The U.S. economy is at a crossroads, with some analysts saying a failure by Congress to pass another stimulus package, even as the COVID-19 pandemic continues to spread, would tip the nation back into recession.

Lawmakers remain deadlocked over a measure to provide another round of $1,200 checks to most households and more aid to struggling small businesses and unemployed Americans. Most saw the money they received from Congress’s $2.2 trillion CARES Act run dry over the summer.

“If they don’t” approve another stimulus, “they’re taking a huge risk, says Mark Zandi chief economist of Moody’s Analytics. “The odds are better than even the economy backslides.”

Some other economists believe the nation would dodge another downturn even without more assistance, which would further swell the staggering $26 trillion national debt.

“The economy will strengthen and continue to get better,” says Chris Edwards, an economist with the libertarian Cato Institute. “Further deficit-financed stimulus comes at the expense of higher debt and thus higher taxes and a lower standard of living down the road.”

Congress has just a few weeks remaining in its scheduled session adjourning ahead of the November elections. Goldman Sachs recently reckoned there’s just a slightly better than 50% chance lawmakers will approve new relief by the end of September.

In March, the economy sank into its deepest recession since the Great Depression as states ordered nonessential businesses such as restaurants and movie theaters to shut down and consumers avoided traveling and public gathering spots to contain the outbreak.

States are gradually allowing businesses to reopen and most are reporting declining rates of new cases. But several states recently have reached new case records, the U.S. death toll is approaching 200,000 and the possibility of a virus flare-up looms this fall.

Economists believe the U.S. emerged from recession in May and has since recouped about half the 22 million jobs lost in the early spring as businesses have reopened. But experts say recovering the rest will be tougher. Many restaurants are running at partial capacity and sectors such as airlines, hotels and large entertainment venues remain depressed amid contagion fears. Some temporary layoffs are becoming permanent.

After contracting at a record 31.7% annual rate in the second quarter, some economists predict 30% growth in the July-September period, but that would still leave the economy short of its pre-pandemic output level.

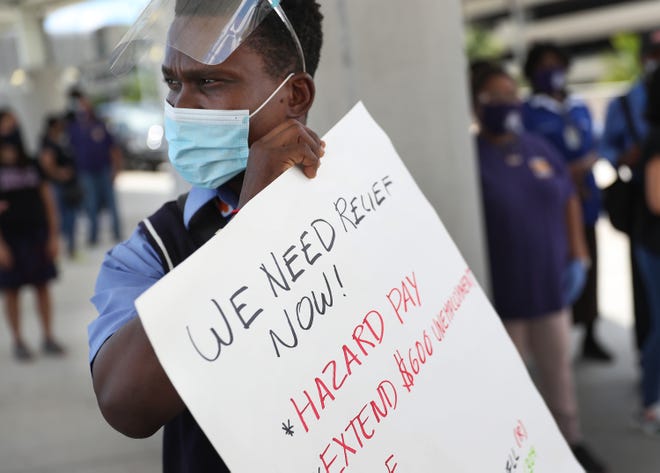

The $3.4 trillion HEROES Act, passed by the Democratic majority House, would restore the $600 federal supplement to weekly unemployment benefits, provide fresh funding for small businesses, and help cash-strapped state and local governments. Republicans have offered alternative packages ranging from $300 billion to $1 trillion that would include $200 to $400 in extra jobless benefits, limit aid to small businesses hit with sharp revenue drops, and offer less money to the state and local governments.

Many economists figure Congress will ultimately compromise on a $1.5 trillion plan, inline with a bill forged by a bipartisan group of House lawmakers.

The stimulus would juice growth

With a stimulus of that size, the economy would grow 3.5% in the 12 months ending in September 2021 and generate 2 million jobs in that period, pushing down the 8.4% unemployment rate to 8.2%, Zandi estimates.

In that scenario, the nation would recover all the jobs lost during the crisis by the end of 2023.

Without any stimulus, he figures the economy would grow just 1.1% over the next year and create no new net jobs as unemployment rises to 10.2%. All the jobs shed in the crisis wouldn’t be recovered until early 2025, he estimates.

More worrisome perhaps is that The U.S. likely would slip back into a downturn in the fourth quarter and first quarter of next year, Zandi says. Such a relapse just months into recovery is known as a double-dip recession.

Gregory Daco, the chief U.S. economist of Oxford Economics, has a similar view, saying a stimulus of at least $1 trillion would increase economic growth by 1.5 percentage points next year. Without it, he doesn’t expect the nation to fall into another slump but he says the economy would grow at a “stall speed” of about 1% by the end of this year. That means a “shock,” such as another COVID-19 wave, could tip the country into recession.

Gains could be curtailed

Edwards, the Cato economist, argues the benefits of another stimulus that largely juices consumer spending would be limited because of “supply constraints” during the pandemic. In other words, many restaurants, for example, aren’t fully open anyway and many businesses can’t hire enough workers because parents are home with their kids while schools are still closed.

He’s also concerned about piling on a federal deficit that tripled in fiscal 2020 to $3.3 trillion because of previous pandemic-related aid. Higher deficits could mean higher taxes and interest rates for consumers and businesses down the road.

Yet Zandi says now is not the time to worry about a widening budget gap. “You’ve got to get back to full employment and then you deal” with the deficit, he says, noting a better economy will generate more revenue for the federal government.

Plus, he says, the soaring debt hasn’t yet significantly pushed up interest rates, which are at historic lows.

At least 8.7 million or more Americans could be at risk of losing out on $1,200 coronavirus stimulus checks due to incomplete IRS and Treasury Department records, according to a Monday report from Congress’ auditing arm, which examined the unprecedented $2.6 trillion lawmakers passed in emergency support as the coronavirus pandemic took hold.

The Treasury Department determined in April that there was no data available for 14 million people who do not normally file tax returns or receive federal benefits but were eligible for the stimulus payments, according to the 371-page report from the Government Accountability Office.

The GAO report also says the Treasury Department followed previous advice in July to extend the deadline through the end of September for those 14 million people to apply for payments.

At least 5.3 million of that group used an IRS tool through July 31 to apply for payments, according to the GAO report, which means at least 8.7 million eligible people have not yet received payment.

As of Monday, both the Treasury Department and the IRS have failed to update the number of people who are eligible for payments but have not yet received them, the GAO reported.

“Without an updated estimate, the Treasury, the IRS, other federal agencies, and IRS’ outreach partners are limited in their ability to appropriately scale and target outreach and communication efforts to individuals who may be eligible for a payment,” the report states.

One entity working with the IRS to promote awareness of the stimulus payments told the GAO that the eligible recipients are outside of the tax system and are likely to be “very low-income,” and therefore most in need of the money.

BIG NUMBER

$10,440,000,000. That’s how much money is being left on the table in unclaimed stimulus payments for non-tax filers, by Forbes’ calculation.

SURPRISING FACT

The Treasury Department has so far reclaimed 70% of the $1.6 billion in stimulus payments mistakenly sent to dead people, according to the Associated Press, following an earlier report from GAO on the erstwhile checks.

KEY BACKGROUND

The GAO report comes amid a partisan showdown in Congress over the next stimulus package. House Speaker Nancy Pelosi (D-Calif.) insisted to reporters on Thursday that nothing less than another $2.2 trillion could work, in a rebuke of the “skinny bill” favored by Republicans. President Trump has also pressed the GOP caucus to take up a more expensive package—including a second round of stimulus payments—because he “want[s] to see people get money.”

TANGENT

House Democrats passed a $3.4 trillion stimulus package, the Heroes Act, in May, but the Senate never took up the bill.