The eurozone dodged a winter recession by growing at the start of 2023, despite inflation remaining a menace.

The 20-nation economy expanded by 0.1% in the first quarter, falling short of the 0.2% median estimate in a Bloomberg survey of analysts. France and Italy bounced back from negative readings in the final months of last year, while Spain gathered momentum and Germany stagnated.

There was bad news on the inflation front, though, with consumer-price gains accelerating this month in France and Spain. The figures will fuel the debate over how big an interest-rate hike the European Central Bank will opt for next. The euro area’s own inflation number is due just two days before the ECB’s May 4 decision.

The European economy is doing better than expected even if core inflation is taking longer to slow, EU Economy Commissioner Paolo Gentiloni said.

“This is encouraging news which shows the EU economy continues to show resilience against a challenging global backdrop,” Gentiloni said at a press briefing during an informal meeting of European Union finance chiefs and central bank governors on the outskirts of Stockholm.

He spoke alongside ECB President Christine Lagarde, who highlighted that she couldn’t comment on monetary policy because of the central bank’s quiet period ahead of next week’s meeting and instead spoke about fiscal issues.

Traders have firmed up bets on the ECB slowing to a 25 basis-point rate hike in May after digesting Friday’s growth and inflation figures. German two-year yields are down 9 basis points at 2.74% while US two-year yields drop 4 basis points to 4.03%.

Equities in Europe, meanwhile, are set for their first weekly drop following more than a month of gains amid worries over the impact of sticky inflation. The earnings season is in full swing, with investors closely watching how corporates are navigating higher rates and lingering price pressures, while next week the Federal Reserve and the ECB are set to deliver their policy decisions.

Consumer-price growth slowed to 6.9% from a year ago in April, according to the statistics institute.

It peaked at more than 10% in October and has since been moderating.

Bloomberg Economics’ new nowcast model points to euro-area underlying inflation tumbling to 5% in April from 5.7% in March.

“A drop of that magnitude would do a lot to settle nerves at the ECB and could mean the roughly one-fifth chance markets place on a 50-basis-point hike in May gets priced out entirely,” economists Andrej Sokol and Björn van Roye said Friday. “In our view, it would take an increase in the core inflation gauge to bring a bigger hike into play.”

Chief European Economist Jamie Rush:

“The euro area has displayed surprising resilience in the face of the energy price shock. That’s partly thanks to governments stepping in to support consumers and businesses. Households dipping into a savings buffer built up during the pandemic may have also helped. A resilient economy means a tighter labor market, keeping underlying inflation higher for longer.”

The German economy is sending mixed signals at the start of the year, according to the Ifo research institute.

Manufacturing is benefiting from easing supply bottlenecks and lower energy costs, a trend that will likely continue over the course of 2023. Business confidence has improved for six consecutive months, order books are bulging and a gradual revival of the global economy further boost demand, it said.

The consumer economy, meanwhile, will only slowly pick up speed. While household income is accelerating as wages rise, price pressures will remain stubbornly high in the coming months.

Recording growth during what many thought would be a painful winter highlights the resilience of euro-region GDP.

Milder weather certainly helped keep energy costs down after Russia invaded Ukraine, while government support underpinned consumer spending. The economy now appears to be gathering momentum, with April surveys pointing to strong demand for services and a significant increase in employment, though manufacturers continue to struggle.

The euro zone’s performance will be a key input into next week’s ECB rate decision. Policymakers haven’t offered any official guidance on that step, beyond saying another hike is extremely likely.

As well as economic expansion, they’ll look to reports next Tuesday on bank lending and inflation. Underlying price pressures haven’t shown much sign of easing, risking demands by workers for bigger pay rises and so-called greedflation as businesses pass on more than just their costs.

First-quarter output increased by 1.6% from the previous three months when it expanded by 0.3%. The result, buoyed by exports, smashes the 0.2% median estimate in a Bloomberg survey of economists.

The Bank of Portugal in March raised its 2023 growth forecast to 1.8%, citing improved performance in the tourism industry.

Slovenian inflation slowed to 9.4% from a year ago in April, remaining around double digits for an 11th straight month.

The main driver is food and beverage prices. “Inflation remains high and broad-based, and core inflation is continuing to strengthen amid high domestic consumption,” the central bank said this week.

The flat first-quarter performance in Europe’s biggest economy was driven by investment and exports as spending by the government and households weighed, according to the statistics office, which will publish a more detailed breakdown on May 25. The reading trailed the 0.2% expansion estimated by analysts in a Bloomberg poll.

The result nevertheless represents a win for Chancellor Olaf Scholz, who — along with the Bundesbank and several forecasters — had said a recession would be averted after months of flirting with one. Only this week the government, which spent billions shielding households from surging power and heating bills, raised its 2023 growth projection to 0.4%.

In the run-up to Friday’s report, Germany’s central bank had said a stronger-than-expected recovery in the key manufacturing sector at the start of the year probably helped stave off a downturn. While persistently high inflation weighed on households, the industry saw demand pick up as energy prices fell and supply snarls eased, it said.

The economy isn’t “growing dynamically,” though, Ifo President Clemens Fuest said this week. Elsewhere, economists predict inflation stabilized at 7.8% in April. The data are due later Friday.

The economy returned to growth in the first quarter as GDP rose by 0.5% in industry and services — more than twice the 0.2% median estimate in a Bloomberg survey of analysts.

The improvement offers reassurance to Prime Minister Giorgia Meloni’s government, whose budget assumes expansion will top expectations this year at 1%.

The Bank of Italy said recently that GDP is likely to grow by more than 0.6% in 2023 as employment improves and inflation abates.

Unemployment rose more than expected as the country slowly emerges from a downturn stoked by the energy crisis and inflation.

Joblessness increased by 24,000 in April, the Federal Labor Agency said Friday. That was more than all of the 16 estimates in a Bloomberg poll of analysts. The unemployment rate held at 5.7%.

Despite the acceleration, April’s figures are in line with forecasts and the slowdown in food-price gains is “encouraging,” the Finance Ministry said.

It attributed the strength in energy inflation to base effects.

First-quarter growth accelerated as investment and tourism remained strong despite high inflation.

GDP advanced 0.5% from the previous three months — above the 0.3% median forecast in a Bloomberg survey of economists.

Inflation, meanwhile, quickened to 3.8% in April on energy costs. The move is just below the median estimate in a Bloomberg survey of economists and highlights the volatility in consumer prices after the measure almost halved in March to 3.1%.

Underlying inflation, which strips out energy and some food costs, slowed to 6.6%.

Austria’s economy contracted in the first quarter, according to the Wifo research institute, which estimates GDP dropped by 0.3% from the prior three months.

While Wifo says Austria can dodge a recession this year with 0.3% growth, recent data suggest it’s still struggling: A gauge measuring the manufacturing outlook fell to its lowest in almost three years in April.

Inflation in the euro area’s second-largest economy unexpectedly accelerated to 6.9% in April on energy and services costs. That follows March’s 6.7% advance and is more than the median estimate in a Bloomberg survey of economists, which saw the rate holding steady.

While consumer-price gains remain below February’s 7.3% euro-era record, increases remained firm for the core goods and services that are keenly watched by the ECB as it decides how much further to lift interest rates.

The Insee statistics agency said services inflation quickened to 3.2% in April, while for manufactured goods it eased slightly to 4.7%. Having spent big to soothe the pain of soaring energy costs, the government wants to ease the spike in food prices. Supermarkets have agreed to take a hit on margins for staples.

Bank of France Governor Francois Villeroy de Galhau said this week that inflation is likely peaking and should slow to about 4% by year-end. But the central bank also raised its forecasts for underlying inflation, which excludes energy and food prices.

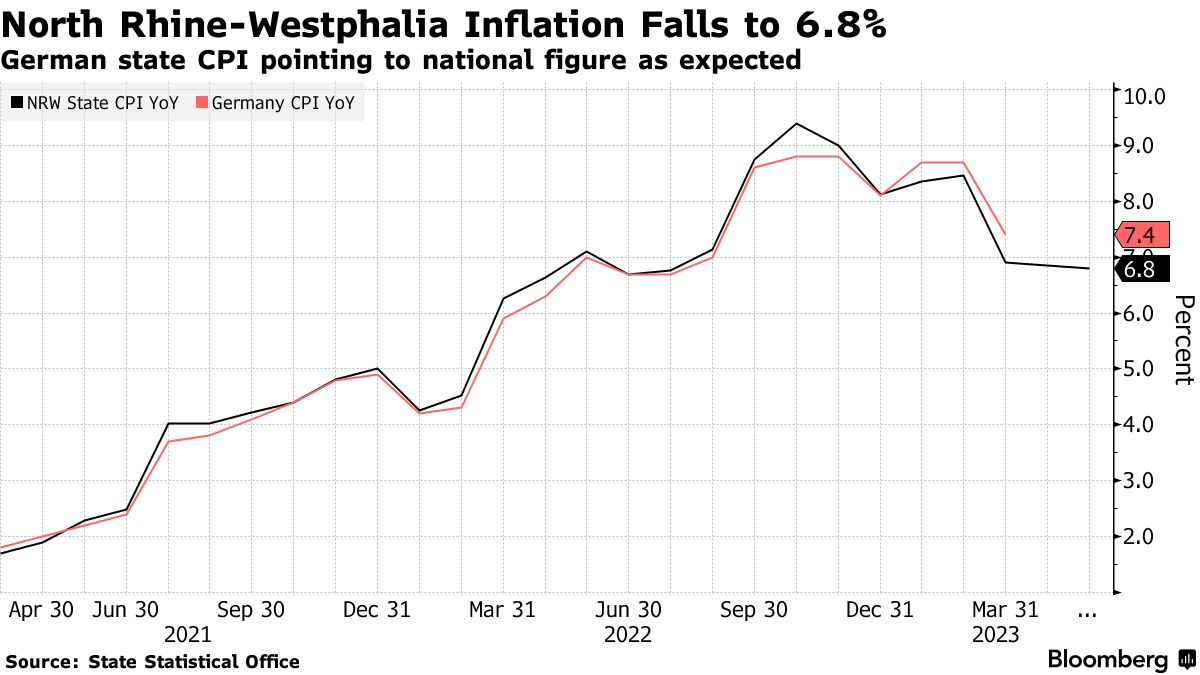

Inflation in the German state of North Rhine-Westphalia fell to 6.8% in April from 6.9% in March, indicating a national figure roughly in line with forecasts.

Consumer prices posted a monthly increase of 0.5%, according to the state statistics office in Dusseldorf.

North Rhine-Westphalia is the first German state to report April inflation readings and can often be the first signal of the trend in the overall figure, which the German statistics office will release later Friday.

Europe’s central banks should be wary of potential dangers ranging from more financial stress to a divergence in bond yields as they stay the course with further interest-rate hikes, according to the International Monetary Fund.

Finance Minister Bruno Le Maire said the return to growth confirms the French economy’s resilience.

Even as households — the biggest driver of GDP — are showing signs of weakness, Le Maire said in a statement that foreign trade is “dynamic”’ and figures show industrial output is growing once more.

“Our fundamentals are holding up,” he said. “Businesses continue to invest and create jobs, bringing us closer to our goal of full employment.”

The growth in the euro area’s second-largest economy defied fears that strikes over pension reform would drag down activity.

The advance in GDP was in line with the 0.2% median estimate in a Bloomberg survey of analysts, thanks to a boost from trade as domestic growth drivers waned. But statistics agency Insee revised its estimate for the final three months of last year to zero from 0.1%.

The first-quarter expansion was supported by a boost from net trade as imports declined and exports remained dynamic, growing 1.1%.

The data show the unrest over President Emmanuel Macron’s raising of the pension age didn’t hobble the economy, with the Bank of France estimating that the hit was limited to a few sectors.

Yet there were signs of softer domestic demand with consumer spending failing to resume growth after contracting at the end of 2022 and total investment declining 0.2%

A separate release from statistics agency Insee showed consumer spending fell 1.3% in March from February as households cut back on food and manufactured goods purchases. Economists polled by Bloomberg had expected a 0.5% increase.