Millions of Social Security recipients will get a 3.2% increase in their benefits in 2024, far less than this year’s historic boost and reflecting moderating consumer prices.

The cost-of-living adjustment, or COLA, means the average recipient will receive more than $50 more every month beginning in January, the Social Security Administration said Thursday. The AARP estimated that increase at $59 per month.

“This will help millions of people keep up with expenses,” said Kilolo Kijakazi, Social Security’s acting commissioner.

About 71 million people — including retirees, disabled people, and children — receive Social Security benefits.

Thursday’s announcement follows this year’s 8.7% benefit increase, brought on by record 40-year-high inflation, which pushed up the price of consumer goods. With inflation easing, the next annual increase is markedly smaller.

“Compared to last year’s 8.7% increase, this is going to feel small and the perception is that it's not keeping up with the inflation and the higher costs that retirees are still seeing,” said Martha Shedden, president of the National Association of Registered Social Security Analysts.

On top of that, an anticipated increase in Medicare premiums for 2024 will eat into the Social Security cost-of-living bump.

Medicare hasn’t announced the increase for traditional Medicare but said the cost of Medicare Advantage plans is expected to remain stable.

Still, senior advocates applauded the annual Social Security adjustment.

“Retirees can rest a little easier at night knowing they will soon receive an increase in their Social Security checks to help them keep up with rising prices,” AARP CEO Jo Ann Jenkins said. “We know older Americans are still feeling the sting when they buy groceries and gas, making every dollar important.”

Social Security is financed by payroll taxes collected from workers and their employers. The maximum amount of earnings subject to Social Security payroll taxes will be $168,600 for 2024, up from $160,200 for 2023.

Retirees whose sole income comes from Social Security are not subject to taxes on that income.

Nancy Altman, president of Social Security Works, an advocacy group for the social insurance program, said that the COLA is a “reminder of Social Security’s unique importance” and that “Congress should pass legislation to protect and expand benefits.”

However, the program faces a severe financial shortfall in the coming years.

The annual Social Security and Medicare trustees report released in March said the program’s trust fund will be unable to pay full benefits beginning in 2033. If the trust fund is depleted, the government will be able to pay only 77% of scheduled benefits, the report said.

There have been legislative proposals to shore up Social Security, but they have not made it past committee hearings.

A March poll by The Associated Press-NORC Center for Public Affairs Research found that most U.S. adults are opposed to proposals that would cut into Medicare or Social Security benefits, and 79% of people polled said they oppose reducing the size of Social Security benefits.

The Social Security Administration is still without a permanent leader. President Joe Biden in July nominated former Maryland Gov. Martin O’Malley to lead the agency.

The COLA is calculated according to the Bureau of Labor Statistics’ Consumer Price Index, or CPI. But there are calls for the agency to instead use a different index, the CPI-E, which measures price changes based on the spending patterns of the elderly, like health care, food, and medicine costs.

Any change to the calculation would require congressional approval. But with decades of inaction on Social Security and with the House at a standstill after the ouster of Speaker Kevin McCarthy, R-Calif., seniors and their advocates say they don’t have confidence any sort of change will be approved soon.

The cost of living adjustments will have a big impact on people like Alfred Mason, an 83-year-old Louisiana resident. Mason said that “any increase is welcomed because it sustains us for what we are going through.”

As inflation is still high, he said, anything added to his income “would be greatly appreciated.”

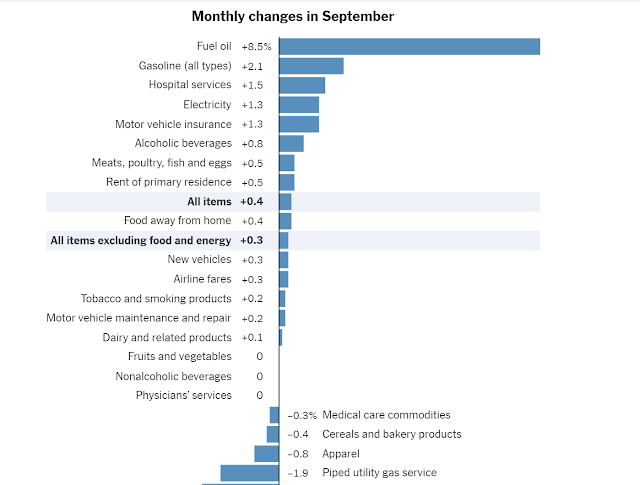

The highly anticipated inflation gauge is out. It shows that consumer prices in September rose 0.4% from the previous month, and 3.7% from a year ago, steady from the 3.7% increase posted in August, according to the latest Bureau of Labor Statistics (BLS) data.

The shelter index—mostly composed of rental costs—increased 7.2% over the last year. That accounted for 70% of all price increases minus food and energy, with gasoline also a major contributor to the rising inflation.

The good news

The consensus is this data is unlikely to prompt the Federal Reserve to hike interest rates at its next meeting. In fact, “today’s data supports being close to the end of the hiking cycle as the US economy remains on a disinflation path,” wrote Goldman Sachs Asset Management’s Lindsay Rosner, head of multi-sector fixed income investing, in a note to clients.

She added this may boost the Fed’s confidence that “monetary policy has been sufficiently restrictive.”

Moody’s chief economist Mark Zandi would agree.

“September CPI was on the script—consistent with inflation returning to the Fed’s 2% target,” he posted on X (formerly Twitter).

The bad news (okay, it’s not that bad)

The two major factors driving September’s inflation were gasoline and housing prices.

Motorists should feel slightly relieved at the pump, with gas prices steadily declining over the last week despite the Israel-Hamas war. The national average price of gasoline as of today (Oct. 12) is $3.65, down from $3.84 a month ago, according to the American Automobile Association (AAA).

The surprise in September was the big bump in housing costs. But analysts aren’t worried, as they’re already seeing signs elsewhere suggesting that growth in rent prices will moderate.

Average asking rents slowed to a 0.2% increase in September, to $2,047, according to the latest Zillow Observed Rent Index (ZORI). This is still 3.2% higher than a year ago, but it continues the 19-month slowdown in the annual growth rate since it hit a record high of 16% in February 2022.

US home values also fell slightly by 0.1% in September, the first monthly dip since February. This is largely due to a fresh supply of new multifamily construction projects that were financed before a surge in mortgage rates, according to Zillow.

It all suggests that the soaring shelter index in the September consumer price report is an anomaly.

“Today’s report is a reminder that we do not have good historic examples to lean on in determining the path for rent inflation,” Bank of America’s economists wrote in a note to clients.

Pensioners feel the pinch from the cost of living

With inflation moderating, Americans receiving Social Security benefits will get a cost-of-living adjustment of 3.2% in 2024, down from the 8.75% boost implemented this year, according to the latest release from the Social Security Administration. But even that hasn’t covered the strain on household budgets. A report from the Seniors Citizen League found that 68% of people on Social Security said that household expenses have been 10% higher than the year before, despite cooling inflation.

Meanwhile, over half of the survey respondents were worried Social Security payments would be insufficient to cover their future living costs.

With the increase now set for 2024, pensioners will receive an average of $50 more per month in their Social Security benefits.