Six straight days of 12-hour driving. Single-digit paychecks. The complaints come from workers in vastly different industries: UPS delivery drivers and Hollywood actors and writers.

But they point to an underlying factor driving a surge of labor unrest: The cost to workers whose jobs have changed drastically as companies scramble to meet customer expectations for speed and convenience in industries transformed by technology.

The COVID-19 pandemic accelerated those changes, pushing retailers to shift online and intensifying the streaming competition among entertainment companies. Now, from the picket lines, workers are trying to give consumers a behind-the-scenes look at what it takes to produce a show that can be binged any time or get dog food delivered to their doorstep with a phone swipe.

Overworked and underpaid employees is an enduring complaint across industries — from delivery drivers to Starbucks baristas and airline pilots — where surges in consumer demand have collided with persistent labor shortages. Workers are pushing back against forced overtime, punishing schedules, or company reliance on lower-paid, part-time, or contract forces.

At issue for Hollywood screenwriters and actors staging their first simultaneous strikes in 40 years is the way streaming has upended entertainment economics, slashing pay and forcing showrunners to produce content faster with smaller teams.

“This seems to happen to many places when the tech companies come in. Who are we crushing? It doesn’t matter,” said Danielle Sanchez-Witzel, a screenwriter and showrunner on the negotiating team for the Writers Guild of America, whose members have been on strike since May. Earlier this month, the Screen Actors Guild–American Federation of Television and Radio Artists joined the writers’ union on the picket line.

Actors and writers have long relied on residuals, or long-term payments, for reruns and other airings of films and television shows. But reruns aren’t a thing on streaming services, where series and films simply land and stay with no easy way, such as box office returns or ratings, to determine their popularity.

Consequently, whatever residuals streaming companies do pay often amount to a pittance, and screenwriters have been sharing tales of receiving single-digit checks.

Adam Shapiro, an actor known for the Netflix hit “Never Have I Ever,” said many actors were initially content to accept lower pay for the plethora of roles that streaming suddenly offered. But the need for a more sustainable compensation model gained urgency when it became clear streaming is not a sideshow, but rather the future of the business, he said.

“Over the past 10 years, we realized: ‘Oh, that’s now how Hollywood works. Everything is streaming,’” Shapiro said during a recent union event.

Shapiro, who has been acting for 25 years, said he agreed to a contract offering 20% of his normal rate for “Never Have I Ever” because it seemed like “a great opportunity, and it’s going to be all over the world. And it was. It really was. Unfortunately, we’re all starting to realize that if we keep doing this we’re not going to be able to pay our bills.”

Then there’s the rising use of “mini rooms,” in which a handful of writers are hired to work only during pre-production, sometimes for a series that may take a year to be greenlit, or never get picked up at all.

Sanchez-Witzel, co-creator of the recently released Netflix series “Survival of the Thickest,” said television shows traditionally hire robust writing teams for the duration of production. But Netflix refused to allow her to keep her team of five writers past pre-production, forcing round-the-clock work on rewrites with just one other writer.

“It’s not sustainable and I’ll never do that again,” she said.

Sanchez-Witzel said she was struck by the similarities between her experience and those of UPS drivers, some of whom joined the WGA for protests as they threatened their own potentially crippling strike. UPS and the Teamsters last week reached a tentative contract staving off the strike.

Jeffrey Palmerino, a full-time UPS driver near Albany, New York, said forced overtime emerged as a top issue during the pandemic as drivers coped with a crush of orders on par with the holiday season. Drivers never knew what time they would get home or if they could count on two days off each week, while 14-hour days in trucks without air conditioning became the norm.

“It was basically like Christmas on steroids for two straight years. A lot of us were forced to work six days a week, and that is not any way to live your life,” said Palmerino, a Teamsters shop steward.

Along with pay raises and air conditioning, the Teamsters won concessions that Palmerino hopes will ease overwork. UPS agreed to end forced overtime on days off and eliminate a lower-paid category of drivers who work shifts that include weekends, converting them to full-time drivers. Union members have yet to ratify the deal.

The Teamsters and labor activists hailed the tentative deal as a game-changer that would pressure other companies facing labor unrest to raise their standards. But similar outcomes are far from certain in industries lacking the sheer economic indispensability of UPS or the clout of its 340,000-member union.

Efforts to organize at Starbucks and Amazon stalled as both companies aggressively fought against unionization.

Still, labor protests will likely gain momentum following the UPS contract, said Patricia Campos-Medina, executive director of the Worker Institute at the School of Industrial and Labor Relations at Cornell University, which released a report this year that found the number of labor strikes rose 52% in 2022.

“The whole idea that consumer convenience is above everything broke down during the pandemic. We started to think, ‘I’m at home ordering, but there is actually a worker who has to go the grocery store, who has to cook this for me so that I can be comfortable,’” Campos-Medina said.

It seems like a contradiction: How would increasing the cost of monthly credit payments help to bring down the price of goods and services in the economy?

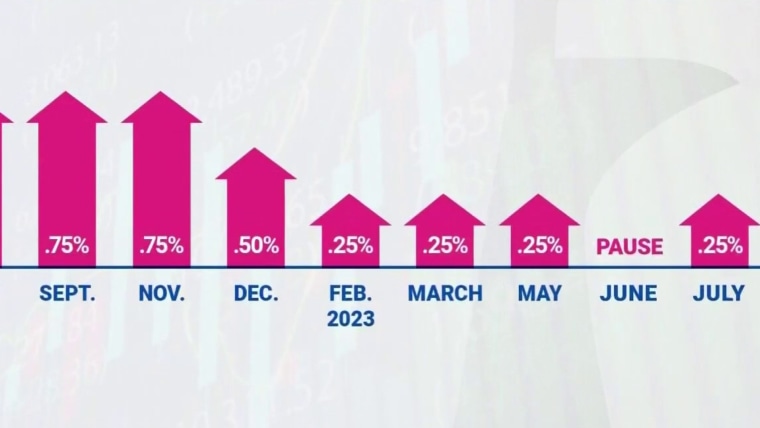

But that is the logic Federal Reserve officials are following as they raise interest rates to 5.5%, their highest point in more than 22 years, to combat a pace of inflation that Fed Chair Jay Powell said Wednesday remains "much too high."

As Americans are now well aware, the cost of seemingly everything — hotels, cars, dining out — has gone up at a pace the Fed is deeply uncomfortable with.

“My colleagues and I are acutely aware that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing and transportation,” Powell said.

How the Fed thinks about inflation

By making it more expensive for consumers and businesses to borrow money, it hopes to reduce overall economic activity — too much of which tends to cause inflation.

"We do want to see demand running below potential for a sustained period to create slack and give inflation a chance to come down," Powell said.

It's a trade-off: Raise costs now so that consumers and businesses don't expect prices to increase in the future.

“If you fail to deal with it in the near term," Powell said of inflation, "it only raises the cost ... of dealing with it later to the extent people start to see it as just part of their economic lives,” Powell explained, suggesting that a high level of inflation — which is anything above 2% — could become entrenched, making it harder to pull down.

For the average consumer, that means higher credit card interest rates, higher auto loan rates and higher mortgage rates. In some cases, it means being denied when you apply for new credit, said Mark Hamrick, Washington Bureau Chief for the financial services website Bankrate.

'Medicine' for the U.S. economy

Hamrick calls the higher interest rates "medicine" designed to target inflation. He acknowledged that not everyone, including central bankers, understand exactly how the higher rates work their way through the economy because those costs can manifest in many different ways, but there remains "a high degree of confidence" that the higher rates do help reduce inflation.

For businesses, the higher interest rates also mean it costs more to borrow money, thus making it tougher to hire people and invest.

"That is an unfortunate fact," said Derek Tang, an economist, co-founder, and CEO at Monetary Policy Analytics/LHMeyer, a Washington, D.C., research firm.

The way the Fed is bringing down inflation, Tang said, might cause workers to experience fewer or lower raises, or even lose their jobs outright.

"On a human level, that hurts the poorest the hardest, because they already have less savings to draw on, because they're also facing higher inflation and have to spend more on essentials like food, housing, and gasoline," Tang said. "So really, there are no easy answers here."

Ideally, the cost to people’s jobs because of higher interest rates will be minimal. And, so far, there’s been little significant impact on employment since the Fed began its current rate-hiking cycle in March 2022.

Notably, the unemployment rate, at 3.6%, remains at historic lows, and inflation has come down for 12 straight months.

This is what the Fed has sought all along. But Tang said the Fed hopes to make sure that inflation comes down — and stays down. Specifically, the Fed wants to see year-over-year price increases at 2%.

"The inflation rate is not low enough, not yet at the target the Fed wants it to be," Tang said. "It needs to be confident it will be at that level in the future."

Powell has acknowledged the difficult choice the central bank faces, but that for now, it remains focused on wrestling down price increases, even if it comes with other costs.

“Restoring price stability is just something that we have to do,” Powell said Wednesday. “There isn’t an option to fail to do that because that is the thing that enables you to have a strong labor market over time. Without restoring price stability, you won’t be able, over the medium and longer term, to actually have a strong ... sustained period of very strong labor market conditions,” Powell said.

And with a stronger labor market comes a more resilient economy, as long as the central bank can keep inflation in check.