The US has plunged into recession as soaring inflation hammers the world’s largest economy.

GDP fell 0.9pc in the second quarter, according to the Commerce Department. That came after a 1.6pc decline in the first three months of the year.

The two consecutive quarters of contraction mean the US is now in a technical recession.

Personal consumption, the largest part of the economy, rose 1pc. However, this was a slowdown from the previous period.

It comes as President Joe Biden grapples with surging inflation, which last month hit 9.1pc – a 40-year high.

The Federal Reserve last night confirmed its second 75 basis-point interest rate rise in an effort to keep a lid on soaring prices. However, the move will fuel concerns about a slowdown in the economy.

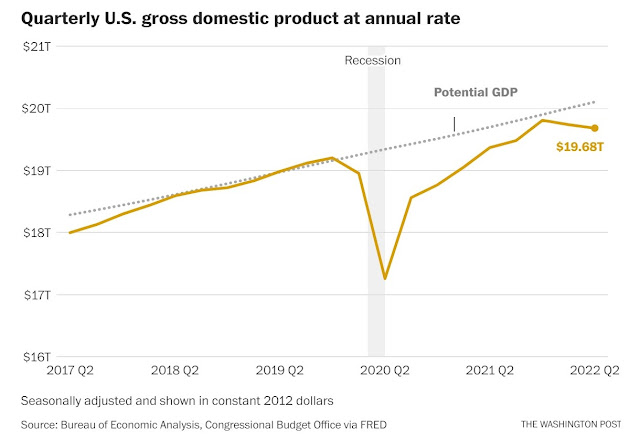

A key measure of economic output fell for the second straight quarter, raising fears that the United States could be entering a recession — or perhaps that one had begun.

Gross domestic product, adjusted for inflation, fell 0.2 percent in the second quarter, the equivalent of an 0.9 percent annual rate of decline, the Commerce Department said Thursday.

The 0.2 percent decline followed a contraction of 0.4 percent in the first three months of the year — meaning that by one common but unofficial definition, the U.S. economy has entered a recession a mere two years after it emerged from the last one.

Most economists still don’t think the economy meets the formal definition of a recession, which is based on a broader set of indicators including measures of income, spending, and employment. The G.D.P. data itself will also be revised several times in the months ahead.

Still, the data released on Thursday left little doubt that the recovery is losing momentum amid high inflation and rising interest rates. Business investment and construction activity both fell in the second quarter after rising in the first. Consumer spending, adjusted for inflation, remained positive but slowed. After-tax income fell after adjusting for inflation.

“We don’t think we’re in a recession just yet,” said Aditya Bhave, senior economist for Bank of America. “But the bigger point here is that the underlying trend in domestic demand is weakening. You see a clear deceleration from the first quarter.”

A deceleration, on its own, isn’t necessarily bad news. The Federal Reserve has been trying to cool off the economy in a bid to tame inflation, and the White House has argued that the slowdown is part of an inevitable and necessary transition to a period of steadier growth after last year’s rapid recovery.

“Coming off of last year’s historic economic growth — and regaining all the private sector jobs lost during the pandemic crisis — it’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation,” President Biden said in a statement issued after the G.D.P. report. “But even as we face historic global challenges, we are on the right path and we will come through this transition stronger and more secure.”

Still, forecasters in recent weeks have become increasingly concerned that the Fed’s aggressive moves — including raising interest rates three-quarters of a percentage point on Wednesday for the second month in a row — will result in a recession. There are hints that layoffs are picking up and that consumers are struggling to keep pace with rapidly rising prices.

“The job market doesn’t have to turn around that much in order for us to have a recession,” said Tim Quinlan, senior economist for Wells Fargo.

The top-line number for U.S. gross domestic product is a composite of positive and negative forces and the details matter:

Consumer spending, which powers the majority of the economy, rose 1 percent on an annualized basis, a marked slowdown from previous months as purchases of goods declined and spending on services grew only moderately.

Home construction also referred to as a residential fixed investment, sagged 14 percent at an annual rate under the weight of rising interest rates, which have put mortgages beyond the reach of more would-be home buyers.

Inventories, which measure the amount of stuff that’s been produced or imported but not yet sold, depressed the overall number by more than two percentage points on an annual basis. Companies still added to their inventories in the second quarter, but more slowly than in the first, which dragged down overall growth.

Business construction, known as a fixed investment in nonresidential structures, dove by 11.7 percent on an annual basis, as construction of factories and warehouses — also an interest rate-sensitive sector — slowed.

Federal government spending shrank 3.2 percent on an annual basis, as stimulus money continues to fade out and oil was released from the Strategic Petroleum Reserve, although defense spending grew 2.5 percent as military aid flowed to Ukraine.

Final sales to domestic purchasers, which some economists favor as a metric that cuts out volatile inventories and government spending, sank 0.3 percent.