The December jobs report blew past economists' expectations and the unemployment rate fell, but evidence of cooling wages caused equity markets to rejoice Friday.

In other words, the good news was actually taken as good news for a change.

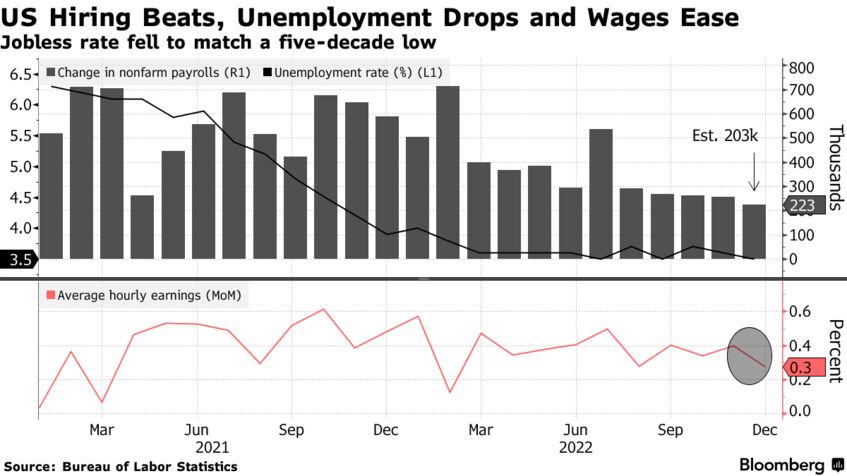

Nonfarm payrolls increased 223,000 last month, while the unemployment rate dipped to 3.5% from 3.7%, the Bureau of Labor Statistics reported Friday. On an unrounded basis, the unemployment rate came in at 3.468%, or the lowest level since 1969, according to University of Michigan economist Justin Wolfers.

Economists were looking for the economy to add 202,000 new jobs in December, per a survey by Bloomberg, and for the unemployment rate to remain unchanged.

The Federal Reserve has been raising interest rates at the most aggressive pace since the late Carter and early Reagan administrations in a bid to tame the worst inflation in four decades. As such, stronger-than-expected job growth is usually taken as bad news by market participants. However, cooling wage growth suggests that labor market inflationary pressure might be easing.

Average hourly earnings increased 0.3% month-to-month in December, vs. a forecast for a gain of 0.4%. On a year-over-year basis, average hourly earnings rose 4.6%, vs. expectations of 5.0% growth.

Market reaction was immediate and bullish, with all three major indexes gapping up sharply at the opening bell.

With the December jobs report now a matter of record, we checked in with economists, strategists, investment officers, and other market pros to see what they had to say about the state of the economy, markets, and the Fed's path going forward. Please see a selection of their commentary, sometimes edited for brevity or clarity, below:

- "The release was a win-win from the Fed's perspective, as it signaled that wage inflation is moderating while job growth remains steady. Coupled with the fact that headline inflation continues to move in the right direction, there's a growing chance the Fed may be able to navigate a soft landing in the economy. If it meets its target, 2023 could be one of the best years for markets given the amount of negative investor sentiment currently weighing on prices." – Peter Essele, head of portfolio management at Commonwealth Financial Network

- "This morning's job report offered something for everyone. The report surprised to the upside but wage growth slowed, which will help bring inflation down. The unemployment rate came down to 3.5% because of an uptick in the participation rate. More workers are coming back into the workforce. The report was better than feared and finally, there is good news for investors." – Gina Bolvin, president of Bolvin Wealth Management Group

- "The report helps to underpin the Fed's goal to moderate the ability of workers to demand higher wages and create a balance within the labor market. Small business owners have been reporting that the demand for higher wages has eased. Wages are a significant input cost for companies and a cost that employers hope to pass along to the end consumer with higher prices. Overall this report indicates that the labor market remains resilient, but lower wage growth indicates that the Fed's campaign to thwart inflation is working." – Quincy Krosby, chief global strategist at LPL Financial

- "The average hourly earnings number came in lower than expected and this could be viewed positively by the market. We continue to be concerned that although inflation is coming down from its highs, it won't come down far enough to meet the Fed's 2% target unless the job market gets significantly weaker. As a result, we believe the Fed is going to take rates higher for longer than the market currently expects. Any rallies are likely to be short-lived and as long as the market doesn't price in the pain that will be required to break the back of inflation, we aren't likely to exit this bear market." – Chris Zaccarelli, chief investment officer at Independent Advisor Alliance

- "A tight labor market is both good news and bad news. The good news is consumer incomes will likely support spending, despite inflation pressures. The bad news for markets is the Federal Reserve will continue to tighten monetary policy. Given the long and variable lags in monetary policy, the Fed will likely further downshift the pace of rate hikes and will likely increase rates by 0.25% at the next meeting as inflationary pressures abate." – Jeffrey Roach, chief economist at LPL Financial

- "A better-than-expected jobs report, capping off a year of excellent job growth, suggests the U.S. was not in a recession in late 2022. Other data are less upbeat; PMI surveys show the private sector may have contracted in late 2022, the Conference Board's Leading Economic Index has been pointing to a recession ahead for a few months, and continuing jobless claims are up by more than a quarter over the last six months, a rate of increase usually observed only during recessions. But if today's jobs data go unrevised, the committee of economists who determine recession dates is unlikely to call late 2022 a recession. Inflation has peaked in the U.S. and continues to slow, with energy prices down from their peaks last summer, shortages of most goods ending, and house prices falling. If the good news keeps coming on inflation, the Fed could pivot to rate cuts in late 2023. But December's strong jobs report shows that the pivot is not just around the corner. The Fed's next move will probably be a quarter percentage point hike at their first meeting of this year, concluding February 1." – Bill Adams, chief economist at Comerica Bank

- "The U.S. jobs report had a little something for everyone: plenty more jobs and better job prospects for the unemployed, but also somewhat slower wage growth and a pullback in work hours that suggests the economy is losing steam. Alas, a hawkish Fed will likely fret more about the ongoing tightness in labor markets." – Sal Guatieri, senior economist at BMO Capital Markets

- "For an investor, this report went about as well as it could have gone. If our goal in the next several months is to have this soft landing, where the economy continues growing, but at a slower pace and inflation continues to slow, this was a good report for that scenario. And that's the scenario the market is hoping for. Investors are worried about two things: interest rates (which have been the primary driver of markets for the last year) and a recession. On the issue of interest rates, one bit of information I see is that it looks like wage growth is continuing to slow. That goes to the inflation and interest rate concerns. You will still have the Fed acting to raise rates to slow things down, but the fact it looks like some of the inflationary pressures are continuing to fade, makes you feel good about the Fed having an end date sooner rather than later. In terms of a recession, it would be an odd recession indeed when we see unemployment falling, which we did. And you have job numbers coming back higher than expected. In terms of these numbers, you really don't see signs we're headed into a typical recession. Those are not recession numbers. So economically, these numbers would make you feel good. They're not pointing to an immediate recession and they're not pointing to interest rates going to the sky." – Tim Courtney, chief investment officer at Exencial Wealth Advisors

- "Another blockbuster employment report to end 2022 on an upside for the U.S. economy. This means that the Federal Reserve (Fed) still has some work to do in order to slow economic activity. However, there were several sectors of the economy that were showing weakness in employment while earnings were weaker than expected and remained on a downward trend, which is what the Fed wants to see. Perhaps the biggest surprise from the employment report was the strength and resilience of construction employment in the face of the weakness we have seen in the U.S. housing market." – Eugenio Alemán, chief economist at Raymond James

- "It's a mixed bag between the unemployment rate dropping lower to 3.5% and wage growth slowing further. The jobs report has become the stepchild to next week's more anticipated Consumer Price Index (CPI) report, and I think it'll be the combination of the two that will inform the Fed. Today's NFP data suggests the Fed could get its immaculate disinflation, where wages ease and so does inflation without the labor market deteriorating. I'm skeptical of this though because it has never happened before. Also, the number of goods-producing jobs jumped significantly last month after falling or barely growing over the past 6 months. This could challenge the bond market's narrative that there are goods disinflation that is offsetting the services inflation, and that will bring inflation down to prompt a Fed pivot." – Megan Greene, global chief economist at the Kroll Institute

- "The December employment report was generally encouraging. Nonfarm payroll growth slowed modestly but remained solid with a 223,000 monthly gain. More importantly for Fed officials worried about the inflation outlook, wage growth cooled in December, and the labor force participation rate ticked higher for both prime-age (25-54) and older (55+) workers. Despite the directional improvement in labor supply, the labor market remains exceptionally tight. The unemployment rate fell two tenths of a percentage point to 3.5%, matching its lowest level on record since 1969. It will take more than just this report to convince the FOMC that supply and demand in the labor market are in healthy balance." – Sarah House, senior economist at Wells Fargo Economics

- "The labor market showed resilience and strength last month, but we are seeing some high-profile layoff announcements in the new year. The average hourly earnings decline should give the Fed some solace that they can continue to slow the pace of tightening." – Eric Merlis, managing director, co-head of global markets at Citizens

- "Jobs came in stronger than expected on both the nonfarm payrolls report and the ADP private report. The unemployment rate came in lower than expected, falling back down to 3.5% on increased labor force participation. The equity markets overlooked this data and focused on the softer-than-expected average hourly earnings, which came in at 0.3% month-over-month for December and 4.6% year-over-year. The 4.6% annual wage growth in December was the lowest since August 2021. This will be welcomed news by the Fed, but still shows serious labor market tightness. The Fed's been clear in their communications that they are more comfortable going at a pace of 0.25% increases to interest rates here, given the front-end heavy lifting they did in 2022. Barring a huge upside surprise in CPI, I think that's pretty much a done deal." – John Luke Tyner, portfolio manager at Aptus Capital Advisors

- "As we close out 2022 amid recession concerns and significant layoffs in the tech industry, it is encouraging to see a strong jobs report. We expect the unemployment rate to remain below the natural rate of 4.5% in 2023. Still, we will continue to pay particular attention to factors that could impact the jobs market, such as the higher fed funds rate, inflation, and geopolitical issues. As the Fed begins to scale back its aggressive rate hikes, following a series of 75-basis point [0.75%] increases to a 50-basis point [0.5%] increase in December, we are optimistic this slight slowdown will curb economic volatility. Ideally, the economy will reach a goal of 2% inflation, 2% economic growth, and a natural rate of unemployment of 4.5% by 2024." – Steve Rick, chief economist at CUNA Mutual Group

- "Today's December jobs report contradicts both the message from consensus and the U.S. Treasury yield curve. This report should add to investor confusion and heighten market volatility in the weeks ahead. It also complicates the Fed's battle against inflation, though the minutes from the December monetary policy meeting reiterate the committee's resolve. A 50-basis point move is back on the table for the next FOMC meeting in a few weeks. The long end of the Treasury yield curve appears to be pricing in a pivot in policy this year, a step we view as unlikely. Equities should remain volatile in the first half of 2023 until investors get comfortable with a trough in the gross domestic product (GPD) and earnings per share (EPS), along with a peak in rates. As markets begin to price in recovery by mid-year, we look for 5.0% EPS gains in 2024 to result in a fair value of 4,150 for the S&P 500 index by year-end." – John Lynch, chief investment officer at Comerica Wealth Management

- "We believe that the moderation in employment conditions will continue, as parts of today's report show, but we think there is still a stickiness to the labor demand in services, which will persist for a while. Ultimately, this makes the Federal Reserve's job of slowing demand for employment and reducing high wages, and thus stubbornly high levels of inflation, harder from here." – Rick Rieder, BlackRock's chief investment officer of Global Fixed Income and head of the BlackRock Global Allocation Investment Team

Amazon and Salesforce are among the latest tech companies to announce job cuts, after rapid hiring over the last several years. For every company announcing layoffs, senior leaders and managers must keep the remaining employees motivated and productive.

Among U.S.-based companies, announced layoffs were up 172% in the fourth quarter of 2022 — with more than 154,000 jobs cut, as compared with nearly 57,000 in the final quarter of 2021, according to the latest report from Challenger, Gray, and Christmas.

“Managers should know what to expect after a layoff,” said Connie Whittaker Dunlop, founder of Monarch Consulting Group, which develops leaders, teams, and organizations through coaching and training. “Layoffs done wrong are going to incur additional costs of hiring and defeat the initial purpose.”

The aftermath of a layoff is significant not only for those who lose their jobs but also for those who remain. Companies that go through layoffs are often left with employees who are less trusting, less committed, and less satisfied, experts say.

Leading and managing ‘layoff survivors’

About 70% of “layoff survivors” say their motivation at work has declined since the layoff, according to a survey done in late November by BizReport. Additionally, 66% report they feel overworked since the job cuts, and a third of those who survived a layoff believe that things will worsen for their company in the future.

Workers feeling insecure in their jobs and higher levels of stress lead some employees to quit out of frustration. To counter those negative sentiments, experts say leaders need to communicate the organization’s near-term goals and plans very clearly with front-line managers.

“Leaders have to show how they’re in tune with what’s the most important thing for their teams to accomplish with fewer people,” said Mark Dollins, president of North Star Communications Consulting, a consulting firm focused on talent development.

Having a clear and compelling story about how the layoffs are going to better prepare the company for the future is an important component of managing change.

That means “giving employees confidence that we’re doing this because it’s not just a reactive thing,” Dollins said, “and when we get to the end of this state, as a result of this restructuring or layoffs or whatever we’re calling it, we’re gonna be in a better place.”

Be transparent about ‘quiet hiring’

“Quiet hiring” is when an organization acquires new skills without actually hiring new full-time employees. That may mean current employees temporarily move into new roles.

To avoid the pushback from layoff survivors who already feel overwhelmed, experts say leaders should let workers know what skill sets will be needed and how they can get them and communicate that clearly. Otherwise, they risk a public employee backlash.

“Workers don’t take this out in the breakroom anymore, they take it out on TikTok,” said Sam Caucci, founder and CEO of workforce training platform 1Huddle.

Signal an ‘all-clear’

Layoffs tend to come around the end of the fiscal year, as companies close their books and make adjustments for the future. Of course, economic conditions can always change, but giving employees an ‘all-clear’ signal when the company is done with a round of layoffs can help reset the stage.

“That creates a sense of ‘OK, now let’s get back to work’,” Dollins said.

Hopes the Federal Reserve can tame inflation without widespread job losses mounted Friday after a government report showed robust hiring and a historically low unemployment rate paired with a cooling in wage growth.

In some respects, the December jobs report offered a best-case scenario for the Fed — Americans keep their jobs but inflationary pressures of earnings are easing — giving policymakers room to slow the pace of interest-rate hikes.

Most economists anticipate the Fed’s aggressive tightening to push the economy into recession in the next year and for unemployment to rise to some degree. Last month’s trends, if sustained for several months, mitigate the chances of an economic downturn — at least for now.

“It’s not that the Fed wants fewer jobs. What they want is lower wage growth, more because they’re worried about persistent inflation,” Randall Kroszner, a former Fed governor and now an economics professor at the University of Chicago Booth School of Business, said on Bloomberg Television.

Fed officials raised interest rates by 50 basis points in December, bringing them to the highest level since 2007. They moderated their pace after four straight 75 basis-point moves but signaled they not only expect to keep hiking in 2023 but also to keep rates elevated for some time.

The data “may make it more likely that they go 25 basis points rather than 50 basis points” at the February and March meetings, Kroszner said.

Key takeaways from the December jobs report:

The S&P 500 rose and Treasuries rallied as investors speculated the easing in wage pressures would lead the Fed to pursue less restrictive policy in the coming months.

One set of data won’t sway policymakers, though, and Fed Chair Jerome Powell has emphasized the need to see a sustained downward trend in inflation. The highly watched consumer price index for December is due next week.

Separate figures out Friday showed a gauge of activity in the services industry contracted in December for the first time since May 2020. The Institute for Supply Management’s measure of services employment shrank for the second time in three months, with respondents noting both troubles filling positions and hiring restraints tied to economic concerns.

‘Goldilocks Print’

Last month’s job gains were led by health care and social assistance, leisure and hospitality, and construction. Several sectors were little changed.

The figures underscore both the enduring strength of the jobs market and a persistent imbalance in labor supply and demand. But an uptick in participation paired with the slowdown in wage growth suggests some of the tightness in the labor market is starting to unwind.

What Bloomberg Economics Says...

“December’s nonfarm-payroll report seems like a Goldilocks print: An expanding labor force and robust hiring drove down the unemployment rate, but wage growth also moderated... momentum in the labor market may have picked up again after loosening somewhat toward the end of last year.”

—Anna Wong and Eliza Winger, economists

To read the full note, click here

The report was “full of good news” for the possibility of a soft landing — a scenario where the economy cools without contracting — according to Nick Bunker, head of economic research at Indeed Hiring Lab.

“If these trends continue, we can feel more and more confident that the strength of this labor market is sustainable,” he said in a note. “The outlook for next year is uncertain, but many signs point toward a soft landing.”

Still, there are growing pockets of weakness in the labor market, particularly in sectors like technology and real estate. Non-durable goods manufacturing, temporary-help services, and information all shed workers in December, the Labor Department report showed.

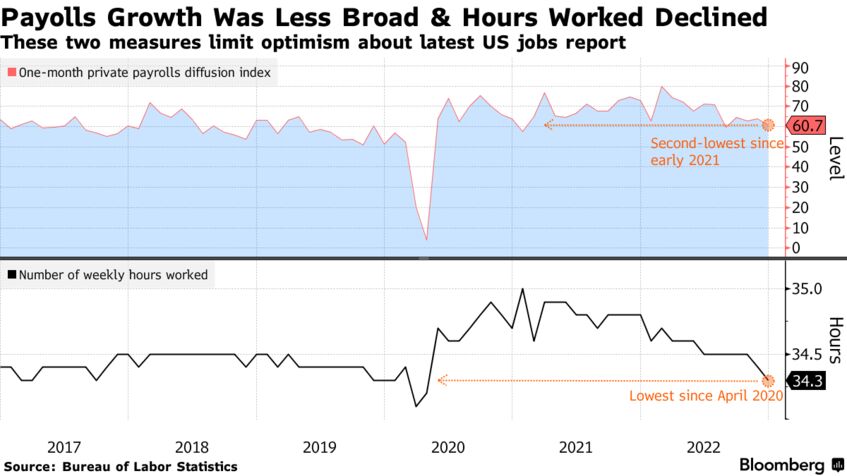

The concentrated nature of payroll gains paired with the fewest hours worked since the onset of the pandemic tempered some optimism around labor demand.

Just this week, Amazon.com Inc. said it plans to cut more than 18,000 employees — the biggest reduction in its history — while the real estate brokerage Compass Inc. announced further layoffs.

The labor force participation rate — the share of the population that is working or looking for work — ticked up to 62.3%, and the rate for workers ages 25-54 rose.

The uber-tight labor market has prompted employers to speed up the hiring process to land the best candidates before they disappear—and increasingly, the software is helping to make those job offers.

Speed is everything in today’s job market. The nation’s unemployment rate held steady at 3.7% in November, the most recent data available, and the 10.5 million job openings outpaced the 6.1 million people seeking work. The result is an unprecedented labor shortage that has put employees firmly in the driver’s seat. They’re bargaining better, commanding higher salaries, and entertaining multiple job offers.

A large swath of companies is dropping college degree requirements, boosting internal promotions, and accelerating the time to hire. Some, including UPS, Home Depot, and the Gap are even going so far as to skip the job interview entirely.

But the key to hiring fast increasingly relies on AI software: 70% of companies now rely on automated tools for scoring candidates and conducting background checks, and AI-enabled tools are matching skills to jobs. This can happen in minutes and cut the time to hire to 35 to 40 days on average.

“If you don’t get somebody through the process fast, you’re going to lose them,” says Josh Bersin, CEO of the Josh Bersin Company, which analyzes the talent market and trends impacting the global workforce.

OPPORTUNITY KNOCKS FAST

Nine in 10 of new hires who got a new job within the past six months said they heard back from their current employer within a week, according to a survey by ZipRecruiter. At least half of them (50.3%) heard back within three days after applying for jobs.

Chatbots with names like iCims, Phenom, and SmartRecruiters now enable a candidate to submit a résumé and book an interview on the spot. Artificial intelligence tools like Jobvite, Modern Hire, VidCruiter, and HireVue now assess and score a person’s word choice, micro gestures, and overall answers in recorded video interviews. Software tools like Predictive Index, Harver, and Plum prompt candidates to do interactive job scenarios and take online tests, and then scores them and send the best job candidates on to do interviews.

A jewelry store might give a candidate an interactive video test in which she is asked how to handle a customer who thinks a necklace is too expensive. Do they talk the customer into buying it? Find them something less expensive? “They’re trying to quickly decide if this person is a good fit—and it works,” says Bersin.

For hourly job openings, McDonalds uses a Paradox.ai, an AI chatbot that asks the candidate questions about their job history and where they live, and the hours they can work. The system conducts a background check, and if the person is qualified, he gets a job offer. The software cut the hiring process to one to two days from 10 to 14 days.

Florida PR firm Otter started using software by Breezy HR to keep its pipeline of candidates moving. The 52-person firm intends to hire 12 people in the next six months, and the software constantly alerts the team of new people in the pipeline. It prompts candidates to do an online writing assessment, scores those tests, and sends top contenders to another round of tests. The scores get sent to the Otter team each week, and after a group meeting, they decide who gets interviews and job offers.

“It gives us insight into their capabilities,” says Tiffani Martinez, Otter’s head of HR. “Because sometimes people look really good on paper and they’re not as good fit in the role.” Better yet, it takes just one week from application to job offer.

The accelerated hiring process comes with risks. There is still concern that AI may promote biased hiring. Critics contend it perpetuates a status quo because it uses unconsciously prejudiced selection patterns, such as language and demography, and is programmed on biased and inadequate data sets.

And sometimes quick hires aren’t always the best ones, says Kelly Robinson, CEO at Panna Knows, an HR consulting firm. “Companies are cutting çorners,” she says, and many have consequently paid inflated salaries, some paying $50,000 more than normal—just to get someone into the position.

“They’re overpaying and not getting the [best work],” Robinson adds. “We advise all our clients to slow it down.”