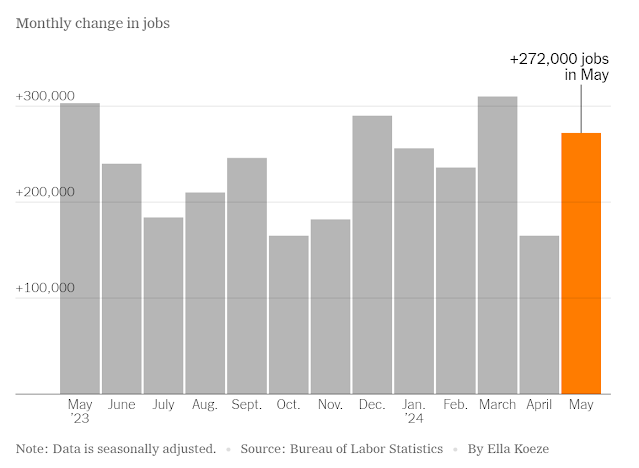

The U.S. created a bigger-than-expected 272,000 new jobs in May, suggesting the economy is still expanding at a steady pace and is in no danger of recession.

The unemployment rate, meanwhile, rose to 4% from 3.9%, the first time it's hit that mark since January 2022. More people said they lost their jobs last month and fewer people entered the labor force.

Another large increase in jobs last month likely means the Federal Reserve will wait longer to cut interest rates. Wall Street is betting the first reduction won’t take place at least until September.

The Fed was been put off by persistent inflation and it’s looking for signs of slower economic growth before it cuts rates. A slower economy tends to reduce inflation.

Here is a rewrite of the provided context in English:

The unexpectedly strong job growth shows that employers remain undaunted, despite pressure from high interest rates and slowing consumer spending, and are finding workers as immigration has provided a boost to the labor supply.

What this means for the Federal Reserve: The jobs data is unlikely to affect the Federal Reserve's decision next week on interest rates when most economists expect policymakers to leave rates unchanged at their currently high level. Fed officials have noted they are most focused on progress in easing inflation.

More hiring trends: In other data released this week, the ratio of job openings to unemployed workers in April declined to pre-pandemic levels after peaking at more than two to one in early 2022. Employers aren't hiring very quickly, but they're not laying many people off, and workers are less likely to quit their jobs than they were in 2019.

More than 400,000 people left the labor force in May. This sure isn’t what the Fed -- or anyone -- wants to see. The participation rate remains below the pre-Covid level:

President Joe Biden celebrated what he called the “great American comeback” as monthly jobs growth blew past expectations.

“On my watch, 15.6 million more Americans have the dignity and respect that comes with a job,” the president said in a statement, after the government reported 272,000 new jobs were created in May.

With unexpectedly high numbers of new jobs and wage growth staying around 4%, inflation will stay relatively high and the Federal Reserve will hold off on lowering interest rates.

Inflation is a key issue for voters as Biden prepares to face former President Donald Trump in the November election, and Biden stressed in his statement that he’s focused on bringing down prices for things like groceries and prescription drugs.

MarketWatch has reached out to the Trump campaign for comment.

With 272,000 jobs added and a 4% unemployment rate in May, the job market is probably still running a little too hot for the Fed to cut interest rates. In some places, it’s running even hotter.

MarketWatch analyzed employment, income and rent data to find the five metropolitan areas across the country where the unemployment rate is ultralow — and where rents still make up a relatively small portion of a typical income.

The winner: Ames, Iowa. There, the unemployment rate is 1.6% — less than half the current nationwide rate of 4% — and the median rent makes up only 22% of the median income.

How does this small city keep its economy bustling while making sure residents can actually live in the area where they work? We talked to a local leader to find out.

The May jobs report bears bad news for home buyers, as reports of a strong economy will likely keep mortgage rates at status quo, the National Association of Realtors says.

With the better-than-expected jobs report indicating that the U.S. economy is still doing fine, the market is expecting the Federal Reserve to hold back on cutting rates.

And with “Wall Street … expecting a further delay in the Fed’s interest rate cut,” Lawrence Yun, chief economist at the NAR, said in a statement, “the mortgage rate looks to be stuck at near 7% average for at least another month.”

The 30-year mortgage rate averaged at 6.99% as of Thursday, according to Freddie Mac. The median sale price of a home in the U.S. was $392,200 at the start of June, an all-time high, according to real-estate brokerage Redfin.

As economists assess the latest jobs report, they're highlighting how its survey of households wasn't so great.

Elise Gould, a senior economist at the left-leaning Economic Policy Institute, has offered some thoughts about what's going on.

"The weakness in the household survey appears to be driven by the more volatile young adult series, likely a blip and could be due to an odd seasonal factor at the start of summer. I'll be surprised if that doesn't rebound next month," she said in social-media posts, which are shown below.

Digging deep into May jobs report, here's what we found

Now hiring: That about says it all about the U.S. economy.

Yes, there are signs the economy is slowing. And there's evidence to suggest employment growth will slow, especially once the U.S. is past the spring hiring season. Lots of young workers will be looking for summer jobs and businesses need to staff up for the summer.

But make no mistake. There's still plenty of demand for labor.

In May, businesses hired an estimated 917,000 people before seasonal adjustments. In other words, that's the number of net new jobs actually created.

Historically that's par for the course. The economy normally adds 600,000 to 900,000 jobs in May every year. The latest increase was at the top of the range and similar to the gains in 2022 and 2023.

Could hiring fall off a cliff in the next few months? Perhaps, but there's no sign of it.

Today’s report brought us another strong jobs growth number — but for plenty of white-collar workers, it’s still difficult to find a new job.

One of the latest challenges facing those job seekers: Employers are handing out hefty homework assignments.

More companies are asking applicants to put together huge projects — like detailed department strategies, long writing assignments or 40-slide presentations — as a mandatory part of the interview process. Candidates are getting fed up with the unpaid work and time-consuming requests. But in this job market, many feel forced to do whatever employers ask.

“I’ve never seen it so bad,” one recruiter told MarketWatch. “When a company asks a candidate to complete a project or a presentation without compensation, it’s almost like they’re exploiting their time and their expertise.”

It’s the latest reminder that although the headline numbers look rosy, plenty of workers face steep odds in finding a good job. For them, the ball is back in employers’ court.

May jobs report: 272,000 jobs added to the US economy, coming in much hotter than the Street’s expectations. pic.twitter.com/aFilrFR46s

— Yahoo Finance (@YahooFinance) June 7, 2024

New: The US added 272,000 jobs last month, smashing estimates.

— Bloomberg Opinion (@opinion) June 7, 2024

Tune in for a break down of the data 📊https://t.co/FwP2GdgHgO

.webp)