Financial freedom isn’t about how much you make.

It’s about how much you save.

Earning $1111 or $9999 won’t make a difference for your financial freedom if you’re spending all of it on consumer goods like food, technology, and travel.

By not investing anything, you won’t have left enough from your salary slip to make your money work for you.

Investment principles work like weight loss. You only lose weight if you increase the difference between the calories you eat and the calories you burn.

The higher this difference, the faster you lose weight. To enhance this gap, you can either eat fewer calories or burn more calories and exercise more. If you work on both ends, you’ll get great results.

With investing, you also want to focus on increasing the difference between how much you earn and how much you spend. The broader this gap, the sooner you’ll achieve financial freedom. You can earn more or spend less. By focusing on both factors, you’ll reach financial freedom.

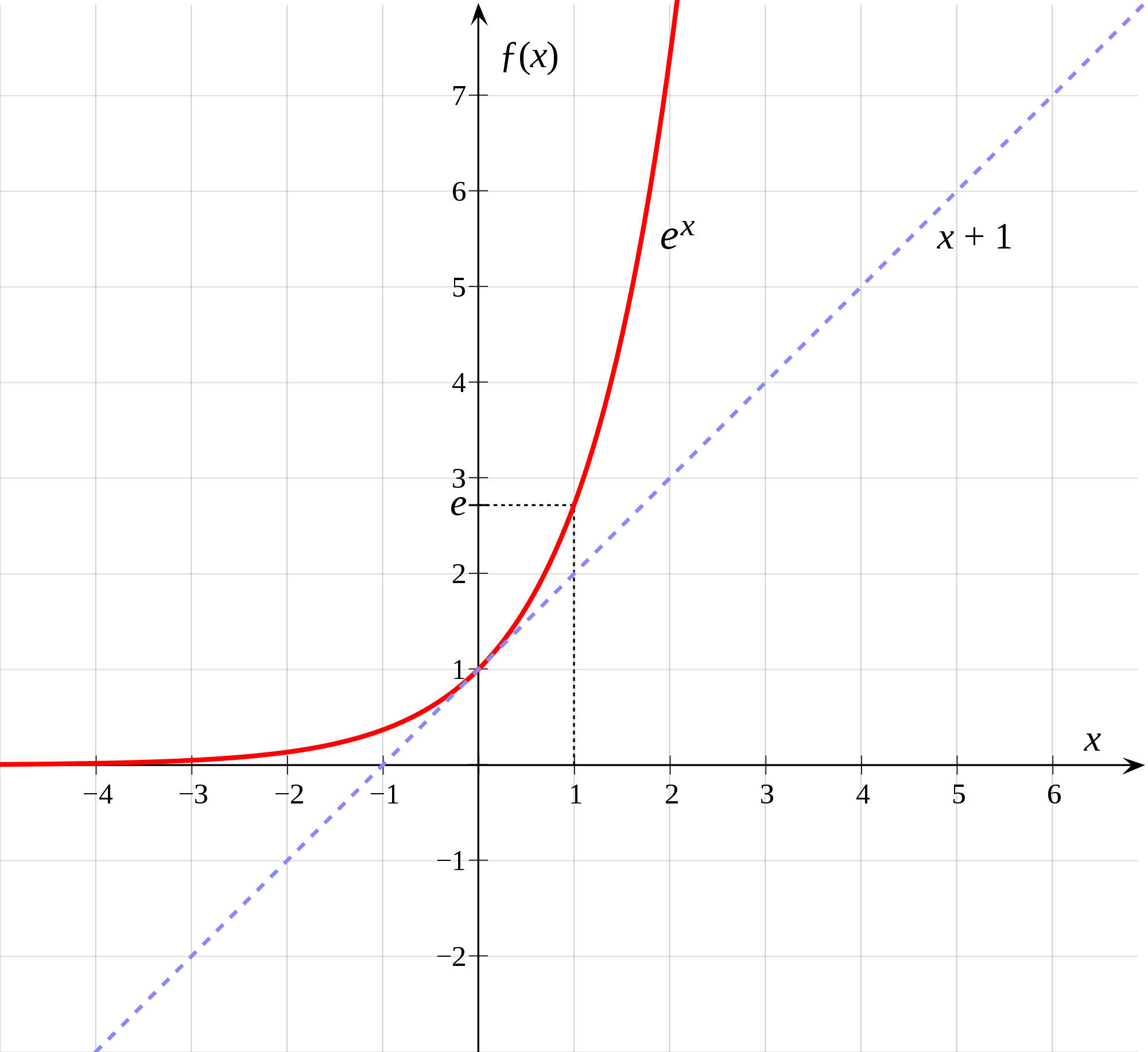

Here’s why earning more and spending less makes sense: The more you invest each month, the faster your money will grow. Factor in compound interest, and you’ll see your investments grow exponentially.

By saving enough, you can achieve financial freedom faster than you imagine.

6 Ways To Earn More Money

1) Do great work, then renegotiate your salary.

You only get what you dare to ask for. And you only dare to ask for things, you’re confident you deserve.

Whatever salary you ask for, you can find companies that are able and willing to pay for it. Yet, you will only be able to make them agree by being 100% confident your work is worth that price.

To excel at your job, you must first know what your employer needs. Hence, instead of dutifully completing your tasks, figure out how you can make a dent. For example, gather information by asking the decision-makers in your company:

What does the ideal outcome for this project/term/process look like?

What’s the worst-case you’re worried about?

How to apply this advice:

You want to ask for so long until you figure out what you can do to make your employer more successful.

By being essential for your company’s success, your manager will do everything to keep you. Your goal is to become indispensable.

Make your work’s results visible. Stress numbers, like the money you saved, the time you saved, the customers you won, or the deals you’ve closed.

Then ask for the salary or bonus you think you deserve. Prepare for negotiations and ask correctly for what you think is right.

There are countless opportunities available to everyone if they‘d muster the courage to ask. Be the one who dares to ask.

2) Be intentional on how you spend your time.

Time is money. Yet, we give away our time without thinking about it. Or as Seneca puts it,

“No person hands out their money to passersby, but to how many do each of us hand out our lives! We’re tight-fisted with property and money, yet think too little of wasting time, the one thing about which we should all be the toughest misers.”

Using your time unintentionally is easier than ever before. Businesses in our attention economy trick us with smart hooking mechanisms. A notification here, a gratification there, and you’ll find yourself glued to your screen.

Do you read a book, or do you scroll through IG?

Do you take a MOOC or watch Netflix?

There’s no right or wrong answer to these questions. But whatever you do, be intentional on why you do it and for how long you want to do it.

I struggled for a year until I understood the value of my time. My phone became my time’s enemy. Changing my smartphone habits was the hardest part but also the most effective one.

How to apply this advice:

Build default options that protect your time instead of robbing your time.

Disengage with everything that takes your time without taking your consent.

On your phone, disable all notifications and switch your phone to airplane mode whenever you want to concentrate.

Whenever possible, replace your phone with another solution. For example, replace your smartphone’s alarm function with a classic alarm clock to kickstart your day with a clear mind.

Moreover, set intentions in the morning and at night. By knowing how you want to spend your time, it’ll be easier to identify situations on how not to spend your time.

Know what matters to you and ruthlessly say no to everything else.

3) Visualize your financial goals.

Many people want to change their financial situation but fail. Instead, they find themselves in the same thought pattern over and over again.

You can’t expect things or circumstances to change.

Nothing changes unless you change.

Start with changing your thoughts. Once you change your thoughts, you’ll make new choices that ultimately lead to new decisions.

What kind of work do you want to be doing to earn your money?

What’s your biggest dream, and how much does it cost?

How much money have you saved in 5, 7, 10 years?

How much money will you be making?

How to apply this advice:

Take seven minutes to answer the above questions. Then, browse through google or Pinterest to find pictures that represent your goals. Print the pictures or make a collage to save them as your wallpaper.

Look at your goals every day and dive into the emotion. How do you feel when you’ve accomplished everything you aimed for? How does your posture change? How do people around you react to your achievements?

The more vivid you picture your so-called vision board, the sooner you’ll make your dream become a reality.

Here’s what I visualize almost every morning:

I earn and own enough money to spend my winters in places filled with sunshine. I picture myself in a hammock beneath the palm trees, gazing over the sea. I have money that I can use for positive change in the world. I’ve enough money to invite my closest friends for weekend adventures in nature. I can afford high-quality food and can use my time to learn and help. I’m financially independent and have time to spend with my family, friends, and inspiring people all around me. To achieve this, my partner and I need 12K$ a month.

4) Diversify your income streams.

It’s easier to make more money by diversifying your income streams than to increase the one income stream you have.

The best way to do so is to look for scalability. The most profitable jobs are the ones that don’t pay you for an hour of presence but for the great stuff you created.

Create a passive income. Sell unlimited products, like e-books or online courses. Build a system that’s scalable in which your profit doesn’t correlate with your time investment.

How to apply this advice:

If you already started a side hustle, execute. If you’re clueless, listen to Chris Guillebeau’s Side Hustle School Podcast, where he shares the ideas of >100 entrepreneurs.

Here are some ideas for more income streams with low entry barriers:

- Self-Publish on Amazon

- Sell Photos & Stock Footage on Websites like Shutterstock, iStock/Getty Images, and Fotolia

- Offer language courses online

- Sublet your apartment on Airbnb

I rented my home in Vienna twice, then stopped. I don’t like other people staying at my place while I’m not around. Instead, I focus on diversifying my income streams with writing, website building, and education consulting.

5) Invest in yourself.

Investing in yourself will change your self-worth. Or as Benjamin Franklin put it:

“An investment in knowledge always pays the best interest.”

You can’t expect other people to make a big investment in your products if you’ve never done it yourself.

Once you’ve invested large sums in yourself, it’ll be easier for you to convince other people of your worth.

Reading the right books is the simplest yet most effective way of self-improvement. By learning and applying strategies from the smartest minds, you improve yourself step by step.

Since 2016, I read 161 books, and every day I find so much value on the pages. Recently, Ryan Holiday’s Ego is the Enemy dissolved many of my destructive belief systems.

How to apply this advice:

Buy books and read every day. Set 50$ aside every month to invest in coaching sessions, networks, online courses, or masterclasses.

Invest in your professional development by learning from the geniuses in your field.

To start, browse through Tim Ferriss’s Tools of Titans. In the wealth section, you’ll find world-class performers share their essential money lessons.

I pay 350$ a year for member access to an exclusive community of female leaders and to join invite-only events. It’s not the content that convinced me to join but the access to persons that prioritize personal growth.

6) Have a clear WHY you want to earn more.

Striving for wealth for the sole purpose of accumulating money isn’t sexy.

It’s not what motivates you to go all-in at work your job or to build passive income streams.

To earn more, you need to be clear about why you want to make more. Or as Simon Sinek says:

“Working hard for something we don’t care about is called stress: Working hard for something we love is called passion.”

Ask yourself:

- Why do you want to achieve financial freedom?

- What is different from nowadays?

- Why do you want to have ______ (fill in answer from 2)?

How to Apply this advice:

Take a pen and a piece of paper, set a timer for 10 minutes. Start scribbling your answers and only stop writing when your timer rings. Then, go back to your answers and highlight your quintessence.

Once you have your “why,” answering the “how” will be a lot more fun.

4 Ways To Spend Less Money

1) Spend more quality time with friends

Many people waste their youth climbing the corporate ladder. Workaholics trade lifetime for high paychecks. And after working long hours, they feel they deserve some material stuff.

Sadly, I write from experience. After a week of 13-hour days, I’d reward myself with a massage and an expensive new coat.

Yet, buying new things will never come close to the feeling of deep human connection.

By spending more time with your friends or loved once, you’ll feel abundance and belonging. You won’t need money to have a good time, or as SIA sings:

“I don’t need dollar bills to have fun tonight,

I love cheap thrills

But I don’t need no money,

As long as I can feel the beat”

How to apply this advice:

Avoid long working hours that leave you with nothing but money and void.

Instead, initiate low-cost, high involvement activities with your friends.

For example, plan a day hike in an area you can reach by public transport. Choose your favorite park and organize a picnic. Start a dancing session in your living room. Invite your friends over for a trivia night.

The more abundance you feel within your relationships, the less you’ll want to spend money on things.

2) Meditate daily to find joy within you

In our Western world, we think doing comes before being. We need to engage in stuff to increase our self-worth.

Even philosophers never agreed on this one. Socrates said to be is to do. Sartre wrote to do is to be.

Meditate to find out what’s true for you.

Meditation is a way of feeling true abundance without doing anything.

You’ll feel everything you need inside exists already inside yourself.

If you meditate daily, your cravings will vanish. Promise.

“We don’t meditate to get better at meditating, we meditate to get better at life. “— Sharon Salzberg

How to apply this advice:

Download and install Calm, Headspace, or Insight Timer, to get started. If you’re an experienced meditator, consider joining a donation-based Vipassana course.

Here’s a great article on how to make meditation a habit:

For me, the best time to meditate is right after waking up and drinking a glass of water. Whenever I skipped meditation as first thing in the morning and promised myself to do it later in the day, I forgot.

3) Sleep a night before buying >20$ consumer goods

Advertisements are incredibly good at suggesting what we should possess. However, we don’t need most things you buy. Or, as Dave Ramsey puts it:

“We buy things we don’t need with money we don’t have to impress people we don’t like.”

The fewer things you need to own, the less money you need to earn. What you own, ultimately owns you.

Unless you have a regular use for the item, don’t spend money on it.

Does this piece add value to your life?

If not, let your cravings go.

How to apply this advice:

Research popular minimalist advocates such as Leo Babauta, Matt D’Avella, and Joshua Fields Millburn & Ryan Nicodemus.

They developed an entire philosophy stating the quality of your life increases by owning less.

Before buying any consumer goods that cost more than 20$, sleep a night over it. Ask yourself:

What will you do with this ___________ (insert consumer good) next Tuesday?

4) Track Your Spending Habits

We sometimes spend money on things we don’t need without even realizing it. By tracking what you spend your money on, you’ll get better at spending less.

Because what gets measured gets improved.

At the beginning of each month, determine how much you want to spend on leisure. If you never spend any “funny money,” you might feel you’re living in sacrifice. Have a subaccount for leisure and have an automatic transfer at the beginning of each month, e.g., 10% of your salary.

What did you spend your money on today?

How to apply this advice:

Analyze how you spend your money right now. Apps like Mint, Monefy, Wallet, or Goodbudget can help.

Once you’ve analyzed your monthly spendings, cut out anything that doesn’t deliver value. Cancel all online subscriptions you don’t use, the hosting service fo a blog you know longer publish, and the gym membership you don’t use anyway.

The Bottom Line

Your salary won’t make you rich, but your spending habits will.

By increasing the gap between how much you earn and how much you spend, you can achieve financial freedom faster than you imagine.

To earn more:

- Do great work and renegotiate your salary

- Treat your time like money and spend it with intention

- Visualize your financial goals whenever you can

- Diversify your income streams by starting side projects

- Read more and invest money in yourself

- Find your reason for working more

To spend less:

- Initiate quality time with your friends and family

- Meditate to find the abundance within you

- Think twice and sleep a night before buying new stuff

- Track your spending habits and cut down things you don’t need

Focus on the principles that make a difference in your spending and saving habits. Follow some of them, and you’ll find yourself on your path to making your money work for you.