The job market remains stronger than expected despite ongoing recession fears and seemingly constant news of mass layoffs.

Job openings rose to 10.7 million in September, according to the Department of Labor’s latest Job Openings and Labor Turnover Survey, after a dip in August that economists said could kick off a downturn in the labor market.

Other report numbers show signs of stabilizing between hiring demand and available workers: New hires edged down to 6.1 million (from 6.3 million) and quits slid down to 4.1 million (from 4.2 million). Layoffs remain historically low at 1.3 million, or under 1% of the workforce. But there are still nearly two job openings for every available worker.

However, some sectors are experiencing surprising drops in employment, and it’s enough to cause job seekers and workers to worry, ZipRecruiter chief economist Julia Pollak tells CNBC Make It.

A tale of two labor markets

Pollak says that diving into jobs in each industry is like looking at a tale of two labor markets.

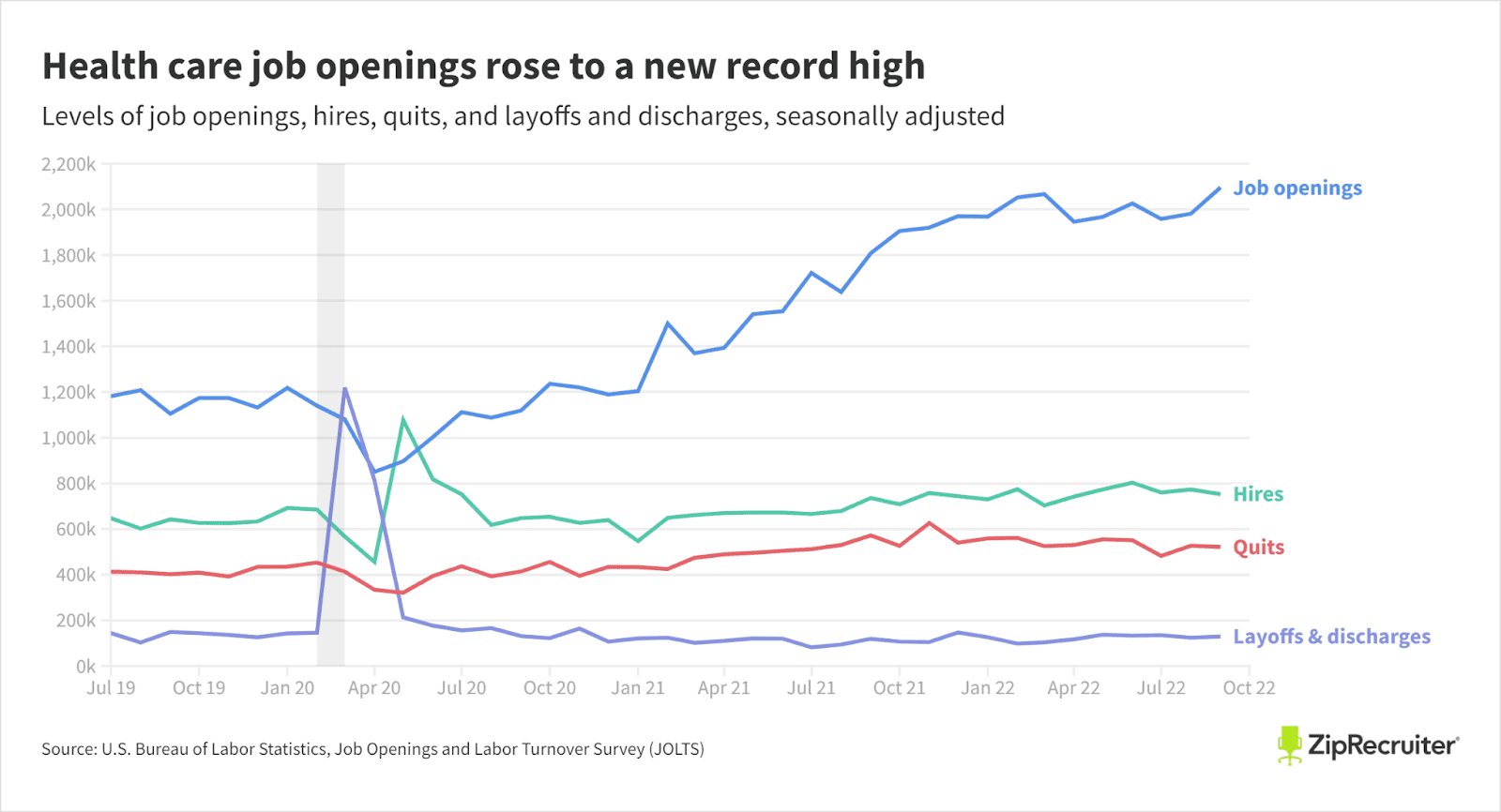

On the one hand, the healthcare industry is “growing by leaps and bounds” with more than 2 million job openings.

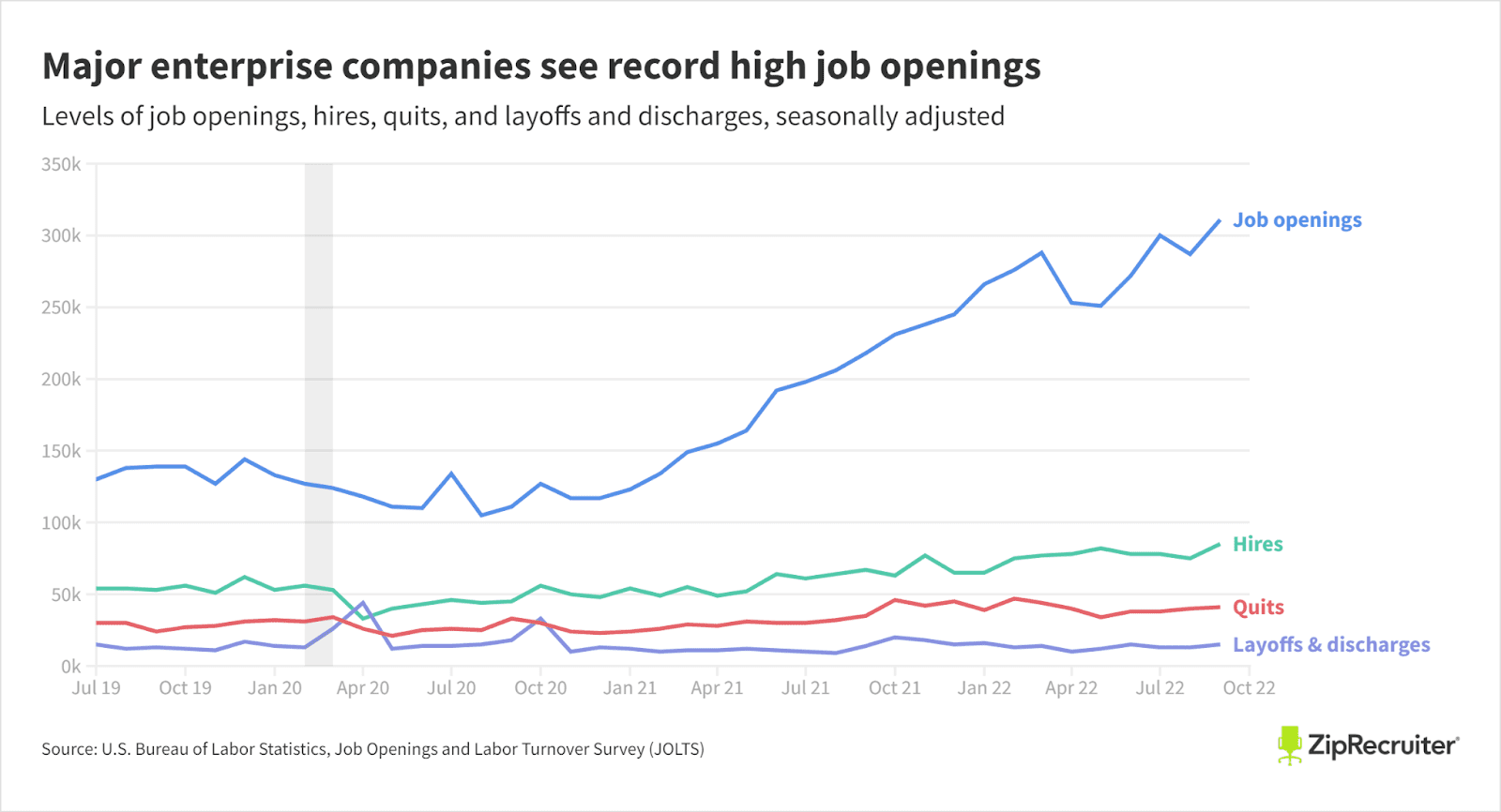

Major enterprises with 5,000-plus employees are also winning out with an all-time high topping 311,000 openings.

“Huge companies are winning the war for talent and consolidating the labor market, with mid-sized companies unable to compete,” Pollak says.

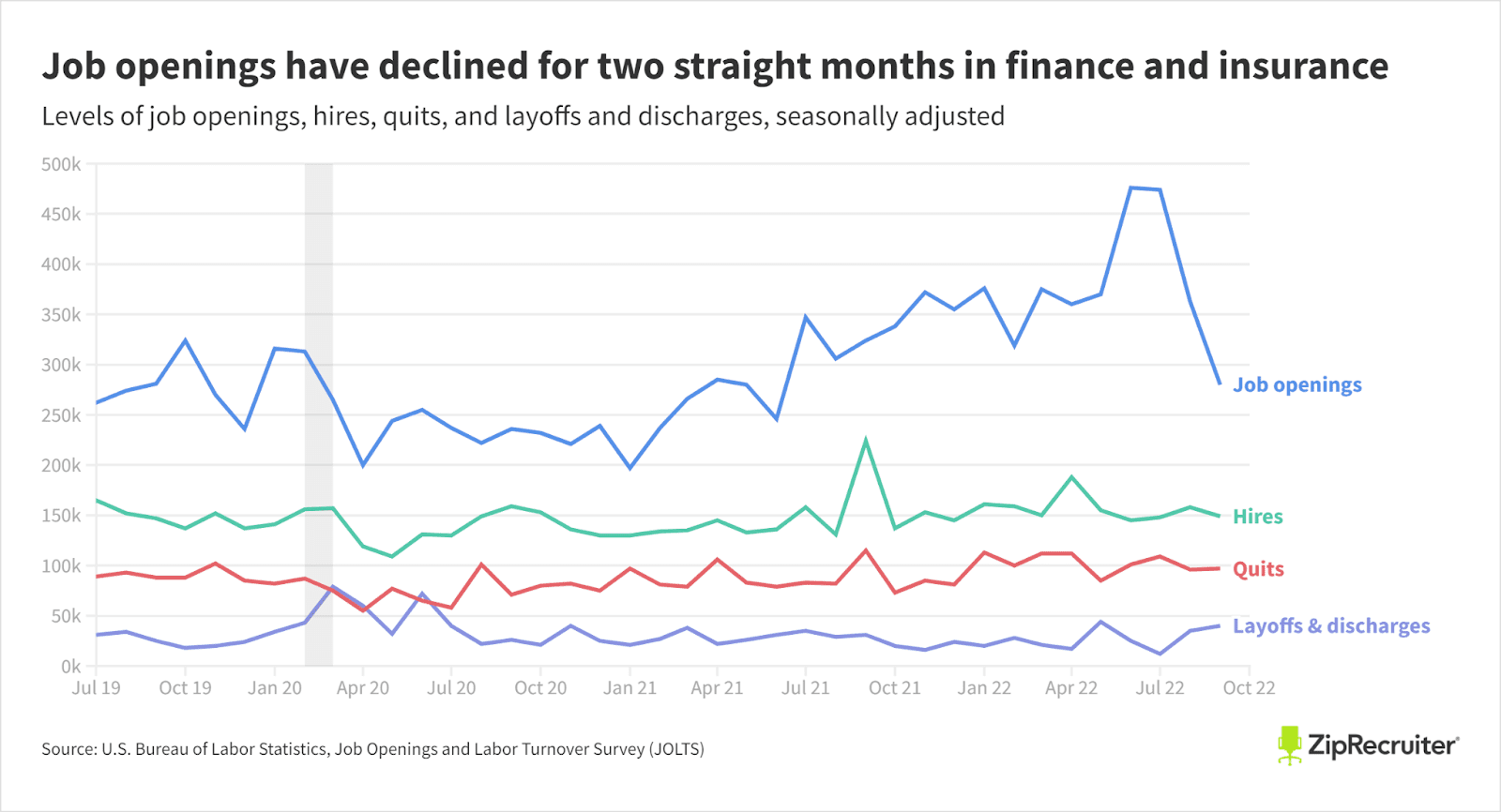

On the flip side, the “most dramatic” part of the September report is the drop in finance and insurance jobs. Companies that benefited from low mortgage rates, a homebuying, and mortgage refinancing spree, and a retail stock trading frenzy throughout the pandemic experienced a “huge hiring boom” through mid-2022. Now that the Federal Reserve raised interest rates and made it more expensive to borrow money, “all those trends have gone sharply into reverse,” Pollak says.

Job openings in finance and insurance grew rapidly throughout the pandemic but have fallen by more than 40% in the last two months, Pollak adds. “It’s the one part of the report that looks like a recession.”

Why the job market is still good when we keep hearing about a recession

Job market turbulence has been more pronounced for Wall Street and Silicon Valley jobs, Pollak says, which tend to get a lot of media coverage but aren’t always a good proxy for what the rest of the labor market looks like.

A majority of CEOs are preparing for a downturn by reducing headcounts, particularly around marketing and advertising teams. But as long as consumers are out there spending on goods and services, those workforce reduction plans in aggregate will keep getting pushed back.

“We see CEOs preparing for a downturn that hasn’t arrived yet and may never arrive,” Pollak says. Hotel occupancy rates are stable, airlines continue to see high numbers of travelers, and restaurant spending is healthy, she says. “Businesses on Main Street continue to do well and are fighting for talent.”

These sectors will continue to do well and pump up hiring as long as Americans are willing to go out and spend, and “the average U.S. consumer is still doing pretty well,” Pollak says.

Many Americans, whose savings ballooned throughout the pandemic between spending less and getting Covid stimulus, still have more money in the bank today than they did pre-pandemic, but personal savings rates are dropping as high inflation eats into purchasing power and leads more people to rack up credit card debt.

At some point, this growth in spending will have to slow, Pollak says. That could happen if people start to lose their jobs.

Job seekers are becoming less bold

Workers in some sectors may be more cautious with recession fears looming: Quits fell in construction; transportation, warehousing, and utilities; and durable goods manufacturing as workers see fewer alternatives for better work and hang onto their jobs.

Job seekers in the last month are becoming less bold, according to a ZipRecruiter index. People are less likely to negotiate their offers and less likely to quit without another job lined up. They’re putting more priority on job and company stability, like big corporations in recession-resistant sectors.

With all that said, Pollak says we’re not in a recession, by definition of the National Bureau of Economic Research which takes a look at sustained drops in personal income, employment, consumer spending, and industrial production.

Jobs are plentiful, hiring is strong and layoffs are low. “It’s hard to call something a recession when people are making money and getting great jobs,” she says.