The Biden Administration recently announced that it plans to cancel up to $20,000 in federal student loan debt, which is likely to affect many of the nearly 43 million Americans who borrowed to attend college.

Additionally, under the plan, the pause on student loan payments that were instituted in 2020 as a response to the COVID-19 pandemic was extended again, through Dec. 31, 2022.

Student loan borrowers on average carry about $30,000 in debt, including federal and private loans, according to U.S. News data.

New details continue to emerge about the one-time loan forgiveness program, but a lot is still up in the air, particularly its legality.

With the Biden Administration and the U.S. Department of Education intent on moving forward with the plan, here are answers to some frequently asked questions.

Who is eligible for forgiveness? What types of debt will be forgiven?

Current students and borrowers who have federally held undergraduate, graduate, and Parent PLUS loans that were distributed on or before June 30, 2022, are eligible for the relief, says Megan Walter, a policy analyst for the National Association of Student Financial Aid Administrators.

The White House announced that single borrowers earning less than $125,000 per year, or households earning less than $250,000, are eligible for $10,000 in loan forgiveness. Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10,000 – totaling $20,000 in forgiveness.

The plan recently was changed to no longer include borrowers who have Perkins loans or Federal Family Education Loans held commercially rather than by the Education Department. This could leave more than 4 million borrowers without relief, since they must have applied to consolidate those loans into a federal direct loan before Sept. 29, 2022, to be eligible for forgiveness, according to new guidance posted by the Education Department on StudentAid.gov. The plan originally gave these borrowers until Dec. 31, 2023, to consolidate and apply for forgiveness.

How is relief administered? Do I need to sign up or apply?

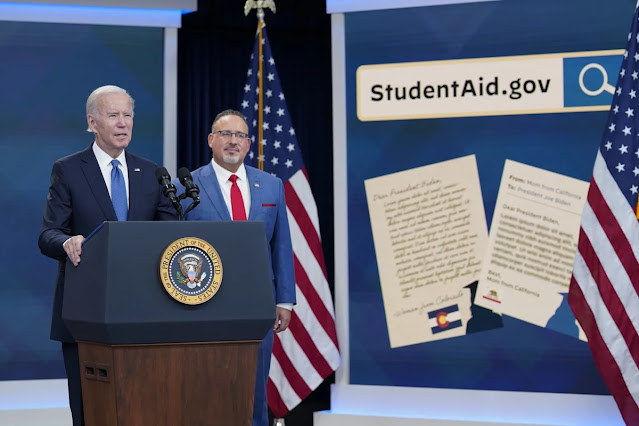

Applications are now live in beta form on StudentAid.gov. "We're accepting applications to help us refine our processes ahead of the official form launch. If you submit an application, it will be processed, and you won't need to resubmit," the website reads.

Borrowers are asked to complete a few basic personal identification questions, including their Social Security number, and to review the eligibility requirements before signing and certifying the application. Borrowers do not have to attach any proof of documentation that they qualify, but they do sign the form acknowledging they will provide proof of income if asked.

Nearly 8 million borrowers may be eligible to receive relief automatically because their income data is already available to the Education Department, the White House announced in its press release. Walter says the Education Department may have the necessary data for borrowers based on information submitted for income-driven repayment plans or for the Free Application for Federal Student Aid, known as FAFSA.

The Education Department encourages all who might qualify to fill out the application, even if their information might automatically be available.

Once borrowers submit their application, they can expect relief within four to six weeks, according to the Federal Student Aid website.

The Education Department advises borrowers to apply before Nov. 15, 2022, to receive relief before the payment pause expires at the end of December.

How is income eligibility determined?

Borrowers will have the choice to use either their 2021 or 2020 tax return information when applying for loan forgiveness, says Jared Walczak, vice president of state projects at the Tax Foundation, a nonprofit that focuses on tax policy. Even if borrowers have a single income above $125,000 or a household income above $250,000 at the time of the announcement, they can still qualify as long as their income in 2021 or 2020 was under the threshold, Walczak says.

For current students, the Education Department will have income data for any borrowers who completed the FAFSA in 2021-2022, Walter says. For borrowers who were dependent during the 2021-2022 school year, the Department of Education will use parental income information to calculate loan cancellation eligibility.

How does this affect Public Service Loan Forgiveness?

In October 2021, the Biden Administration announced a limited-time waiver that relaxed eligibility requirements for the Public Service Loan Forgiveness program, which had faced criticism and investigations for its high ineligibility rates. Borrowers that worked in certain nonprofit and public service sectors for 10 years or more, even if not consecutively, might be eligible for all of their student debt to be canceled or get credit toward forgiveness.

This, however, is separate from the one-time student loan forgiveness recently announced by the Biden Administration and will have no impact on a borrower's eligibility for either $10,000 or $20,000 in forgiveness, according to the NASFAA.

What if I continued paying despite the repayment pause during the pandemic and now owe less than $10,000? Can I receive a reimbursement?

Relief is capped at the amount of your outstanding debt, according to StudentAid.gov. For example, a student who made payments to bring their balance down to $15,000 but is entitled to $20,000 in forgiveness would only receive $15,000 in relief. The Education Department hasn't indicated that it will reimburse borrowers for payments made during the pandemic pause, Walter says.

That said, borrowers can contact their loan servicer to request a refund for any payments they made since the pause began on March 13, 2020. Borrowers should be aware, however, that accepting a refund would result in that money being added back to the loan balance

Will debt relief be considered taxable income?

While debt forgiveness is ordinarily taxable income, it will not be counted toward federal income taxes as part of the Biden Administration's plan. The American Rescue Plan Act of 2021 allows canceled student loan debt to be federally tax-free through 2025, Walter says. However, in some states, borrowers could potentially have to pay state income tax on the amount of forgiveness they receive.

While most states align their state income tax codes with federal income tax codes for simplicity, adopting any changes made at the federal level, some states make changes or have entirely separate tax codes, Walczak says. At least seven states have statutes that could result in borrowers having to pay state income tax on their debt relief, barring any legislative change. Those states are Arkansas, California, Indiana, Minnesota, Mississippi, North Carolina, and Wisconsin, Walczak says.

California does not tax student loan forgiveness if it is part of an income-based repayment plan, but other forms of loan forgiveness are subject to income tax, Walczak says. He says California legislators are planning to amend that policy to include similar provisions for federal student loan forgiveness.

Walczak says other states may make similar amendments to their tax laws in order to help those who receive forgiveness.

What if I didn't finish my degree? Do I still qualify?

Yes. Completion of a degree is not a requirement for debt relief, the Education Department confirmed to U.S. News in an email.

What does this mean for borrowers who took out private student loans?

The Biden Administration's debt relief plan does not apply to borrowers with private student loans. Borrowers who consolidated federal loans with a private company are also ineligible because their loans are no longer held by the federal government.

What if I'm in default on my loans?

It's unclear whether or not borrowers in default are eligible for debt relief.

In April, the Education Department announced the "fresh start" plan that seeks to help approximately 7.5 million borrowers avoid the negative effects of default and get back in "good standing" on their federal student loans. The initiative, according to the Education Department, "will increase the long-term repayment success of borrowers with defaulted federal student loans by helping them access low monthly payments under affordable income-driven repayment (IDR) plans, as well as provide substantial benefits to borrowers over the coming months."

Have there been legal challenges to the plan?

In late September, six states announced a joint lawsuit against the Biden Administration in an effort to stop the plan, alleging that the administration is overstepping its executive powers and that it would cause harm to the states.

At least three lawsuits have been filed challenging the administration's plan.

The first student loan debt relief lawsuit was filed by the Pacific Legal Foundation, a California-based libertarian group, on behalf of a borrower living in Indiana who argues the plan will cost him more than $1,000 in state taxes on canceled amounts, as Indiana is one of seven states that could potentially tax loan forgiveness as income.

Another lawsuit, filed by Arizona Attorney General Mark Brnovich, argues that the student debt relief plan is unconstitutional and will interfere with his office's employee recruitment, hurt the state’s economy by reducing taxes collected and increase the state's law enforcement costs.