Norway's $1.4 trillion sovereign wealth fund, the world's largest, posted a 374 billion crown ($33.80 billion) loss in the third quarter, it said on Tuesday, as higher interest rates and economic weakness sparked declines in all asset classes.

The fund's return on investment was minus 2.1% for the July-September period, 0.17 percentage points stronger than the return on its benchmark index.

Equities - its biggest asset class, accounting for 70.6% of its value in the quarter - recorded a 2.1% loss. Fixed income investments, which account for just above another quarter of its assets, returned a loss of 2.2%, and real estate assets of 3.3%.

The broad-based nature of the decline "maybe indicates that there is a little bit of a fundamental macro factor driving this and ... one would point to the continued rising interest rates," Deputy CEO Trond Grande told Reuters.

Equities over the past year have outperformed compared to other asset classes, said Grande.

But there too, the fund had "a little bit of... concern", Grande said, as the growth was "really concentrated on a few super large U.S. tech companies".

Asked whether he saw a higher risk of a correction in markets now compared with three months ago, Grande said he did not.

Still, "we've been warning that we come from a rather long period of low-interest rates, and also expansive... fiscal policies", he said.

"When the interest rates rise this much and this fast, obviously there's going to be businesses that need to refinance and finance themselves on higher rates. And the question is if all are well positioned to do that with the profitability."

ISRAEL

Regarding the war between Israel and Hamas, the fund is little exposed, with 0.1% of its investments held in Israel, equivalent to 20.4 billion crowns, as of Oct. 6, the eve of the start of the conflict.

The fund has not changed its investment strategy there, but is monitoring the situation, it previously told Reuters.

"To the extent it has the potential to grow into a bigger and more regional conflict, that's obviously concerning," Grande said on Tuesday.

Coca-Cola reported its third-quarter earnings before the bell Tuesday.

Here’s what the company reported compared with what Wall Street analysts surveyed by LSEG, formerly known as Refinitiv, were expecting:

- Earnings per share: 71 cents, vs. expected 69 cents

- Revenue: $11.91 billion, vs. expected $11.44 billion

The beverage giant’s stock has fallen 15% this year, dragging its market value down to about $234 billion. Shares are under pressure as investors worry about both short-term and long-term challenges for Coke.

Like many companies, Coke has been raising prices on its products, driving some consumers to shop for cheaper private-label options instead. The strong U.S. dollar makes its drinks even more expensive abroad. And while many commodities have become less expensive, sugar prices have stayed high.

But sugar isn’t just hurting Coke’s profit margins. Walmart said users of diabetes drug Ozempic are spending less on groceries, sending shares of Coke and rivals like PepsiCo lower.

While Coke has pivoted its portfolio in recent years to include fewer sugary drinks, its namesake brand and other sodas are still important to the company’s net sales. Coke has also recently introduced alcoholic drinks, which have also seen their consumption fall among users of the so-called GLP-1 drugs.

For 2023, Coke expects comparable adjusted earnings per share growth of 5% to 6% and organic revenue growth of 8% to 9%.

General Motors beat Wall Street’s third-quarter expectations on Tuesday, as it battles through ongoing labor strikes by the United Auto Workers union that’s costing the automaker roughly $200 million a week in lost vehicle production.

The labor strikes, which started Sept. 15, have cost the automaker roughly $800 million in pre-tax earnings due to lost vehicle production, including $200 million during the third quarter, according to CFO Paul Jacobson.

Due to the ongoing volatility caused by the strikes, GM is pulling its previously announced earnings guidance for the year that called for $12 billion to $14 billion in adjusted earnings and net income attributable to stockholders of between $9.3 billion and $10.7 billion.

Prior to the UAW strikes, Jacobson said the company was on track to achieve “toward the upper half” of its earnings forecast.

Here’s how the company performed in the third quarter, compared with average estimates compiled by LSEG, formerly known as Refinitiv:

- Adjusted earnings per share: $2.28 versus $1.88, estimated

- Revenue: $44.13 billion versus $43.68 billion, estimated

For the third quarter, GM reported net income attributable to stockholders of $3.06 billion, or $2.20 per share, down 7.3% from a year earlier when the company earned $3.31 billion, or $2.25 per share.

Revenue during the period increased 5.4% from $41.89 billion a year earlier, while adjusted earnings before interest and taxes (EBIT) declined 16.9% from the third quarter of 2022 to $3.56 billion.

GM’s North American adjusted earnings were off 9.5% during the third quarter from a year earlier to $3.53 billion. Its international operations increased earnings by roughly 7% to $357 million, while its equity income from operations in China were down year over year by about 42% to $192 million.

GM said on Tuesday from January to September of this year it lost roughly $1.9 billion on Cruise, the company’s majority-owned autonomous vehicle subsidiary. Those losses include $732 million during the third quarter, as the company geographically expands operations.

EVs

Jacobson said GM also is pulling near-term targets for its electric vehicles amid slower-than-expected demand. The automaker had previously set goals to sell 400,000 EVs in North America from 2022 through mid-2024 and produce 100,000 EVs in North America during the second half of this year.

Jacobson said GM will retain its targets of achieving low-digit profit margins on EVs as well as North American annual production capacity for the vehicles of 1 million by 2025.

“We’re really focusing on making sure that we’re driving toward demand targets,” Jacobson said. “We’re balancing production to demand.”

GM last week said it would delay production of electric trucks at a second plant in Michigan by at least a year until late 2025. The delay is expected to save GM about $1.5 billion in capital next year, Jacobson said.

GM continues to increase production of the EV models that are currently in production as well as battery cell production at a joint-venture plant with LG Energy Solution in Ohio, according to Jacobson.

He said the automaker is seeing improvement in earlier problems in battery cell production that hampered EV output, however, officials are still “working through the issues.”

Overall, Jacobson said GM is focused on “streamlining the business” wherever it can to reduce costs and boost profits to achieve 2025 financial targets.

GM CEO Mary Barra, in a letter to shareholders, said through next year the company will launch “a wide range of new SUVs that are more profitable than the outgoing models.”

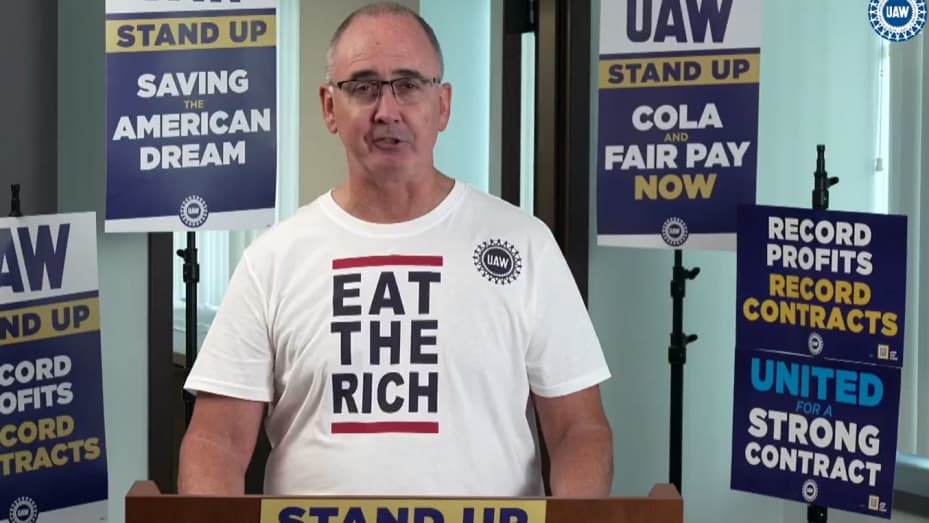

UAW

GM has been navigating ongoing strikes by the UAW after the union and Detroit automakers failed to reach tentative labor deals by a Sept. 14 deadline for contracts covering 146,000 union workers.

The UAW has been expanding work stoppages at GM, Ford Motor, and Stellantis as bargaining continues.

As of Monday, more than 40,000 UAW members at the automakers, or roughly 28% of UAW members covered by the expired contracts, were on strike.

Of the Detroit automakers, GM has the fewest number of workers — roughly 9,200 — currently on strike. Another 2,350 or so GM employees have been laid off at other operations due to the strikes, according to the company.

The UAW, which has escalated strikes to pickup truck plants at Ford and Stellantis, hasn’t expanded strikes at GM since Sept. 29.

Jacobson declined to estimate how much the impact of the strikes would increase if expanded to other plants such as GM’s highly profitable Arlington Assembly, which the union has previously threatened as a potential target.

“We’re trying to prepare the best we can for whatever decisions they might make, but we remain optimistic and hopeful that we’ll make progress and get this resolved going forward,” he said.

During the last round of contract bargaining four years ago, a national 40-day UAW strike against GM cost the company about $3.6 billion in earnings that year.

Immigration will benefit the U.S. in the long term by addressing the worker shorter and supplementing benefits of retirees according to New York University Professor Emeritus of Economics and International Business Nouriel Roubini.

He spoke with CNBC on why a selective but open immigration policy has helped U.S. growth. Most billion-dollar startups in America have been founded by immigrants, and companies such as Google, Tesla, and Apple have had CEOs from immigrant backgrounds.

“Many people are against immigration because they fear that it’s going to lead to job losses or income losses. But the evidence is not consistent with that. We have a shortage now of labor because of the aging of populations. That reduces potential growth, reduces productivity, and creates a larger fiscal deficit and implicit liability for the government, those deriving from a pay-as-you-go Social Security and health-care system. So we need more younger workers to be able to pay for the benefits of those who are retiring,” he said.

Roubini explained that the future of technology and the singularity are concerning as artificial intelligence is integrated into the workplace.

“Some people talk about singularity. Some people talk about AGI artificial general intelligence or similar types of concepts. They all have to do with the view that eventually machines may become better than any human, not only for specific tasks. … Will AI make the machines and the robots be so much more intelligent than us? Or there could be a merger between the AI and the human brain so that we actually become ourselves super intelligent,” said the author of “MegaThreats: Ten Dangerous Trends That Imperil Our Future, And How to Survive Them.”

Another “mega threat” Roubini discussed is global warming and how companies claiming to reach net zero are behind.

“Firms and corporations have to be involved. And of course, the government and countries have to be involved. Unfortunately, many of the commitments to net zero done by many businesses or even financial institutions are more like corporate PR rather than real plans. Everybody says we’re going to reach net zero, but there’s a lot of greenwashing and green wishing rather than real specific plans. That’s why we still have a significant amount of global climate change. And this is going to be the hottest year in history and next year is going to get worse,” the economist said.

The price of bitcoin breached the $34,000 level to hit its highest since May last year, bolstered by positive sentiment about a bitcoin exchange-traded fund.

The world’s largest cryptocurrency was trading 4.97% higher at $34,596.40 on Tuesday, according to data from Coin Metrics.

Ether, the second-biggest digital coin, surged to its highest since August, according to Coin Metrics data.

“The real catalyst that created the ‘god candle’ earlier today and pushed bitcoin above $34,000 was the $167 million in short liquidations, mainly on offshore exchanges,” said Ryan Rasmussen, an analyst at Bitwise Asset Management.

“I don’t think anyone expected the level of price action we’re seeing, and those investors who were shorting bitcoin in the $33,000 plus range are certainly feeling the pain of that surprise today,” said Rasmussen.

Anticipation of a bitcoin ETF grew after the court ruled in favor of crypto-focused asset manager Grayscale over the U.S. Securities and Exchange Commission in its bid to turn its huge Grayscale Bitcoin Trust (GBTC) bitcoin fund into an ETF.

Last week, the SEC declined to appeal that ruling by a key deadline, sparking hopes a bitcoin-related ETF may be approved in the next few months.

A bitcoin ETF would give investors a way to gain exposure to Bitcoin’s price movements without owning the cryptocurrency directly.

Bitcoin is considered a highly volatile asset, and its price fluctuations are unpredictable.

Goldman Sachs Group Inc.’s top executive said he’s uncertain about mergers and acquisitions in the current period while expressing optimism about a pick-up in dealmaking over the long term.

“Long term, I’m certainly optimistic,” Chief Executive Officer David Solomon said at a panel discussion at the Future Investment Initiative summit in Riyadh, Saudi Arabia. “But I’m uncertain right now.”

Goldman suffered its eight straight quarterly profit drop after real estate writedowns and a continued dealmaking slump. In the bank’s earnings statement this month, Solomon said he expects a continued recovery in both capital markets and strategic activity if conditions remain conducive.

Dealmaking has hit a low after the US Federal Reserve started raising interest rates to combat inflation. Signs of a turnaround are starting to show, with two oil megadeals announced this month, but investment bankers have been eager to signal the business has reached a trough. Fees soared during the pandemic, fueled by low rates and government economic stimulus.

“If you’re a CEO and you’re uncertain, you tend to be cautious about doing significant things that change the trajectory of your business and bring outside factors into your business,” Solomon said during the panel discussion.

As businesses become more certain about the environment, they have to move forward and continue consolidation and scale to compete effectively, Solomon said.

“My strong view is M&A activity, over reasonable periods of time, decades, grows in parallel with economic growth and market cap expansion,” he said. “We’ll continue on that journey and you’ll see a pick up in strategic M&A.”

The recent slump in M&A fees caused lenders to slash their workforce in the first few months of the year. But Solomon said his bank is still competitive when it comes to hiring talent.

“Goldman Sachs feels very good about where it sits competitively to attract people,” adding more than a million people applied for positions at his firm last year. The company employs about 45,000, he said.