A technology issue at Alaska Airlines resulted in the temporary grounding of flights in Seattle on Monday morning and problems into the afternoon for people trying to book flights on its website, the airline said.

The Seattle-based company said in a statement the issue Monday morning resulted in a “significant disruption” to its operation — including delayed flights. The airline said it requested a 40-minute ground stop at Seattle-Tacoma International Airport to clear aircraft congestion.

No further details were given about the technology problem, and the reason for the disruptions was unclear.

A message on the company’s website Monday afternoon said it was experiencing issues with booking flights on the website, through a mobile app, and at the contact center.

“We sincerely apologize to our guests who are impacted and are working to resolve the issue as soon as possible,” the statement said.

The problems came at the start of the company’s Cyber Monday flight sale. In comments from its account on X to customers complaining of missed flights, delays, and problems using the airline’s app and website, the carrier also apologized.

In late September, Alaska Airlines flights were grounded in Seattle because of what the company called significant disruptions from an unspecified technology problem.

If you're paying for a membership, you'll want to listen up.

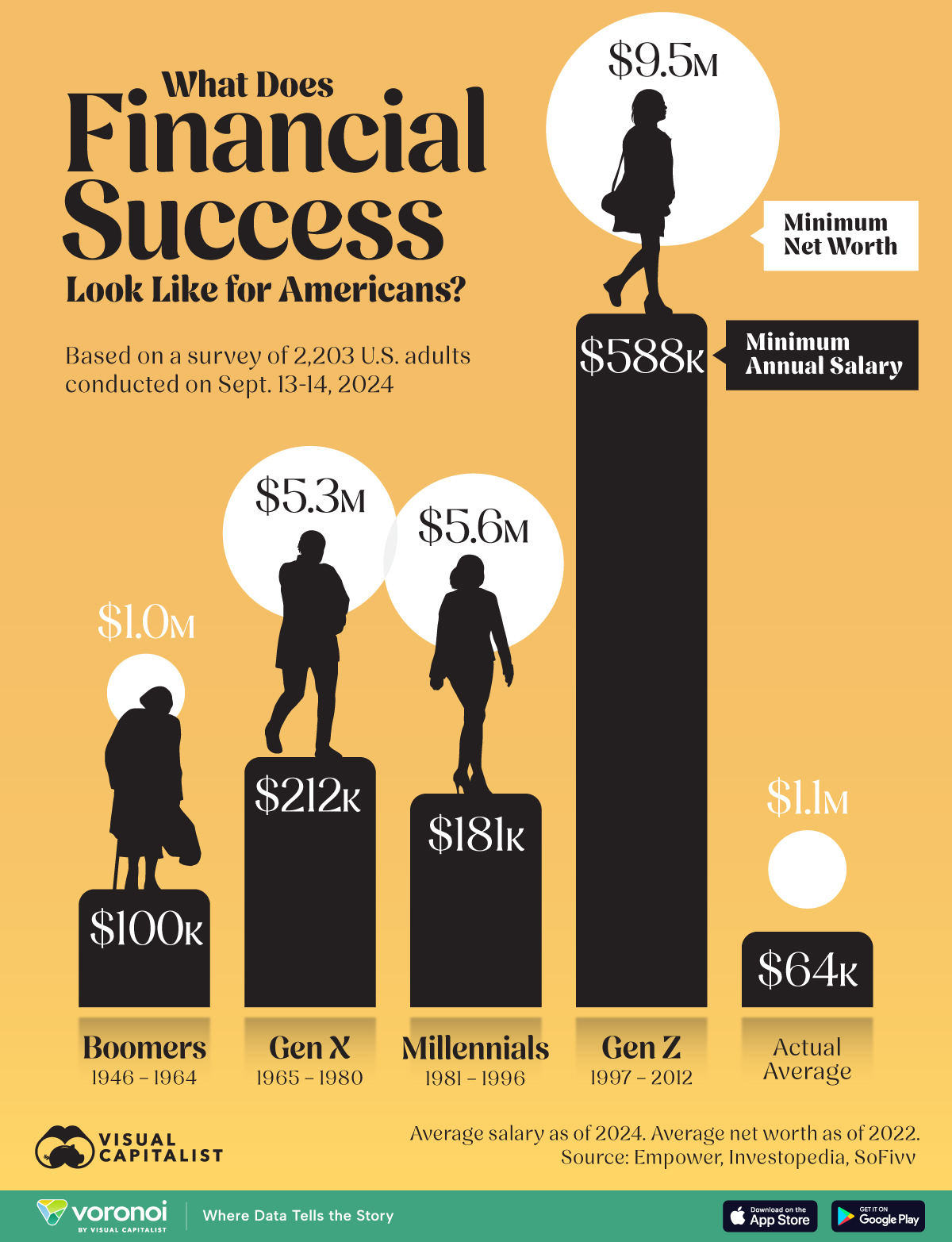

In the US, the average salary stands at just under $64,000 — but for many Americans, a successful income is several times that.

Based on a survey by Empower, which asked US adults for their definitions of financial success, the chart below shows the minimum salary and net worth each generation believes is needed to be financially successful.

For boomers, someone earning a minimum of $100,000 a year has achieved financial success. Millennials have the second-lowest threshold, at $180,000.

The Gen Xers surveyed think it takes at least $212,000 be financially successful in the US.

Gen Z has the highest salary requirement of the age groups, believing that a minimum income of $588,000 a year indicates financial success. According to the survey, Gen Zers also think success looks like a net worth of $9.5 million — that's almost nine times the US average.

Elon Musk's $56 billion pay package is rejected

Monday’s decision granted $345 million in attorney fees to the lawyers who successfully challenged Musk’s pay plan

The compensation plan, one of the largest of its kind, was based on performance targets rather than guaranteed pay. Despite a majority of Tesla investors voting to approve the package at the company’s June shareholder meeting, Judge Kathleen McCormick ruled that a shareholder vote couldn’t stand. She described the package as “deeply flawed” in January, emphasizing that it was improperly structured and failed to meet legal standards for executive compensation. Tesla’s legal team had hoped to sway the court by pointing to the vote, but McCormick rejected that argument.

In addition to rejecting the revisions, Monday’s decision granted $345 million in attorney fees to the lawyers who successfully challenged Musk’s pay plan on behalf of Tesla shareholders. The court deemed this amount an “appropriate sum to reward a total victory.”

Tesla has the option to pay this fee in either cash or by issuing stock that can be sold on the open market.

While Musk could appeal the decision to the Delaware Supreme Court, this ruling could have broader implications for how companies structure executive compensation and the role of shareholder votes in such decisions.

Still, Musk’s wealth continues to climb. His net worth has surged by $43 billion in recent weeks, largely thanks to a 42% rise in Tesla stock.

The relationships we build over our lifetime are essential to our well-being — but research shows that as we near the end of our lives, much of our time is spent alone.

Using data from the American Time Use Survey, Our World In Data charted who Americans spend the hours of their day with, by age. Figures are based on averages from surveys conducted between 2009 and 2019.

In our childhood and teenage years, a lot of our time is dominated by family and friends. As we go through our twenties, however, partners and children take over as the people we spend the most time with.

Coworkers also become a major part of our lives between our thirties and fifties — but by retirement age, time with almost everyone besides our partners drops off dramatically.

For those in their seventies or older, a significant amount of the day is spent alone. As the chart shows, the average American around the age of 80 can go as many as eight hours a day without spending time with anyone else.

There is, of course, a difference between being alone and feeling lonely — and the quality of our time spent with others likely benefits us more than the amount. But with 30 percent of Americans aged 72 or older reporting feeling lonely at least some of the time, reaching out to a loved one you haven't seen in a while could make all the difference.

Many of us have felt it, and now it’s official: “Brain rot” is the Oxford dictionary’ word of the year.

Oxford University Press said Monday that the evocative phrase “gained new prominence in 2024,” with its frequency of use increasing 230% from the year before.

Oxford defines brain rot as “the supposed deterioration of a person’s mental or intellectual state, especially viewed as the result of overconsumption of material (now particularly online content) considered to be trivial or unchallenging.”

The word of the year is intended to be “a word or expression that reflects a defining theme from the past 12 months.”

“Brain rot” was chosen by a combination of public vote and language analysis by Oxford lexicographers. It beat five other finalists: demure, slop, dynamic pricing, romantic, and lore.

While it may seem a modern phenomenon, the first recorded use of “brain rot” was by Henry David Thoreau in his 1854 ode to the natural world, “Walden.”

Oxford Languages President Casper Grathwohl said that in its modern sense, “’ brain rot’ speaks to one of the perceived dangers of virtual life, and how we are using our free time.”

“It feels like a rightful next chapter in the cultural conversation about humanity and technology. It’s not surprising that so many voters embraced the term, endorsing it as our choice this year,” he said.

Last year’s Oxford word of the year was “rizz,” a riff on charisma, used to describe someone’s ability to attract or seduce another person.

Collins Dictionary’s 2024 word of the year is “brat” – the album title that became a summer-living ideal.

While “Made in China” has become a staple of our everyday lives, with everything from our phones to our clothes made in “the world’s factory”, that hasn’t always been the case. It wasn’t until China acceded to the World Trade Organization in 2001 that the country really opened up to the world economy, quickly turning it into the most important link in today’s global supply chains.

Our chart, based on WTO data, illustrates China’s breathtaking rise to the top of the world’s merchandise exporters over the past 23 years, while also showing who dominated world trade before the China's manufacturing sector became the all-conquering force it is today. It also shows the immense effects of globalization on export volumes. Between 2000 and 2023, global merchandise exports increased 3.7-fold from $6.5 trillion to $23.8 trillion in nominal terms, i.e. not adjusted for inflation. At the same time, China's exports grew 13.6-fold from $250 billion to $3.4 trillion, leaving other major exporters in the dust.

China's transformation into a global manufacturing hub and the world's largest exporter stems from a combination of factors, including abundant labor, favorable government policies, and vast infrastructure investments. China's accession to the World Trade Organization in 2001 marks the starting point of the country's race to become an integral part of global supply chains, delivering both raw materials and finished goods to the rest of the world at competitive costs.

TARIFFS WORRY

An effort to unionize Amazon’s delivery drivers faces an unusual initial challenge: they don't work for Amazon.

Sure, the drivers wear Amazon-labeled uniforms. They also drive the Amazon-branded vehicles that seem to populate every street corner, especially during the holiday season. But much of Amazon's last-mile delivery system is subcontracted to a web of smaller businesses called delivery service partners.

It's a setup that some drivers in Southern California say is a sham.

"Amazon ultimately calls the shots," said Daniel Herrera, a driver in Victorville. "They're the ones that put our routes out."

Those drivers are challenging Amazon's business model through an ongoing union drive with the Teamsters — one of the nation's largest and most powerful labor unions. It started more than a year ago in Palmdale, when a group of drivers for one Delivery Service Partner announced they planned to form a union. More recently, drivers in Victorville and the city of Industry have joined the cause.

These union efforts are setting up a larger legal battle: Amazon says these drivers are not their employees. The Teamsters say Amazon is their joint employer, which would mean the tech giant has to bargain with the workers accordingly.

That allegation got a boost in late September when the National Labor Relations Board's Los Angeles region issued a complaint naming Amazon as a joint employer of its delivery drivers in Palmdale. Amazon denied the claim.

“As we’ve said all along, there is no merit to any of these claims. We look forward to showing that as the legal process continues and expect the few remaining allegations will be dismissed as well," Amazon spokesperson Eileen Hards said in a statement.

What’s a Delivery Service Partner?

Subcontracted small businesses make up a substantial part of Amazon's logistics web. Over the past five years, some 390,000 people have driven for delivery service partners across 19 countries, according to Amazon.

"While DSPs as independent businesses hire and manage their own employees, they receive support from Amazon to help them be successful," Amazon's website states.

Amazon technology creates driver routes, and Amazon says that all its company-branded vehicles all have "in-vehicle camera safety technology." It's dynamics like these that have led the Teamsters and others to say Amazon is the drivers' true boss.

"It's set up and modeled so that it can control the delivery services, yet pretend that it's not controlling the delivery services," said Catherine Creighton with Cornell University's School of Industrial and Labor Relations. "It wants one, [to] avoid liability if there are accidents or problems with the delivery system. And No. 2, avoid a unionized workforce."

When 84 drivers in Palmdale announced they had reached a contract agreement with a Delivery Service Partner last year, it was the beginning of the fight at the National Labor Relations Board over Amazon's employer status.

"These workers in Palmdale demanded that Amazon recognize them as drivers and demanded that Amazon come to the table because clearly Amazon has so much control over these operations," said Randy Korgan, director of the Teamsters' Amazon division.

Around the same time, Amazon canceled its contract with that subcontractor and the drivers lost their jobs. But it also sparked a wider organizing drive. While the Teamsters filed unfair labor charges with the NLRB, drivers picketed at the Palmdale facility and other Amazon hubs.

It was one of those demonstrations that caught the attention of Vanessa Valdez, a driver at an Amazon delivery center in the City of Industry.

"I remember [them saying] 'You deserve more…Are you tired of this?'" Valdez said.

This fall, drivers at four delivery service partners at a Victorville Amazon facility and two at a City of Industry location signed union cards with the Teamsters and demanded union recognition.

"The truth is that there are multiple independent small businesses that deliver on our behalf from these facilities, and none of them are Amazon employees,” Amazon's spokesperson said in response.

Delivering Amazon packages

Drivers who have joined the union drive say they want to negotiate with Amazon over crushing quotas, broken-down vans, and pay.

"We skip our 15-minute breaks because the quantity is so high," said Rubie Wiggins, another driver in the City of Industry who said she wants more drivers to unionize. "You're constantly at a battle with yourself."

Multiple drivers in Los Angeles report not having the time or space to use the bathroom while delivering packages.

Labor relations under Trump

A hearing on the Palmdale charges is scheduled for March, and the dispute is likely to continue to wind through the courts after that, according to Catherine Creighton at Cornell.

By then, the Teamsters will face a changed landscape at the national level with President-elect Donald Trump returning to the White House.

Trump can remove NLRB General Counsel Jennifer Abruzzo when he takes office, and whether the five-member board will have a Republican or Democratic majority is up in the air. That leaves in question the fate of rulings during President Joe Biden's tenure that boosted labor protections, including one expanding the definition of a joint employer that was blocked by a federal judge earlier this year.

Organizing battle ahead

While the legal dispute with Amazon continues to play out, the Teamsters have made it clear they'll continue to organize more drivers.

Veena Dubal, a professor of law at UC Irvine, says it's an organizing strategy that plays the long game.

"It's about creating conversations with the delivery service providers themselves, creating conversations with the workers so that they see their boss as being Amazon and not the DSP," Dubal said. "And using these legal mechanisms, even if they're not immediately successful, to change how people think about it."

.webp)