Stock indexes closed mostly lower Friday after a roller-coaster day following a blockbuster report on the U.S. jobs market that offered both good and bad news for Wall Street.

The benchmark S&P 500 ended just 0.2% lower after recovering from an early slide as investors reacted to the report, which showed that U.S. employers unexpectedly added hundreds of thousands more jobs than forecast last month.

The blistering data suggests the economy may not be in a recession, as feared. But it also undercuts investors’ speculation that a slowing economy may mean a peak in inflation soon. That means the Federal Reserve may not let up on its aggressive rate hikes to combat inflation as early as hoped. And much of Wall Street still revolves around expectations for rates.

“It’s a reminder for investors on how uncertain Fed policy is going forward and the strong jobs market data shows just how far the Fed has to go,” said Charlie Ripley, senior investment strategist at Allianz Investment Management.

Stocks of technology and other high-growth companies once again took the brunt of the selling amid the rising-rate worries. The tech-heavy Nasdaq composite cut its early losses and closed down 63.03 points, or 0.5%, at 12,657.55.

The good news on the jobs market helped to limit losses for the Dow Jones Industrial Average, whose stocks tend to move more with expectations for the overall economy. It added 76.65 points, or 0.2%, to close at 32,803.47.

The S&P 500 slipped 6.75 points to end at 4,145.19. Both the S&P 500 and Nasdaq posted a gain for the week.

Beyond the nation’s strong hiring, wage growth for workers also unexpectedly accelerated last month. That’s helpful for households trying to keep up with the fastest price gains in 40 years. But it also raises worries on Wall Street that inflation will become more embedded in the economy.

Higher wages can cause companies to raise prices for their own products to sustain profits, which can lead to something economists call a “wage-price spiral.”

To be sure, some market watchers also pointed to numbers within Friday’s employment report suggesting the jobs market may not be as strong as the overall numbers imply. The number of people with multiple jobs rose by more than half a million, for example, said Brian Jacobsen, senior investment strategist at Allspring Global Investments.

“That was mostly from people who already have a full-time job and then the second job is part-time,” he said. “Maybe this is more superficially impressive than substantively impressive.”

Wall Street’s clearest moves came from the bond market, where Treasury yields shot higher immediately after the release of the jobs data. The two-year Treasury yield, which tends to track expectations for Fed action, jumped to 3.23% from 3.05% late Thursday. The 10-year yield, which influences rates on mortgages, rose to 2.84% from 2.69%.

Wall Street is coming off the best month for stocks since late 2020, a rally driven mostly by what had been falling yields across the bond market. The hope on Wall Street had been that the economy was slowing enough to get the Fed to ease up on its rate hikes.

Higher mortgage rates had cut into the housing industry, in particular, after the Fed raised its short-term rates four times this year. The last two increases were triple the usual size, and the Fed has raised its benchmark overnight rate from nearly zero by 2.25 percentage points.

“Today’s print, coming in much stronger than anticipated, complicates the job” of the Federal Reserve, Rick Rieder, BlackRock’s chief investment officer of global fixed income, said in a statement. He said the assumption now becomes the Fed raising short-term rates by another 0.75 percentage points next month unless next week’s highly anticipated report on inflation “shows some dramatic weakness, which seems highly unlikely at this point.”

Traders scrambled to place bets for bigger hikes coming out of the Fed’s next meeting. They have flipped their expectations from a day earlier and now largely expect the Fed to hike by 0.75 percentage points, instead of by half a point.

Such increases hurt investment prices in the near term, and they raise the risk of recession further down the line because they slow the economy by design.

Such expectations also mean the two-year Treasury yield remains above the 10-year yield. That’s unusual, and some investors see it as a sign of a recession hitting the economy within the next year or two.

On Friday, Warner Bros. Discovery fell 16.5% for the biggest loss in the S&P 500 after reporting weaker results for the latest quarter than analysts expected. Monster Beverage lost 5.2% after it reported weaker profit than expected, though its revenue was stronger than forecast.

Smaller company stocks also weathered the turbulent trading to notch gains. The Russell 2000 index rose 15.37 points, or 0.8%, to close at 1,921.82.

In overseas stock markets, India’s Sensex rose 0.2% after the Reserve Bank of India raised its benchmark interest rate by a half percentage point to 5.4%.

Japan’s Nikkei 225 rose 0.9%, while Germany’s DAX fell 0.6%.

If the U.S. economy is in a recession, somebody forgot to tell employers.

After a few months of moderating job growth, the U.S. economy kicked back into high gear in July when it came to job creation. The July jobs report from the Bureau of Labor Statistics showed total nonfarm payroll employment rose by 528,000 for the largest monthly jobs increase since February and roughly double the pace of new hiring that economists had expected.

With the rise in payrolls and a decline in the unemployment rate to 3.5%, the jobs market has returned to pre-pandemic levels of employment.

“Today's strong jobs report helped confirm that the U.S. economy has not yet entered a recession, but we shouldn't overstate the importance of this one report,” says Preston Caldwell, Morningstar’s U.S. chief economist.

A selloff in the bond market and a return to expectations for continued very aggressive interest rate increases from the Federal Reserve following the jobs report is an overreaction, he says. “The Fed's actions will depend more on upcoming inflation news than today's jobs report, especially given all of the caveats regarding the signal provided by today's report.”

The coming week will bring the July Consumer Price Index report. Inflation hit a fresh four-decade high in June.

“Additionally, employment is a lagging indicator, and we think economic headwinds caused by Fed tightening won't fully play out until 2023,” Caldwell says. “So it's unsurprising that the job market is still registering some strength. The decline in GDP in the first half of 2022 was largely noise, in our view, not a genuine recession.”

On the employment front, the 528,000 surges in hiring for July came after job growth had leveled out for several months following the late 2021 explosion in employment. With the July numbers, the three-month moving average of nonfarm payroll employment, which helps smooth out the month-to-month noise, rose to 437,000 from 384,000 in June. That’s still down substantially from the peak hit in December of 637,000.

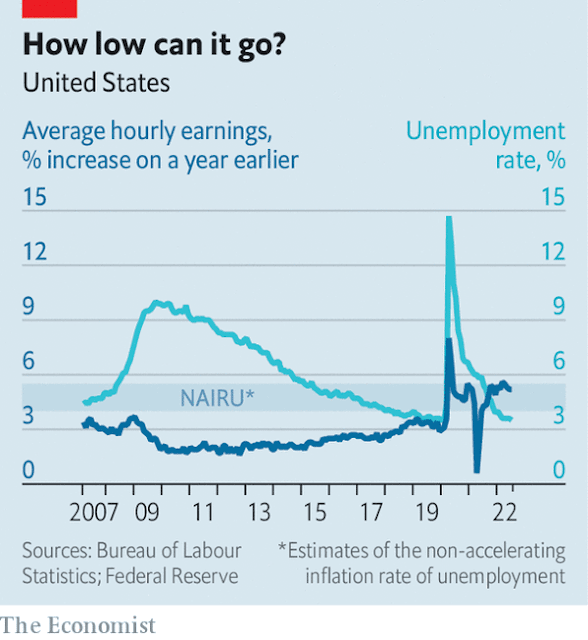

The unemployment rate fell back to its pre-pandemic level of 3.5% after hovering at 3.6% for several months.

Caldwell notes that the two distinct parts of the employment report—payrolls come from a survey of businesses, and the unemployment rate from a survey of households—are telling fairly different stories about the jobs market. He says that while the payroll data are usually a better signal of economic health, it is worth considering the household data as well.

“While seemingly an arcane data issue, we can't ignore the glaring divergence between the headline payroll employment data and the alternative household survey,” he says. “Although nonfarm payroll employment has averaged a robust increase of 500,000 over the past three months, household employment has increased an average of merely 100,000. The truth is probably somewhere in between.”

Caldwell also points to other data showing a more mixed picture of the job market that suggests the Federal Reserve is successfully cooling off the labor market, such as the government’s Job Openings and Labor Turnover Survey.

“One the one hand, the job opening rate has backed off of recent record highs, falling to 6.6% in June from 7.2% in April,” Caldwell says. “It's particularly encouraging that this occurred even while the unemployment rate was largely unchanged because it suggests that the Fed can curb the worst excesses of the job market without provoking massive job loss.”

Within the July jobs report, the Labor Department said gains were broad-based, led by leisure and hospitality, professional and business services, and healthcare industries. Leisure and hospitality added 96,000 jobs, but employment in that industry remains below its February 2020 level by 1.2 million.

Over the last three months, education and health services have been the biggest driver of job gains.

Along with the surge in hiring, the jobs report showed the labor market tightness continues to place upward pressure on wages. Average hourly earnings for all employees on private nonfarm payrolls rose 0.5% to $32.27, up 5.2% from year-ago levels.

“Wage growth ticked up to 5.3% annualized in the three months ending in July, after having trended down earlier in the year,” Caldwell says. “The alternative employment cost index showed a more alarming 6.2% annualized wage growth in the fourth quarter. Wage growth of 5%-6% is consistent with inflation of 3.5%-4.5%, so the Fed has more work to do in ensuring that wage growth is supportive of achieving its 2% inflation target.”

The jobs report sparked investors to shift back toward expecting very aggressive rate increases from the Fed in coming meetings.

In July, the Fed announced it was raising the federal-funds rate by 0.75 percentage points for the second time this year. Before this year, a rate hike of this size hadn’t been seen since 1994. The market expects aggressive rate hikes to continue: 65% of market participants now expect the Fed will hike its target rate another 0.75 percentage points to 3.00%-3.25% in September, according to the CME FedWatch Tool.

But when it comes to the Fed, the next move depends on how inflation looked in July, Caldwell says. “The Consumer Price Index data next week will be more important in determining whether the Fed hikes rates by 0.5 or 0.75 percentage points in September.”

.webp)