Have you ever noticed how a six-figure salary, which used to be considered a significant income, now seems low in Los Angeles? It's surprising how the cost of living has skyrocketed in this city. From basic necessities to everyday expenses like jeans and gym memberships, everything seems to come with a higher price tag. So, how can the average Angeleno, with a median income of $69,000, manage to make ends meet? At least we have the sunshine for free.

On June 6, the release of the 2023 State Income Limits document by the California Department of Housing and Community Development brought attention to a startling fact. It stated that a family of four earning less than $100,900 annually in Los Angeles County is classified as low-income. In most cities, earning six figures would be a comfortable living. But here, it's a struggle to get by.

Of course, some may dismiss the challenges faced by households earning $100,000 or more as first-world problems, especially when we consider the thousands of unhoused residents in L.A. County. However, the reality is that more and more people, including those with what would be considered high salaries in other parts of the country, are questioning their ability to afford to live in this city.

In the aftermath of the pandemic and ongoing strikes by writers and actors, many households that once enjoyed incomes well above $100,900 have seen their earnings decrease, approaching or even falling below that low-income threshold. This threshold determines eligibility for housing assistance programs. Unfortunately, while incomes dwindle, critical expenses like rent, mortgage rates, and gas prices continue to rise to exorbitant levels.

The situation highlights the growing financial strain on residents, making it increasingly challenging to maintain a comfortable standard of living in Los Angeles.

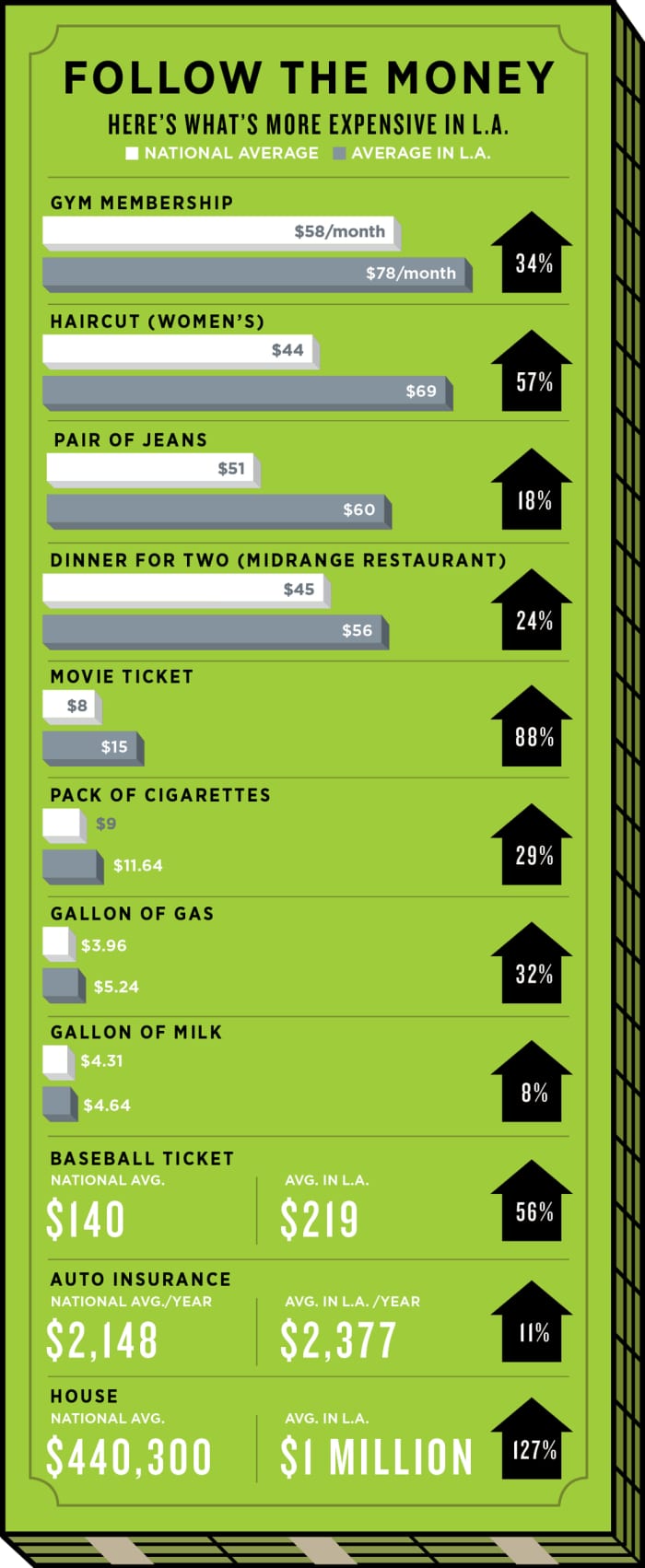

A list of expenses far more expensive in L.A. than the national average.

(Illustration by Neil Jamieson)

"Over the last decade, we’ve seen affordability hit a new crisis level in Los Angeles County," says Darin Chidsey, chief operating officer at the Southern California Association of Governments, a planning organization that produces a battery of financial reports on life in L.A. and other regional cities. "It’s always been an expensive place to live, and certainly real estate values have always been well above what we see in other metropolitan areas throughout the country. But we’ve seen dramatic shifts over the last 10 years in affordability."

Every Angeleno has experienced some form of sticker shock lately — even as we’ve become accustomed to paying $6 for a latte pretty much everywhere. When I arrived in L.A. in 1993, the Burrito King in Echo Park served a size-of-your-head carne asada burrito for a mere $5. Today, it’s $10.99. The three-pack of strawberries at the Atwater Village Farmers’ Market that was $12 pre-pandemic now runs $16. And even as the avian flu scare has subsided, have you seen the price of a dozen eggs?

Reams of hard data back up these casual observations: The MIT Living Wage Calculator finds that an L.A. County family of four with two working parents needs to earn at least $125,411 — before taxes — to support the household at a basic standard of living. When I first moved here, my studio in Silverlake was just $425 a month; a few years later, I moved into a one-bedroom in Echo Park for $550. According to Zillow, the median home rental price in the city on Aug. 23 was (gulp) $2,958. Meanwhile, SCAG’s Economic Summit briefing book, released last December, found that the median price for a single-family home rose 193% during the past decade, to $855,000. More recent analysis puts the median at nearly $1 million.

A battalion of cost-of-living surveys place Los Angeles in various slots, but all of them have the city hovering at the tippy top of the rankings. A Kiplinger report released in April calls L.A. the seventh-most expensive city in the country, with a cost of living 50.6% above the U.S. average. "L.A.’s notorious traffic helps push transportation costs 29% above the national average," the report states, adding cheerfully, "Housing bleeds residents dry." A U.S. News ranking marks Los Angeles as the nation’s second-most expensive place to live, behind San Diego.

It’s death, or at least insolvency, by a thousand credit card taps. On Aug. 23, the average cost of a gallon of gas in Los Angeles County was $5.26, compared with the national average of $3.85, according to AAA. Database website Numbeo puts the price of a pair of Levi’s 501 jeans at $60.01 in L.A., well above the national average of $51.29. Zillow’s home rental average is 41% higher than the national median of $2,100. A Rocket Mortgage online tool finds that it costs $50,000 in Los Angeles to maintain the standard of living that a mere $34,674 would buy you in Phoenix.

The economics of moving are tempting, but the downside is, you’d have to live in Phoenix.

So, what happened? How did Los Angeles become a place where you can make six figures and still feel like you are struggling?

Economists cite a number of factors. Los Angeles’ infamous permitting hurdles and government bureaucracy can slow everything from apartment-building construction to restaurant openings, and delays drive up costs. The city has a hefty 9.5% sales tax, above the 7% in Miami, 8.25% in Dallas, and 8.875% in New York City (though lower than the 10.25% in Chicago).

Then there’s inflation, which soared during the pandemic. According to the U.S. Bureau of Labor Statistics, prices in the Los Angeles area in June 2021 were 4% higher than 12 months earlier. Then things went from bad to craptastic, with another 8.6% spike in June 2022. The year-over-year inflation rate in the region this past June was a moderate 2.5%, but if your income failed to keep up with inflation during any of those years, then every dollar you make buys less than it did before COVID.

But the primary driver, which will surprise no one, is the cost of housing in Los Angeles. Years of underbuilding have tightened supply, driving up prices and helping fuel the homelessness crisis. SCAG’s Regional Housing Needs Assessment found that in the period from 2021-29, L.A. County will need to construct 812,060 housing units to meet demand. That’s six times the number of residences built during the previous eight-year cycle.

Housing, says Chidsey, is "the foundation of our affordability issue."

"We’ve seen on the rental side, over the last decade, about 200,000 units that used to be under $1,000 have disappeared off the market," Chidsey adds.

And L.A. is definitely a renter’s town. An estimated 63% of Angelenos lease their home, almost the opposite of the national picture, where the homeownership rate is 65.9%, according to U.S. Census data. The high price of renting in L.A. puts a distressing amount of the average Angeleno’s take-home pay into housing. The 2021 American Community Survey found that 30.9% of renters in the county were spending more than half of their income on rent. If you’re paying the Zillow median of $2,958 a month in rent, that works out to $35,496 a year. Remember, that’s the median — half of local apartments are more expensive.

Entering the homeownership market is an even steeper uphill climb, to put it mildly. According to the California Association of Realtors, during the second quarter of this year, only 15% of households in Los Angeles County could afford a median-priced house, down from 17% in quarter one. The analysis says a minimum household income of $198,000 would be required to meet monthly payments of $4,950 — totaling just less than $60,000 a year — on a $789,000 home.

You’d think L.A.’s pandemic-driven population drain — the county shrunk from 10 million in April 2020 to 9.72 million in July 2022 — might have loosened the tight housing market. But you’d be wrong: There are fewer homes for sale in L.A. today than at this time last year, especially among those considered lower-priced properties (shockingly, in the $650,000-$1 million range).

Still, Brian Ades of Sotheby’s International Realty says there are home-buying options, assuming one can cobble together 20% for a down payment and qualify for a mortgage — also a challenge, as interest rates in August climbed above 7%, their highest in two decades. He suggests looking for a single-family residence in places such as Burbank, Mission Hills or the small city of San Fernando, where a Metro light-rail project is in the works (estimated completion in 2030). Central L.A., he adds depressingly, might not be viable in the current market.

“If you go south of the 101, you’re going south of the 10,” says Ades. “There’s not a lot in that 101-405-10 circle.”

Of course, the flip side of the higher cost of living in L.A. is that workers here generally earn more. The minimum wage in Los Angeles is currently $16.78, more than double the federal minimum of $7.25, and it’s even higher in places like Santa Monica ($16.90) and West Hollywood ($19.08). Executive salaries are more generous here as well: The average gray-flannel worker in L.A. earns $122,275, according to Indeed, which puts the national average at $99,210.

But, of course, there’s a cost to giving employees, whether they’re in corner offices or at the corner 7-Eleven, a better quality of life — it pushes up regional prices. Ultimately, customers end up writing those higher-than-national-average paychecks.

That compensation pressure doesn’t look like it’s abating soon; indeed, it could get worse amid strong union and political pushes to raise regional wages even further. County Supervisor Janice Hahn in August introduced a motion to pay hotel and theme park workers at least $25 an hour. Business groups — big shocker — are fighting it.

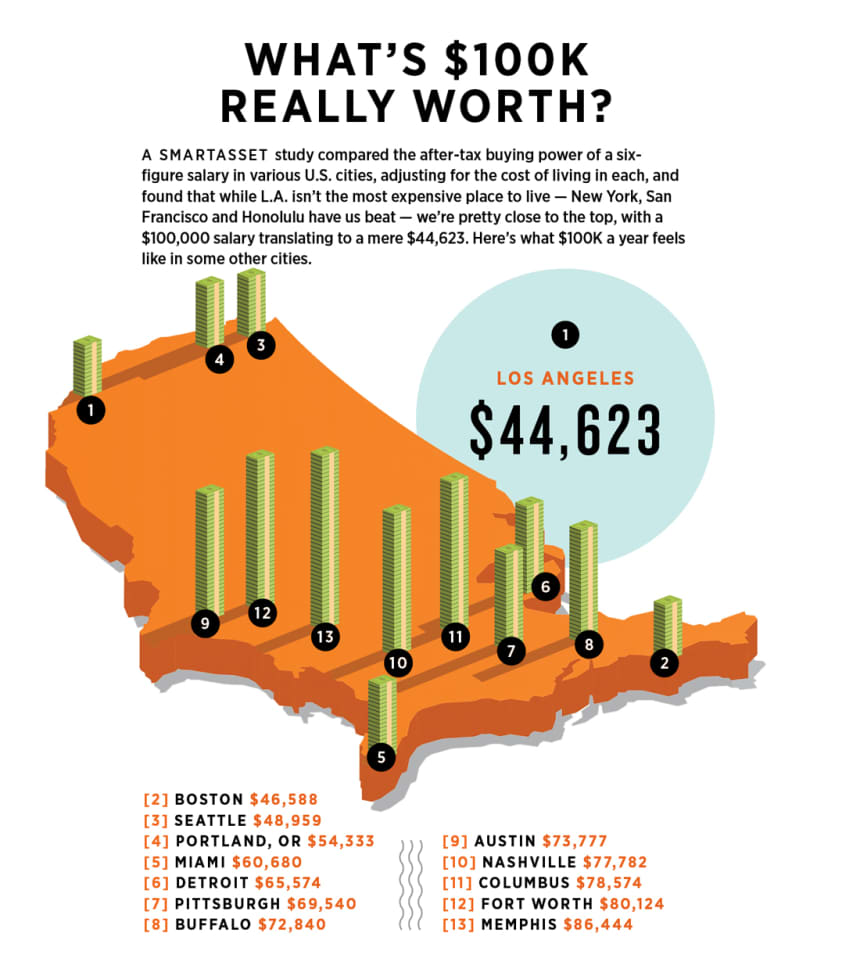

What a $100K salary actually feels like in L.A. and other major U.S. cities after adjusted for cost of living.

(Illustration by Neil Jamieson)

Obviously, the stress of making a living in Los Angeles is far greater for minimum-wage workers, those struggling to survive on $30,000 or $50,000 a year. Nobody is going to be crying a river for $100,000 earners and their middle-class laments over luxury gym membership affordability and the cost of a peanut butter protein smoothie at Erewhon ($13!). But, to be fair, the pain is real for them, too, especially as they struggle to raise families in good neighborhoods — which, as that California Department of Housing and Community Development document makes clear, isn’t at all easy to do on $100,000 in this city.

The good news? You probably already know it, which is maybe why you’re still here. There’s much to enjoy in L.A. that costs nothing. The weather. The beaches. Last time we checked, hiking in the mountains is free, too.

“It’s certainly an expensive place to live,” says Chidsey, “but I think most people stay here because they’re getting what they pay for. It’s a great quality of life.”