Tesla attracts millions of job seekers each year, but those who receive offers often face a strategic dilemma: accept lower base pay initially for the potential of significant future gains.

Business Insider obtained access to an internal Tesla pay database, which includes data for nearly 100,000 employees as of December 2021. This data, combined with public filings and interviews with former Tesla employees, sheds light on the company's compensation strategy. Tesla offers lower base salaries compared to its peers in the tech and automotive industries but compensates with substantial stock grants.

Even Tesla's highest earners must place their bets on the company's success. This high-risk, high-reward system is paired with a rigorous hiring process that, in the past, has required Elon Musk's personal approval for every hire.

Using Tesla's internal salary database, Business Insider analyzed the median base pay for approximately 13,000 full-time, salaried, US-based employees across various job categories, such as engineering, manufacturing, and data management. (Hourly workers, many of whom are in manufacturing roles, were excluded from this analysis as it was not feasible to accurately calculate their median annual pay based on the available hourly payroll data.)

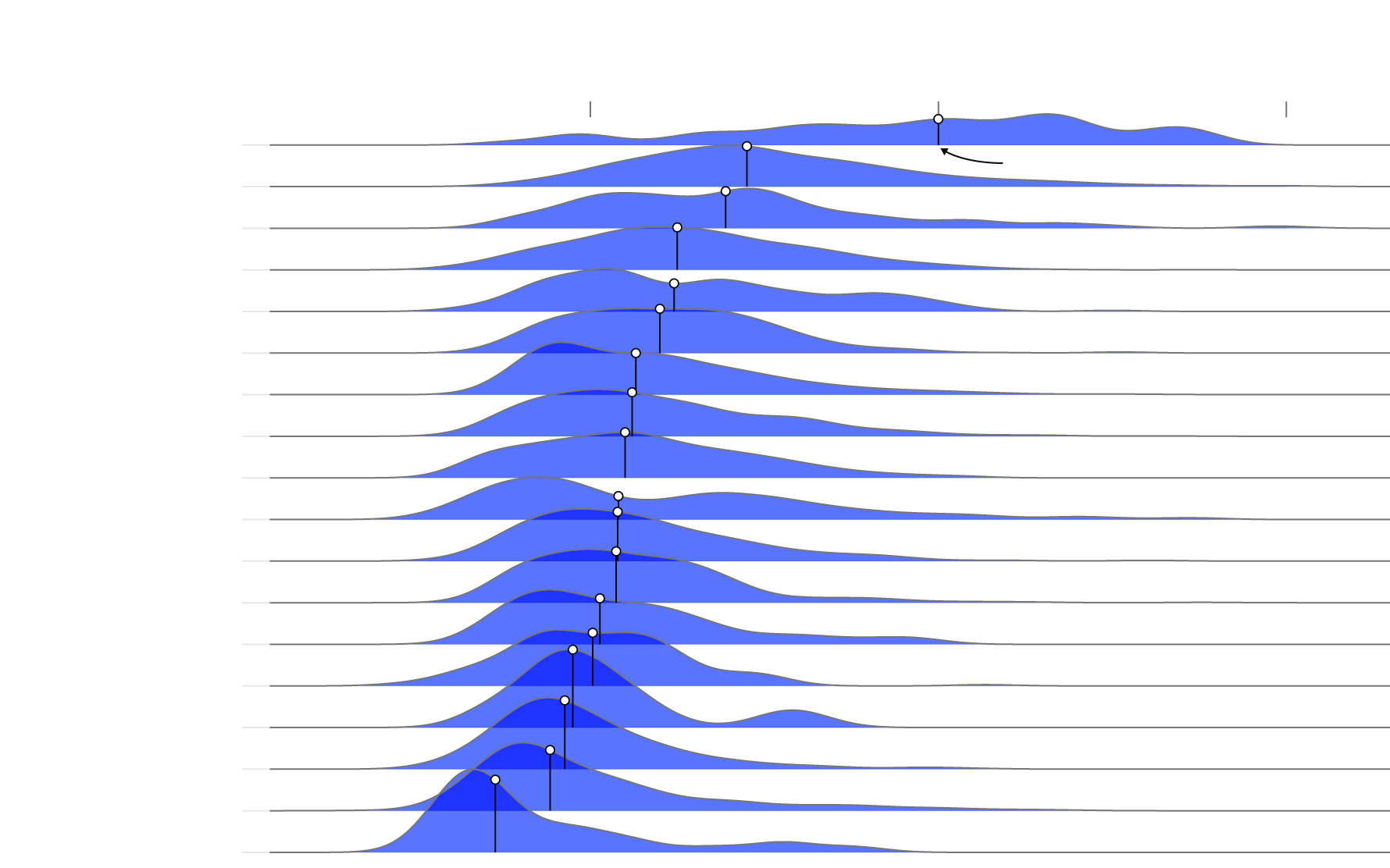

BI further broke down the data to look at median base pay by job title, analyzing the numbers for full-time, US-based, salaried roles with at least five employees.

The base pay for these titles, which include directors of engineering and managers who work in Tesla's service centers fixing vehicles, ranges from about $35,000 to $324,000, according to the data.

Nine current and former workers told BI the pay structure has largely remained in place since December 2021 and is ultimately part of Musk's quest to hire only the most "hardcore" workers.

"The whole system is set up to find the fanatics," a current Tesla worker with knowledge of the company's hiring process said. "They could get better pay somewhere else, but we want the people who are die-hard Tesla."

A former Tesla recruiter who worked with the company until 2024 said the automaker's interview process for engineers — which typically entails at least nine interviews and can take months — and the company's pay structure is designed to weed out workers who are looking to just "clock in and clock out."

"It's a culture thing," the former recruiter said. "It's not even about how smart you are or how much you know. They're looking for a willingness to learn and put in the extra hours."

Tesla, Musk, and the company's board of directors did not respond to requests for comment.

In a December 2023 regulatory filing, Tesla reported it employed more than 140,000 people worldwide. In April, Tesla told staff it planned to cut more than 10% of its workforce. A June estimate from CNBC placed Tesla's headcount at just over 120,000.

Using separate data from the Securities and Exchange Commission, BI compared the company's median base pay with that of traditional automakers and the six largest tech firms by market cap. Tesla lags behind all of them except Amazon. While there are a variety of factors that can affect a company's median salary — for example, Amazon's large warehouse workforce or Apple's large retail workforce — the data is consistent with what four current and former Tesla employees say: Tesla's base salaries are generally less than competitors'.

Nvidia, Ford, Meta, and Amazon declined to comment on their employee compensation packages. Apple, Microsoft, and Alphabet did not respond to a request for comment. GM said it has doubled its staff in Silicon Valley over the past six months and is competitive in hiring talent away from tech firms.

Nine current and former people in engineering and sales said that Tesla's stock grants make it easier to accept lower base salaries. Tesla stock could make them rich, if only on paper. On November 8, the automaker's stock surged more than 8% in the wake of Donald Trump's re-election, hitting a market cap of $1 trillion.

Some Tesla employees can receive millions of dollars in stock. In 2020 and 2021, 44 US-based employees were offered stock worth more than $1 million, according to the database.

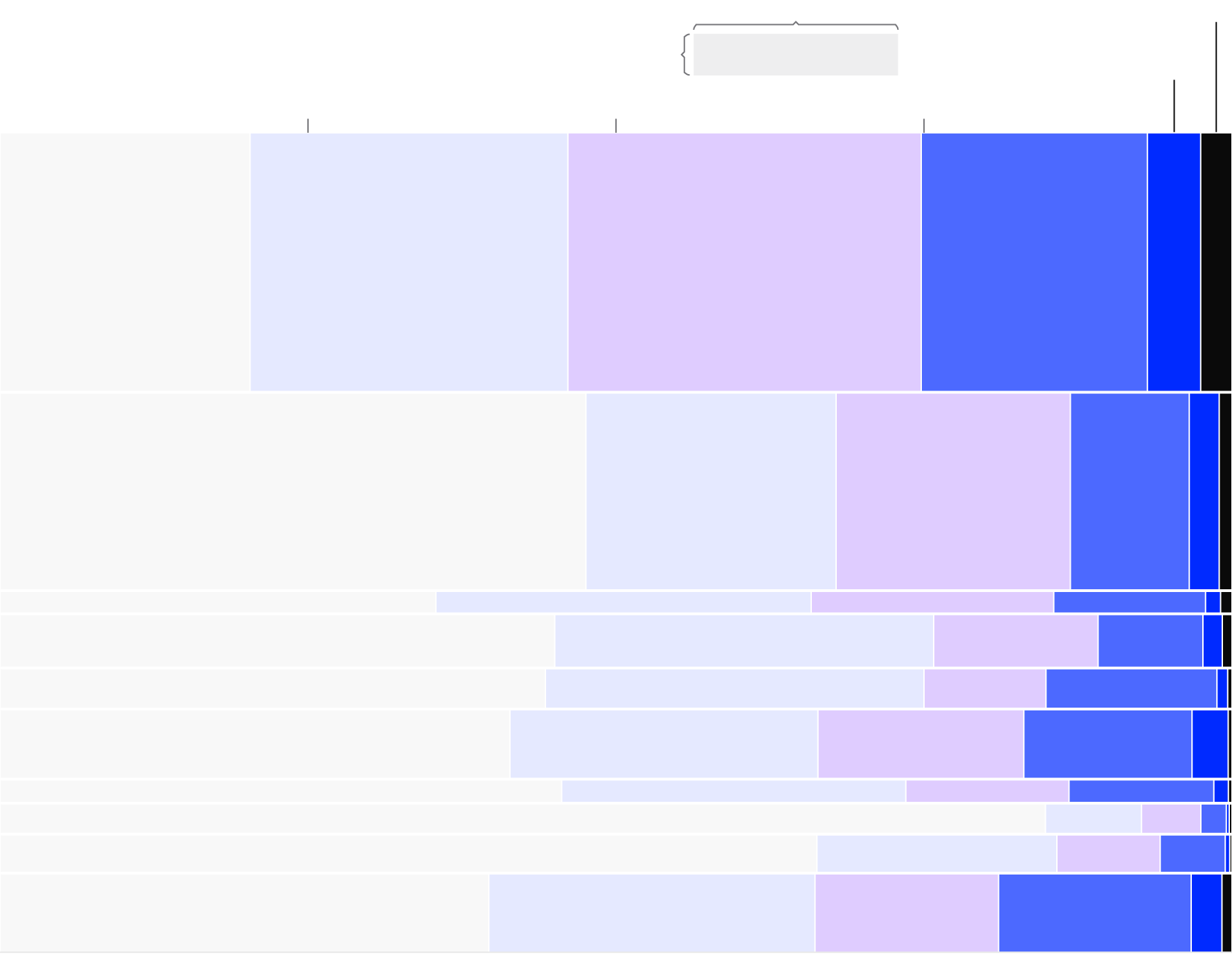

To get a sense of which employees were more likely to take home large grants, BI broke up stock grants based on job category. The data show that most workers in engineering received stock grants above $25,000. The value of the stock is based on the value of the shares at the time they were granted, but it's subject to change based on Tesla's share price.

Of the stock offerings at Tesla, about 75% were restricted stock units, or RSUs, while nonqualified stock options made up 21%, and were given exclusively as merit-based compensation, according to BI's analysis of US-based, full-time workers. Only 4% of employees — including many executives and other high-level workers — received the stock as incentive stock options or ISOs.

Zaheer Mohiuddin, the cofounder of Levels.fyi, said RSUs are very common in tech, while incentive stock options are typically reserved for longtime high-level employees or nonpublic companies. RSUs are typically included in standard compensation packages, while nonqualified stock options and ISOs are often used as additional incentives.

RSUs give employees actual shares that vest over time, while ISOs simply provide the right to purchase stock at a preset price before expiration — which is potentially profitable if the stock price rises above that level, but also requires the employee to have money on hand to pay for the stock in the first place.

Outside of one person within Tesla's executive job category who had no stock amount listed, Tesla executives received stock offerings worth between $950,000 and $20 million, according to the database, which displayed the latest stock amount for each employee as of December 2021. All but one of the executives' offerings were ISOs.

Tesla is far from the first company to enhance base pay with stock grants. Companies like Meta, Google, and Amazon have been known to offer employees healthy stock grants. Employee survey data from 2024 from the compensation-benchmarking company Levels.fyi found that Tesla's median base pay and stock grants for US-based software engineers are slightly lower than that of US-based software engineers at Meta, Amazon, Apple, Netflix, and Alphabet, collectively.

Over the past five years, Tesla's stock has spiked well over 1,000%; that performance potentially makes those grants attractive.

Greg Selker, a managing director at the executive recruitment firm Stanton Chase, told BI that while other Big Tech companies might have higher base pay and equity grants to match, Tesla's strength also lies in its image.

"There's a mission-driven element to it that allows Tesla to get away with paying less," Selker said. "These people are working to bring about the decarbonization of the planet."

Musk has previously described what the stock options can do for employees. "We give everyone stock options; we've made many people who are just working the line — who didn't even know what stocks were — we've made them millionaires," he said last year.

BI examined the median stock grants and the percentage of employees who received grants for each job category and found that a majority of workers in nearly every category received some type of stock grant.

Tesla's compensation strategy aligns more closely with Silicon Valley tech giants like Google or Meta than with traditional automakers such as GM or Ford, according to Harley Shaiken, an auto industry and labor expert. Traditional automakers typically offer higher base salaries, while companies like Tesla, which has seen substantial stock returns over the past five years, attract talent through significant stock grants.

"Tech workers are looking for the opportunity for a big payday, not just an incremental salary bump," Shaiken explained.

A former sales manager at Tesla noted that the company's stock offerings were initially appealing but described them as "golden handcuffs."

"The stock is the major hook. You might be unhappy in your role, but you just decide, 'I'm going to keep my head down and wait a few months longer until I vest,'" he said.

Tesla's stock offerings have indeed provided some employees with significant financial gains. For instance, Drew Baglino, Tesla's former senior vice president of powertrain and energy engineering, and Zachary Kirkhorn, the former CFO, each received 10 million in stock offerings, according to the internal database.

"It's part of the benefit of taking a chance on a company like Tesla," an engineer who joined the company in 2015 told Business Insider. "You might have to deal with the aches and pains of a startup — the long hours, some of the uncertainty — but there can also be a significant payoff."

Aaron Greenspan, a vocal critic of Musk and the founder of PlainSite, an organization advocating for legal transparency, first mentioned Afshar's stock grant in a lawsuit filed against Musk and Tesla, accusing them of defamation, among other claims. Lawyers for Musk and Tesla have dismissed Greenspan's claims as "largely unintelligible allegations." The lawsuit is ongoing.

Tesla awards stock grants during promotions and annual reviews, basing them on the company's performance, according to the salary database and conversations with four current employees. Last year, the company reduced merit-based stock awards for staff, as reported by Bloomberg and confirmed by the four employees. In June, Musk announced plans to award additional stock grants for "exceptional performance." During annual performance reviews in July, managers were limited to recommending no more than 20% of their team for the extra award, according to two people with knowledge of the situation. Tesla typically awards employees restricted stock units that vest over four years.

Historically, Tesla workers have relied on the company's stock continuing to grow.

"It's a bet they have to make," Selker said. So far, stock grants have "proven to be better than cash in your pocket."

"Now, if the stock were to become inconsistent or halve, then Tesla will have to change its strategy," he added.

Tesla's stock has experienced significant volatility this year, slumping as low as 44% in mid-April from its price at the start of the year. Following Donald Trump's re-election, it's up nearly 30% overall year to date.

At least one longtime Tesla staffer expressed concern about new hires.

"I feel lucky that I got in early, but I see a lot of younger engineers expecting to reap the same benefits," they said. "And I'm not sure they will."