(Reuters) - The U.S. economy ended last year with the labor scars from the COVID-19 pandemic effectively healed and a quandary for Federal Reserve policymakers so far waiting in vain for wage and job growth to cool to a sustainable level.

The addition of 216,000 jobs to U.S. payrolls in December and wage growth of 4.1% both beat expectations, leaving the central bank still looking for clear signs of a slowing labor market and prompting traders in contracts tied to the benchmark federal funds rate to trim expectations the Fed will start cutting rates at its March meeting.

Monthly job growth of around 100,000 and annual wage growth of around 3% are the Fed's rough benchmarks for growth in each that would be considered consistent with the Fed's 2% inflation target.

"Workers still have the upper hand in the current environment, with strong wage growth and plenty of job opportunities," wrote Nationwide Senior Economist Ben Ayers. Wage growth remaining above 4% adds to concern that inflation in labor-intensive services industries may be hard to quell and represents "another blow to the odds that the Fed will cut rates early this spring."

The Fed held the benchmark interest rate steady at its December meeting in the current range of from 5.25% to 5.5%. But the language in the policy statement issued after the Dec. 12-13 session was changed to allow the possibility that no further rate increases will be needed, while new projections showed a majority of policymakers expect rate cuts of three quarters of a percentage point will be appropriate by the end of the year.

Minutes of that meeting reflected an increased sense among officials that they may be approaching a point where the risks to jobs and economic growth posed by the current level of interest rates are more serious than those posed by inflation and have fallen faster than expected of late and which by some measures is near the Fed's 2% target already.

Yet the job market remains a puzzle.

Payroll employment has grown by 14 million over the past three years, a historic run that not only replaced the positions lost when parts of the economy were shut down at the start of the pandemic, but is now slightly beyond the level that would have been reached under the Fed's benchmark for sustainable job growth.

The unemployment rate has been below 4% since February 2022.

But while those headline numbers speak to continued strength in employment, some undercurrents point to slowing.

Revisions to prior months lopped 71,000 jobs from the estimated payroll additions in October and November. On a three-month average basis monthly payroll growth is now below the average of around 183,000 seen in the decade before the pandemic.

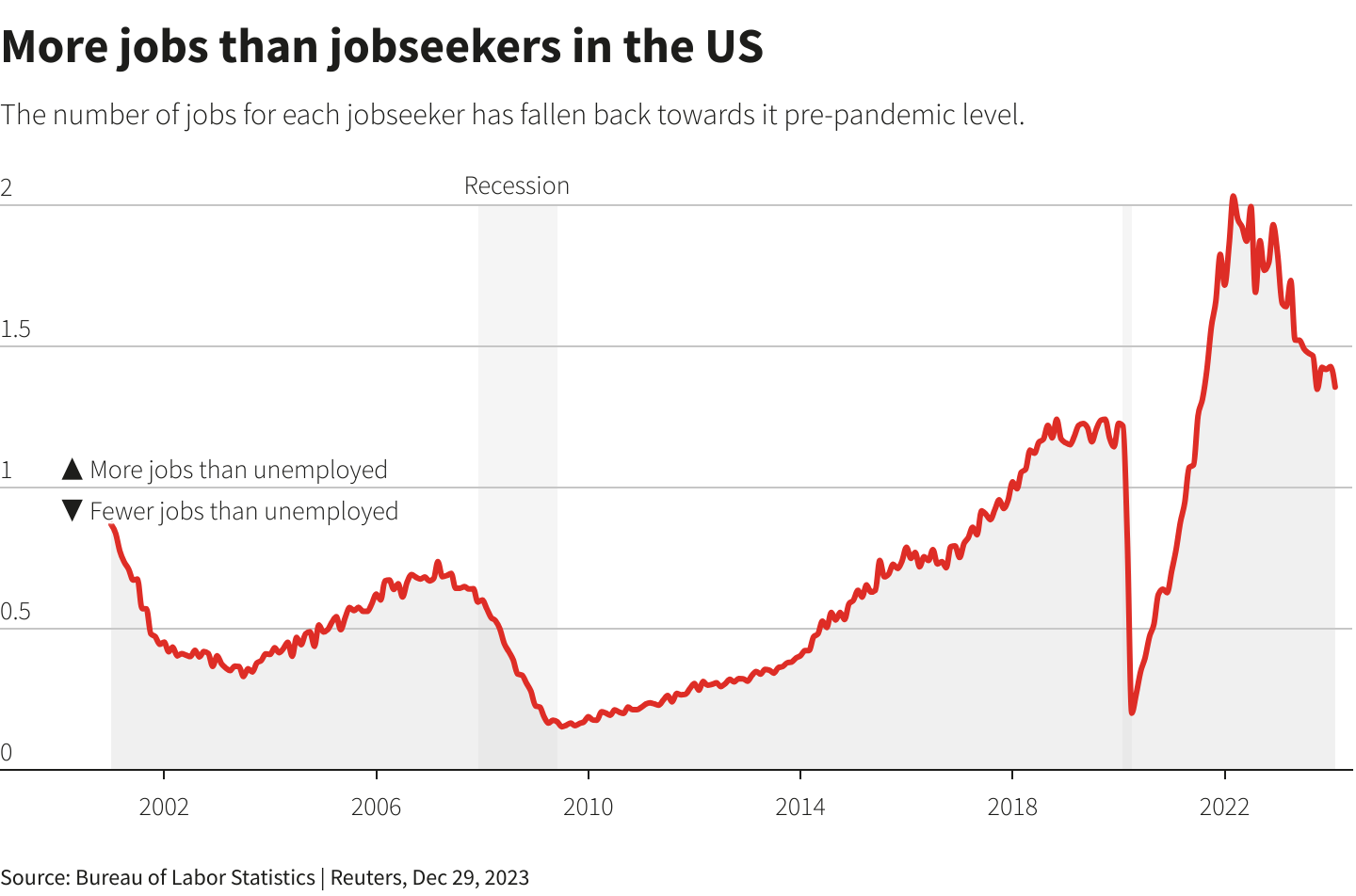

Other aspects of the job market are also easing back to normal, including time lost to sickness and measures of labor churn like the worker quits rate, both of which are at or near pre-pandemic levels. The ratio of job openings to the number of unemployed jobseekers has also been approaching its pre-pandemic norm.

Minutes of the Fed's December meeting said that "a number" of Fed officials had begun questioning how much longer tight monetary policy would be needed, and "pointed to the downside risks to the economy that would be associated with an overly restrictive stance."

"A few" went further and said the Fed may soon face explicit tradeoffs between maintaining a healthy job market and continued progress on inflation.

The Fed under Chair Jerome Powell has so far avoided that difficult choice, with inflation continuing to fall even alongside job and wage gains.

That could reflect changes in how the economy works. Fed officials currently estimate that an unemployment rate of around 4.1% is consistent with inflation remaining stable at the 2% target, but improvements in job matching, for example, or in worker productivity could have pulled that lower at least in the short term.

Or it could just be a delayed reckoning, something worker advocates said the Fed should stay ahead of.

"Job growth has visibly slowed," said Skanda Amarnath, executive director of Employ America, pointing to both the revisions in prior months' payroll numbers based on a survey of businesses and the weaker employment levels reflected in a separate survey of households. "The Fed should be rebalancing their focus away from yesterday's inflation challenges to the potential downside risks the labor market faces in 2024."

Reporting by Howard Schneider; Editing by Dan Burns and Andrea Ricci