Federal Reserve Chair Jerome Powell said the US central bank is prepared to raise interest rates further if needed and intends to keep borrowing costs high until inflation is on a convincing path toward the Fed’s 2% target.

“Although inflation has moved down from its peak — a welcome development — it remains too high,” Powell said in a speech Friday at the US central bank’s annual conference in Jackson Hole, Wyoming. “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

The Fed chief welcomed the slower price gains the US economy has achieved thanks to tighter monetary policy and further loosening of supply constraints after the pandemic. However, he cautioned that the process “still has a long way to go, even with the more favorable recent readings.”

At the same time, Powell suggested the Fed could hold rates steady at its next meeting in September, as investors expect.

“Given how far we have come, at upcoming meetings, we are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks,” he said.

The overall message is that the Fed has stepped into a more gradual approach to policymaking, and is focused on balancing the risk that inflation could remain elevated with the possibility that too much tightening could trigger an economic downturn.

A year ago in the same forum, Powell said the Fed was taking “forceful and rapid steps” to quell inflation. While the central bank has covered a lot of ground since then, he said Friday, the message picked up where he left it in 2022: The job’s not done.

“Overall, the message remains that the Fed has delivered a lot,” said Rubeela Farooqi, chief US economist at High Frequency Economics. “But inflation — even as it has abated — remains too high. And now policymakers are aware of the risks related to resilience in economic activity and are prepared to do more if needed.”

“Another rate hike, perhaps even two, cannot be ruled out although the decision ultimately will depend on the totality of incoming data,” Farooqi said.

After fluctuating in the initial minutes of Powell’s speech, markets settled into a view that the remarks implied higher short-term rates. Two-year Treasury yields rose to a session high before paring gains, while the S&P 500 stock index was below its session high.

Futures traders were pricing in a roughly two-thirds chance that the central bank will raise its key interest rate by a quarter percentage point in November after a likely pause at its meeting next month.

New Phase

Policymakers are in a new phase of their campaign to bring inflation back to the Fed’s 2% target. After aggressive rate increases in 2022, Powell and his colleagues have slowed the pace this year and signaled they may be close to wrapping up. The question now is how long they hold at a restrictive level and how the economy performs under those conditions.

Officials raised their benchmark rate last month to a range of 5.25% to 5.5%, a 22-year high, after skipping a hike at their June meeting. Their most recent projections had one more rate increase penciled in this year.

The increases have raised real interest rates, or interest minus inflation, to positive territory, Powell said, a minimum standard to get inflation lower. He also noted that assessing the so-called neutral rate, which balances supply and demand, in real-time is always uncertain and thus the true level of policy restraint is uncertain.

Powell noted the economy may not be cooling as fast as expected, saying recent readings on economic output and consumer spending have been strong. The economy grew at a 2.4% annualized pace in the second quarter, a surprisingly robust reading that prompted many economists to boost forecasts for the third quarter and reconsider the odds of a recession.

“Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy,” Powell said. He noted improvements in labor supply while demand for workers has moderated.

Even so, he warned that if those conditions reversed it “could also call for a monetary policy response.”

Powell also pushed back on speculation that the central bank could raise its inflation target, an idea that has been hotly debated mostly by academics in recent months.

“Two percent is and will remain our inflation target,” he said.

Inflation has cooled significantly since reaching a four-decade high last year, though it remains above the Fed’s 2% goal. The central bank’s preferred gauge, the personal consumption expenditures price index, rose 3% in June from a year earlier, the slowest pace since early 2021. Underlying price pressures are stronger, with PCE minus food and energy increasing at a 4.1% pace.

Powell said inflation data showing core price pressures easing in June and July were welcome but “only the beginning” of what it will take to build confidence that inflation is moving down “sustainably.”

The Fed chief said officials need to see sustained progress on core goods inflation, which has come down but remains above its prepandemic level. He also said housing services inflation should continue to decelerate further, but said officials will be watching market rent data closely for signs of upside or downside risks to inflation.

In addition, Powell said “some further progress” in non-housing services prices — a category that includes areas such as transportation and food services — will be essential to assure overall price stability.

The UAW said Friday its 150,000 members who work for Detroit Three automakers have given union leadership the OK to strike if necessary.

The strike authorization vote is more of a formality and was expected to pass, but given the strong rhetoric around the potential action against the automakers, it was given more weight this time than in the past.

On Friday mid-morning, the UAW said final votes were still being tabulated, but the current combined average across the three automakers was 97% in favor of strike authorization. The vote does not guarantee a strike will be called, only that the union has the right to call a strike if it cannot reach an agreeable tentative contract.

The current contract expires Sept. 14.

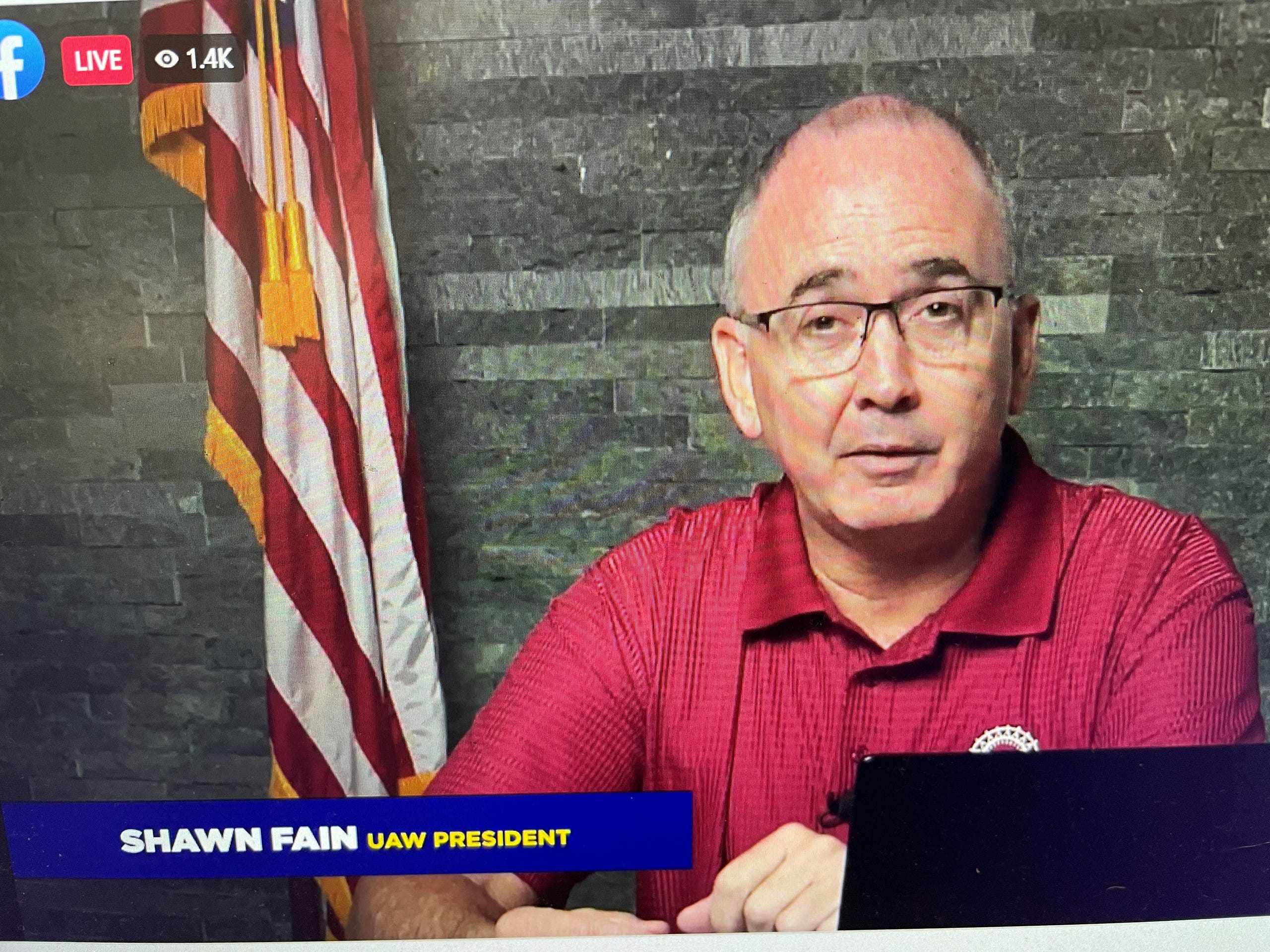

“Our goal is not to strike, our goal is to bargain a good contract for our members. But we prepare for a strike so that we’re ready no matter what happens," UAW President Shawn Fain told members during a Facebook Live broadcast Friday from UAW Local 862 near Ford Motor's Louisville Assembly Plant in Kentucky. Union members there were holding practice pickets on Thursday and Friday.

The overwhelming vote of those UAW members voting and endorsing a strike if necessary was expected, "but is still meaningful," said Harley Shaiken, professor emeritus at the University of California, Berkeley, reacting to the results. "It indicates strong member support for the 'ambitious and audacious” demands the new leadership has put forward."

Bring an offer by Sept. 14 or the union takes action

The Facebook feed was interrupted several times by technical difficulties, but Fain did make a few noteworthy remarks.

In an update on the progress of the talks with General Motors, Ford Motor Co., and Stellantis, he said management has not yet made counterproposals to membership demands and the core economic demands. However, the slow pace was not unusual in company-wide bargaining, where progress usually intensifies closer to the contract deadline. The current contract expires at 11:59 P.M. Sept. 14.

Fain emphasized that the deadline was firm and that extending the contract was not an option. He indicated the UAW was keeping its options open regarding how to strike if it became necessary.

Fain told about 1,400 UAW members tuning into the Facebook feed that he informed each of the Detroit Three to come to the table next week with counterpoints to the union's demands so that a new contract can be reached before the expiration date. When asked if he would pick a lead company to reach a new contract with first and then a pattern that deals with the other two, such as has been the tradition, Fain said no.

“We’re not picking a target company," Fain said. "We expect all three to bargain with us and all three to be done by Sept. 14. We want contracts by Sept. 14 by all three.”

When someone in the online audience forum posted a comment that "it seems like Stellantis is the worst to bargain with," Fain said, “None of the three have come to the pump yet for the membership. So until they want to get serious, they’re all the same in my opinion. They want to drag this out and we’ve warned them and warned them, we want something by Sept. 14.”

Fain promised to keep the members informed and said he had to earn their trust, noted Marick Masters, a business professor and labor expert at Wayne State University, who watched Fain's presentation. "In sum, Fain's livestream reflected the accentuated militancy of the UAW and the new leaders' devotion to responding to members' interests."

Labor expert Erik Gordon, a business professor at Ross School of Business at the University of Michigan, said, "Given his view that workers are fighting a class war with the automakers and that working together with the carmakers doesn’t work, it would have been hard for him to explain why one company is a target and others aren't. Despite expressing hope for an agreement, he doesn't seem to expect one because the companies 'worship at the altar of profits' and don't care about workers."

Automakers react

GM reacted to the vote by posting a Q&A about what the vote means for the company on its www.gmnegotiations2023.com.

"We continue to work hard with the UAW every day and bargain in good faith to ensure we get this agreement right for our team members, our customers, suppliers, the community, and the business," GM spokesman Pat Morrissey told the Free Press in a statement.

Jessica Enoch, Ford's spokeswoman, told the Free Press, “Ford is proud to build more vehicles in America and employ more UAW-represented hourly workers in America than any other automaker. We look forward to working with the UAW on creative solutions during this time when our dramatically changing industry needs a skilled and competitive workforce more than ever.”

Stellantis spokeswoman Jodi Tinson provided this statement following the announcement of the vote results: “The discussions between the Company and the UAW’s bargaining team continue to be constructive and collaborative with a focus on reaching a new agreement that balances the concerns of our 43,000 employees with our vision for the future — one that better positions the business to meet the challenges of the U.S. marketplace and secures the future for all of our employees, their families, and our company.”

Workers for Stellantis voted to authorize a strike with “an overwhelming 95.3%,” according to a letter to local residents, shop chairmen, and financial secretaries from UAW Vice President Rich Boyer, who heads the union’s Stellantis department.

Boyer’s letter, posted on Facebook, called the level of participation inspiring and said it highlights the solidarity and dedication of the membership.

“The turnout was exceptional, indicating just how deeply each member cares about our shared values. It is essential for us to continue to stand together, especially during such pivotal times. We are ready to do what is needed, by any means necessary,” the letter said.

Big Locals, big turnout

Turnout at one of GM’s biggest plants was strong when voting started at 5 a.m. Wednesday, UAW Local 2209 Shop Chairman Rich LeTourneau told the Detroit Free Press. About 650 people from one shift, so about half, had already voted by mid-morning, he said.

“That’s a great turnout,” LeTourneau said.

By Thursday morning, Local 2209 had authorized the union to strike in a vote of 97.5% voting yes. LeTourneau said the workforce deserves a generous wage increase because the jobs they do are difficult and they work long hours, but he gave pause on going on strike right away. He's lived through strikes in the early 1980s, 1998, and the most recent 40-day long strike in 2019.

“We have a very young workforce and they don’t know the implication of a strike and how long it can last. They just think we can get whatever we want," LeTourneau said. "But a lot of money comes out of pockets and not just General Motors, but the workforce too and you never get it back. I hope collective bargaining takes precedence over a strike.”

He said he has explained to his membership the challenges of a strike, noting it's easy to get fired up, but harder to put out that fire. He hopes Fain’s attempts at transparency through repeated Facebook live forums work, but LeTourneau said it is "dangerous" in his opinion.

"Audience-based bargaining is dangerous, it’s extremely dangerous," LeTourneau said. "You’re answering questions on the floor and on Facebook and the expectations then are higher than the reality, and if that happens, it’s very difficult to get a ‘yes’ vote on a tentative agreement from anybody, ever.”

Todd Dunn, president of UAW Local 862, represents Ford factory workers at the Kentucky Truck Plant and Louisville Assembly Plant and reported 99% strike vote approval. He declined to provide specific numbers. The plants employ roughly 12,000 rank-and-file workers at the factories.

Dunn told the Free Press “The membership has spoken. We must stay the course and support our national negotiations for a fair and equitable contract.”

As for the mood and overall feel, he said, “It was business as usual.”

Detroit Three production ahead of a possible strike

Experts suspect the automakers are doing some preparation ahead of a possible strike. Production at two of the Detroit automakers has increased in recent months, said Sam Fiorani, vice president of Global Vehicle Forecasting at AutoForecast Solutions LLC.

GM and Stellantis do not report detailed inventory numbers, but each automaker contributed inventory to a sector that showed an increase in inventory by about 8% over the past two months, Fiorani said. That indicates they are boosting some production in preparation for a possible strike, he said.

GM had a hiccup in the production of its more popular and profitable vehicles: pickups. It has had to pause production at some truck plants due to parts shortages, which is not what it wants to do ahead of a possible strike, Fiorani said.

Ford’s inventory, which the automaker does report, has dropped by more than 12% in August compared with July, he said. Ford’s inventory drop is normal for this time of the year, he said, noting that production of some key vehicles, like the Explorer and Expedition, were abnormally low in June and July, possibly due to a lack of parts. Additionally, the Mustang and Ranger small pickup are transitioning between generations.

“While dealer inventories haven’t grown significantly, there are a few more vehicles available to cover a short strike, but there’s simply no way the automakers could prepare for a protracted factory shutdown,” Fiorani said of the Detroit Three.

Inflation remains too high and signs indicate the economy is not cooling as expected, according to Federal Reserve Chair Jerome Powell. The Fed is prepared to raise interest rates further and hold policy at restrictive levels until inflation downward sustainably. The “rebalancing’ of the labor market is expected to continue.

“So far this year, GDP (gross domestic product) growth has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust,” Powell said in a speech at the “Structural Shifts in the Global Economy” policy symposium Aug. 25 in Jackson Hole, Wyoming.

The housing sector has shown signs of picking back up over the past 18 months, and evidence of persistent above-trend growth could put further progress on inflation at risk.

However, Powell did note progress, with inflation peaking at 7% in June 2022 and declining to 3.3% in July.

Still, “getting inflation sustainably back down to 2% is expected to require a period of below-trend economic growth as well as some softening in labor market conditions,” he said.

The labor market rebalancing is expected to continue toward a normalization in labor market conditions, Powell said. Already, demand for labor has moderated, job openings are high but trending down, payroll job growth has slowed and the average workweek has declined.

Price stability is needed to sustain strong labor market conditions forward, Powell said, and the Fed is trying to walk a line between doing too much and too little or too much.

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment,” he said.