, even if it means spending more on food and utilities.”

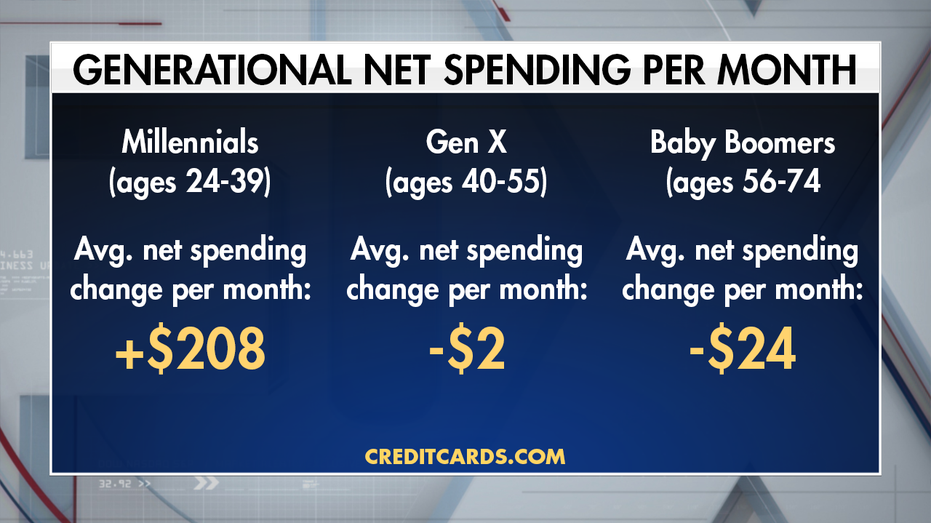

Overall, Millennials who were able to work from home outspent other generations with an increase of $208 to regular expenses on average per month while Gen X and Baby Boomers had their monthly expenses decrease by $2 and $24 on average, respectively.

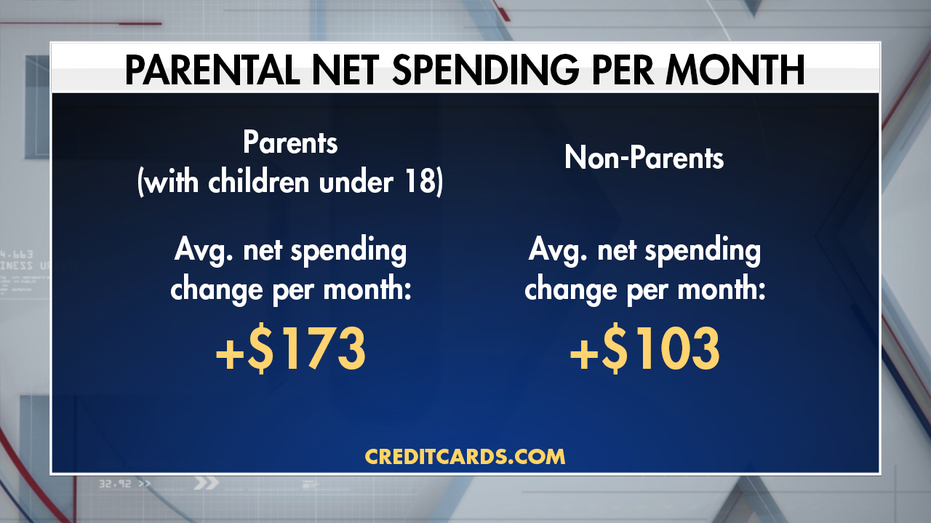

Similarly, work from home employees who are parents of children under the age of 18 spent more money on a monthly basis than non-parents. On average, these parents spent $173 more than they usually do while their non-parent counterparts spent $103 more.

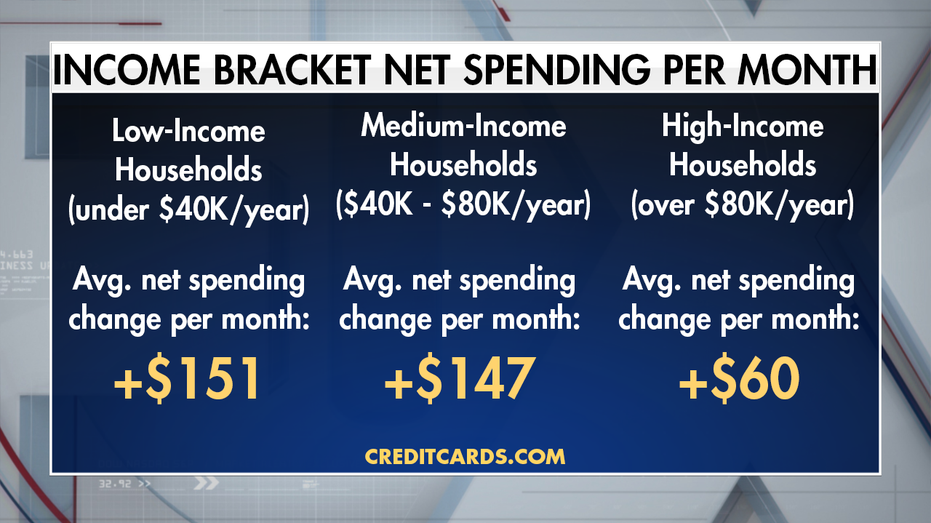

In terms of different income brackets, households that make less than $40,000 annually outspent those that make more, though, the reason is unclear. These households spent $151 more on average per month while households that make between $40,000 and $80,000 annually spent $147 more on average per month and households that make more than $80,000 annually spent $60 more on average per month.

When it comes down to regional differences, 37 percent of Northeastern employees were able to work from home at some point during the pandemic while 34 percent of Western employees were able to do the same. Southern and Midwestern employees were able to work from home at 26 percent and 25 percent, respectively.

By region: +$235 for the Northeast vs. +$108 for the Midwest, +$62 for the South, and +$61 for the West

One-third of employed U.S. adults were able to work from home for a period during the coronavirus, according to CreditCards.com. Moreover, 24 percent of respondents are working from home currently.

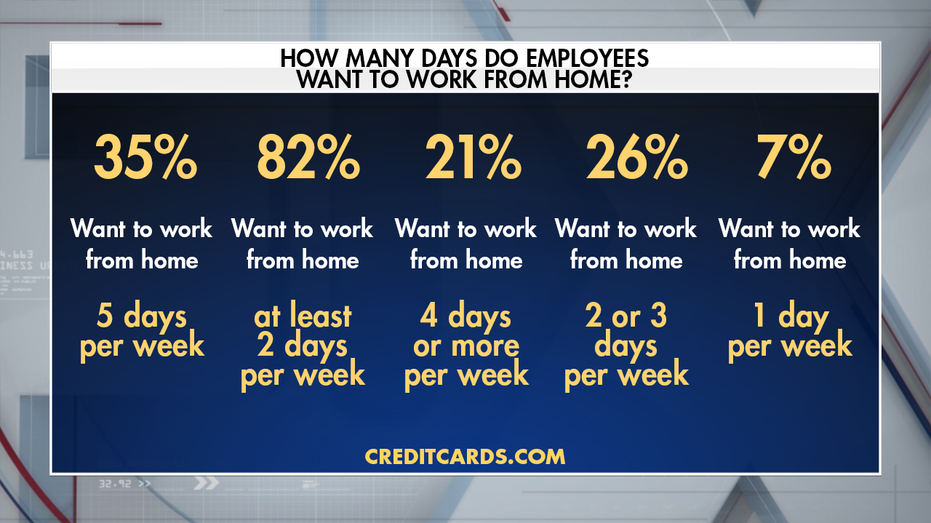

Outside of the 35 percent who said they would like to work from home five days per week, the grand majority of the survey’s respondents said they would like to work from home only part-time when restrictions lift.

A whopping 82 percent of employees said they would like to work from home at least two days per week, which includes the respondents who initially said they would like to work from home full-time. Meanwhile, 21 percent said they would like to work from home four days or more per week and 26 percent said they would like to work from home two-to-three days per week.

Only seven percent of respondents would like to work from home one day per week.

For those who prefer to get work done in their actual workplace, six percent of the survey respondents said they would like to work from home less than one day per week while four percent said they don’t want to work from home at all.