The manufacturing sector shed jobs in October, bringing its tally of job losses to 78,000 over the past three months.

The Labor Department's Bureau of Labor Statistics on Friday released its jobs report for October, which found that the manufacturing sector lost 46,000 jobs last month, according to the agency's preliminary analysis.

That followed a loss of 6,000 jobs in September, which is also a preliminary figure, as well as a decline of 26,000 jobs in August.

Manufacturing's job losses in September included a decline of 44,000 in the transportation equipment manufacturing industry due to strike activity. That can be partially attributed to the ongoing strike by roughly 33,000 unionized machinists at Boeing.

The manufacturing sector has endured a hiring slump in recent months. (Photographer: Emily Elconin/Bloomberg via Getty Images / Getty Images)

The International Association of Machinists and Aerospace Workers (IAM) began its strike on Sept. 13 and has previously rejected Boeing's new contract offers amid the impasse, though the company extended a fresh offer to the union late Thursday that is under consideration.

The Boeing strike has also rippled through the aerospace giant's supply chain, causing some of its suppliers like Spirit Aero to temporarily furlough workers while the labor disruption impacts operations.

Boeing machinists have been on strike since mid-September, though the company offered the union a new and improved contract proposal on Thursday. (M. Scott Brauer/Bloomberg via Getty Images / Getty Images)

A smaller strike by 5,000 IAM machinists at aviation and aerospace contractor Textron also depressed the manufacturing sector's employment figures. The Textron strike began on Sept. 23 and concluded on Oct. 21, meaning it also weighed on the manufacturing sector's employment figures.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BA | THE BOEING CO. | 155.07 | +0.48 | +0.31% |

| TXT | TEXTRON INC. | 82.04 | +0.58 | +0.71% |

The manufacturing sector has struggled with job creation over the past year and is down 85,000 jobs, or 0.7%, in the past six months and 50,000 jobs, or 0.4%, in the last 12 months.

The sector's best job creation month in the past 12 months was a gain of 25,000 jobs in Nov. 2023, which was followed by an increase of 12,000 jobs the following month in December.

In 2024, the manufacturing sector's last monthly jobs gain occurred in July, when it grew by 6,000 jobs. Its largest monthly gain this year was in April when 7,000 jobs were added.

U.S. manufacturers want more freedom in business from the incoming 47th President

Jay Timmons, President and CEO, the National Association of Manufacturers, talks about what the industry needs from the next administration to keep growing and to maintain global dominance.

The National Association of Manufacturers (NAM) has called for the next administration and Congress to restore tax incentives for capital investments in expanding or upgrading facilities and equipment, as well as easing regulations that can be costly to implement.

NAM has also called for lawmakers to provide the industry with certainty by averting a "tax armageddon" next year that's due to occur when several provisions in the 2017 tax law known as the Tax Cuts and Jobs Act are due to expire.

"There is a lot of talk right now from both sides of the aisle, quite frankly, about the possibility of raising taxes on manufacturers, taxes on businesses," NAM CEO Jay Timmons told FOX Business this summer. "That's not going to help us. You know, that's not going to help us grow. That is not going to help our economy grow. And it's certainly not going to help our leadership."

The Ukrainian government has approved its plan for joining the European Network of Employment Services (EURES) at a meeting on 29 October.

Ukraine is now beginning its preparatory stage for joining the European employment framework, in line with the recommendations of the European Commission presented in the Ukraine Progress Report under the EU’s 2023 Enlargement Package. The adopted plan is an important step towards integration into the European labor market and the introduction of free movement of workers. The preparatory measures envisaged by the plan are aimed at laying the groundwork for joining EURES.

The measures include exploring opportunities related to the compatibility of Ukrainian systems and frameworks with EURES requirements and the implementation of regulations that will allow Ukraine to effectively interact with European labor databases.

“In addition to the need to ensure the legislative compatibility of existing Ukrainian systems with European standards, there must be appropriate technical compatibility for effective matching of vacancies and CVs. To do this, we need to improve our internal information systems and adapt some technical aspects to ensure that the data required by EURES is consistent,” Yuliia Svyrydenko, First Deputy Prime Minister and Minister of Economy of Ukraine, said in a press release.

It should be noted that EURES currently supports the free movement of labour in 31 countries of the European Union and the European Economic Area. The platform contains more than 4 million vacancies.

Tetiana Berezhna, Deputy Minister of Economy, emphasizes that the action plan is currently largely aimed at learning from the experience of countries that have already joined EURES, such as Poland and Croatia.

Berezhna added, “There are several issues that need to be thoroughly researched for Ukraine to effectively join the EURES network. These include the compliance of the national occupational classification with international and European norms and standards, the role of intermediaries in the labor market, the coverage of students and trainees by the EURES network, etc.”

A Dutch staffing platform has been criticized for telling its hospitality clients they can avoid new fair tipping laws and a forthcoming ban on zero-hours contractors by using its freelance workforce, reports The Guardian. Temper Works, which supplies workers to more than 5,000 companies, including Hard Rock Cafe, Alexandra Palace, and Claridge’s, is promoting its workforce to restaurants, hotels, and bars on the basis that “they are not covered by the provisions of the new [tipping] legislation”.

The firm, which opened an office in the UK in 2022, warns companies that agency workers “must now be included in tip-sharing schemes” but claims gig economy workers sourced through its website fall outside the legislation. “By engaging freelancers through Temper, businesses can continue to access flexible labor without the added costs and complexities associated with tip allocation for agency workers,” it states in a briefing published last month.

Under the Employment (Allocation of Tips) Act, which came into force last month, firms must share all tips between workers, including temporary agency staff. The legislation was prompted by a public outcry over high street chains deducting money intended for waiting and kitchen staff.

The Unite union, which campaigned for the new tipping rules, said it was potentially unlawful to exclude gig workers from tips shares as the courts would probably find they were not genuinely self-employed. “For Temper Works to be so flagrantly advertising services which seek to flout new and well-established employment law to line their own pockets isn’t just morally reprehensible, it is almost certainly illegal,” said Bryan Simpson, Unite lead organizer in the hospitality sector.

Temper Works is also advising firms to use its 60,000-strong pool of freelancers to get around a proposal to ban zero-hours contracts, which is a key plank in Labour’s new worker’s rights legislation. Under Labour’s forthcoming employment rights bill, agency workers on zero-hours contracts will have the right after 12 weeks to a contract with guaranteed hours.

Founded in 2015, Temper Works is managed by ex-McKinsey consultant Maarten Zoomers. The company’s mission statement states “Through technology, we aim to bring about positive change by harnessing the full potential of the digital world to create a more inclusive and equitable job market”.

Temper Works said it did not recognize the “strong claims” made by Unite. “Temper is a platform that has always operated, and will continue to operate, transparently and according to UK law,” it said in a statement. It said a Dutch court had found it was a platform for work, not an employment agency.

It added that the functions built into the platform, including the ability to appoint substitutes to perform work, negotiate hourly rates and turn down work, ensured it was “a marketplace for independent contractors”. Temper said independent contractors sat outside of the tipping legislation, but clients were free to “allocate tips to contractors on Temper if they wish to do so”.

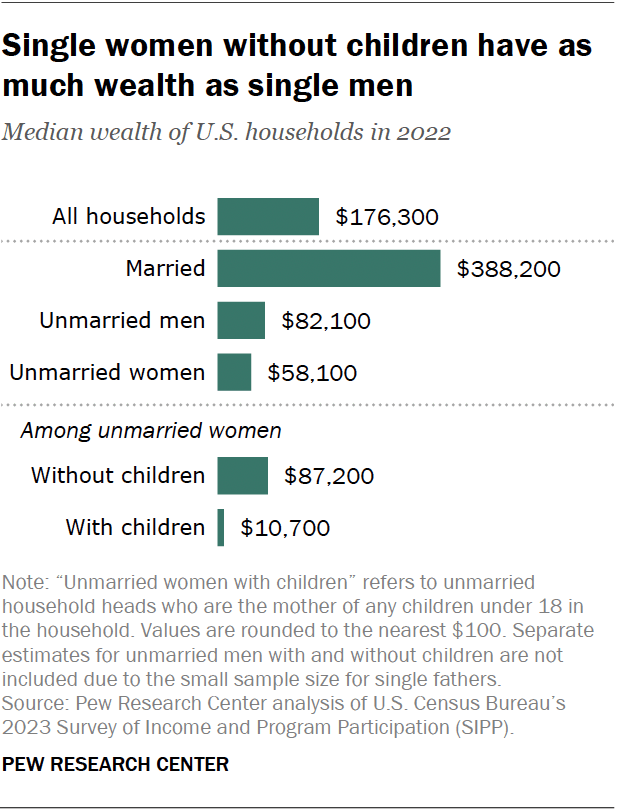

In the United States, households headed by married adults have much more wealth, on average, than those headed by single adults. And among unmarried adults, there’s a significant wealth gap between men and women.

In 2022, the typical single man had $82,100 in wealth, compared with $58,100 for the typical single woman, according to U.S. Census Bureau data.

But among unmarried women, wealth varies considerably between those who have children under 18 in the household and those who don’t.

Households headed by unmarried women who do not have children under 18 had a median wealth of $87,200 in 2022 – similar to households headed by unmarried men. In contrast, the median wealth of households headed by unmarried women with children was $10,700.

(We cannot look at the wealth of households headed by unmarried men with or without children separately due to the relatively small number of single-father households.)

Gaps in specific household assets

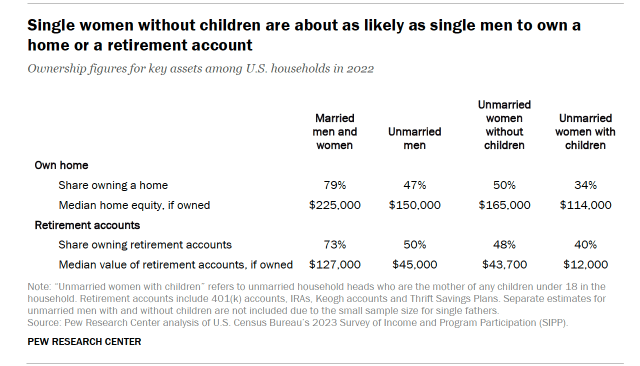

A household’s total wealth is the value of its assets minus its outstanding debts. Across key assets, unmarried women without children are about on par with unmarried men. Single women with children are behind in each area.

- Homeownership: In 2022, 50% of single women without children under 18 owned their home. This is similar to the 47% of unmarried men who owned their home. Only 34% of single mothers owned their home.

- Home equity: The typical single woman homeowner without children had $165,000 in home equity, which is the value of the home minus the outstanding mortgage balance. This is slightly more than the $150,000 median home equity of single male homeowners. Single mothers who own their home had $114,000 in median home equity.

- Retirement account ownership: Among household heads, 48% of single women without children and 50% of single men owned a retirement account (for example, a 401(k) account or IRA) in 2022. That compares with 40% of single mothers.

- Retirement savings: Unmarried women without a child who have a retirement account had a median amount of $43,700 in those accounts, not far below the $45,000 single men had accumulated. In contrast, the median amount in the retirement accounts of households headed by a single mother was $12,000.

How age contributes to wealth

On average, unmarried women tend to earn less than unmarried men. So how do unmarried women without children have similar wealth levels to unmarried men?

One big factor is age. Older household heads tend to have greater wealth than younger ones. And among heads of households, unmarried women without children are older, on average, than unmarried men.

The median age of single women without children heading a household is 61, compared with 50 for single men heading a household.

Once we account for age, single women without children don’t have the same wealth as single men. For example, among household heads younger than 65, the median wealth of unmarried women without children is $38,900, compared with $59,400 for unmarried men.

Age also plays a role in explaining the low wealth of households headed by unmarried women with children. The median age of household heads who are single mothers is 39.