If you want to know how to get the maximum Social Security benefit of up to $5,108 a month in 2025, here are some things you need to know. Your benefits are based on your lifetime earnings and the age at which you decide to retire.

What salary do you need for maximum benefits?

To get the maximum monthly Social Security benefit, you must have earned at least the Social Security wage base in each year, on average. For 2025, that wage base is expected to be more than $160,000, which means you will have had to earn that much for 35 years to get the maximum benefit. The higher you earn up to that wage base limit, the higher your benefits will be.

Another important factor is your full retirement age (FRA), which is based on your birth year. For individuals born in 1960 or later, their FRA is 67 years. If you claim benefits before reaching your FRA, your monthly benefit will be reduced. Conversely, delaying benefits beyond your FRA increases your monthly Social Security check up until age 70.

Maximize your Social Security claim

Timing is everything when it comes to maximizing your Social Security benefits. If you take it at the earliest age possible, age 62, your monthly benefit could be reduced by as much as 30%. If you wait until you reach your full retirement age or beyond, you can increase the amount you’ll receive monthly, by as much as 24% if you delay until age 70.

Other tips to help maximize your benefits

- Work 35 Years or More: The SSA uses your 35 highest earning years to calculate your benefit. If you have fewer than 35 years of earnings, SSA will use zeros for the missing years, reducing your monthly payment amount.

- Consider spousal benefits. If married, consider including spousal benefits. A spouse with little or no work history can get a maximum of 50% of their working spouse’s benefit at full retirement age.

- Taxes on Social Security: Remember, a significant amount of your other income can make your Social Security benefits subject to taxes. Depending on your total income, up to 85 percent of your Social Security benefits may be subject to income tax.

Maximizing Retirement Savings in Addition to Social Security

While Social Security provides some essential support, depending only on it to sustain a style of living in retirement may not be adequate. It is a good idea to supplement your retirement with personal savings, or employer-sponsored retirement accounts, such as 401(k)s, or IRAs.

In conclusion, while qualifying for the maximum Social Security benefit of $5,108 requires years of consistent high earnings and strategic timing, it can provide a substantial foundation for your retirement income. To get the most out of Social Security, carefully plan your claiming strategy and consider working with a financial advisor to maximize your benefits.

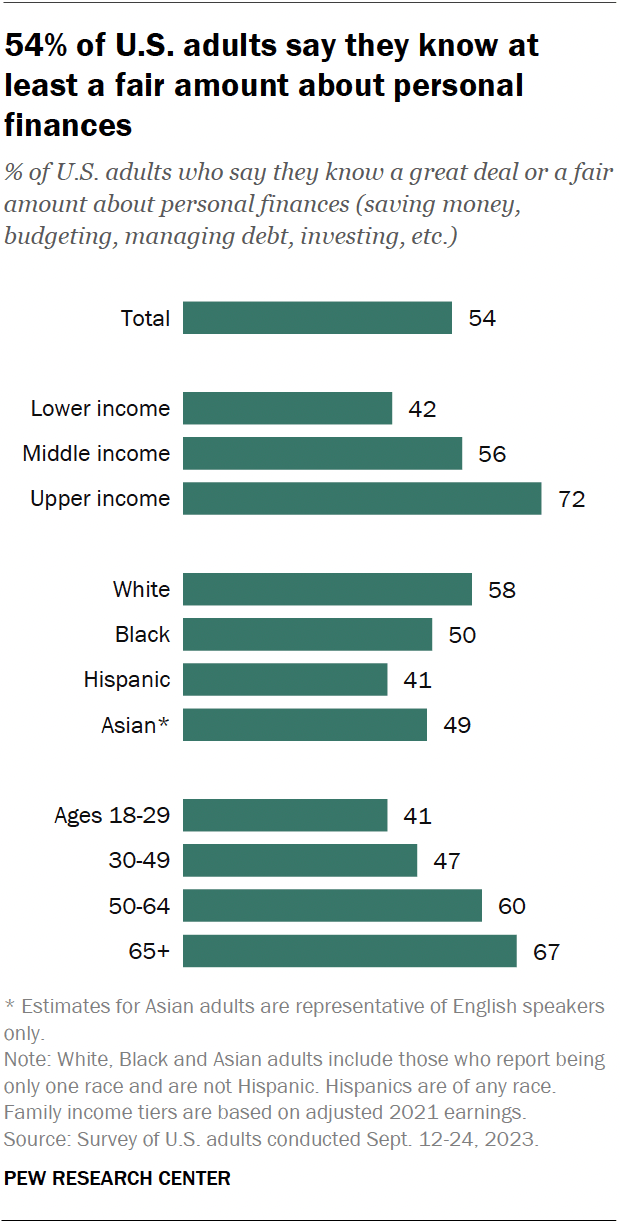

About half (54%) of U.S. adults say they know a great deal or a fair amount about personal finances. Another 33% say they know some about personal finances, while 13% say they don’t know much or know nothing at all, according to a 2023 Pew Research Center survey.

Knowledge about personal finances can refer to several strategies for managing money, including saving, budgeting, managing debt, or investing.

Financial literacy has been associated with greater financial well-being. There have long been economic gaps between Americans of different backgrounds, and our survey also finds gaps in financial literacy:

- Americans in households with upper incomes (72%) are more likely than those in households with middle (56%) or lower incomes (42%) to say they know at least a fair amount about personal finances.

- White adults (58%) are more likely than Black (50%) or Hispanic (41%) adults to say they know a great deal or a fair amount. About half of Asian adults (49%) say the same. These differences by race remain regardless of income.

- Adults ages 50 and older (63%) are more likely than those 18 to 49 (45%) to say they are knowledgeable about personal finances.

On the other hand, about one in five Americans with lower incomes (22%) say they don’t know much or know nothing at all about personal finances. That’s a notably higher share than among those with upper incomes (4%). About a quarter of Hispanic adults (27%) say the same, higher than among Asian (17%), Black (14%), or White adults (8%).

Money management skills

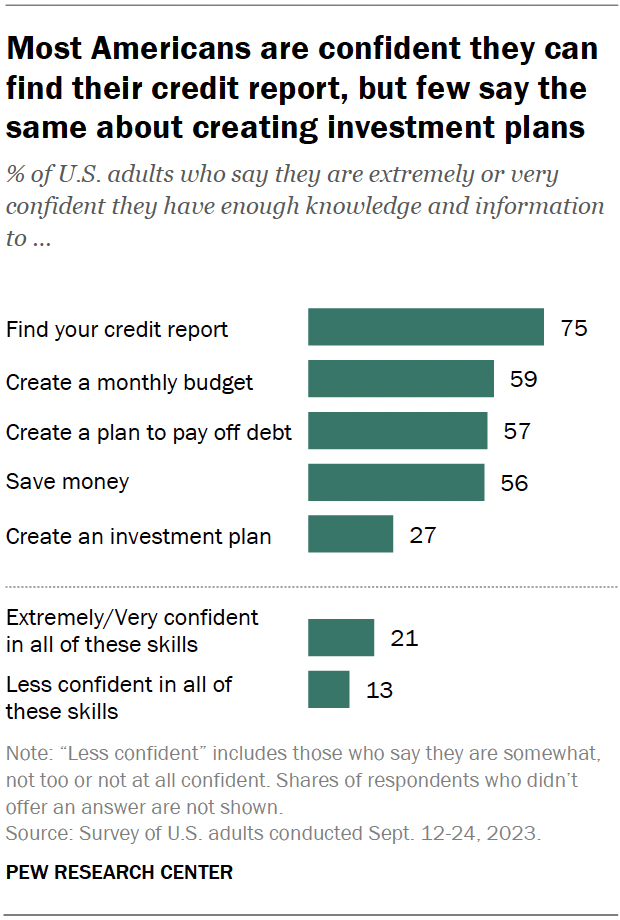

U.S. adults have mixed confidence in their ability to perform various financial skills.

Most Americans (75%) say they are extremely or very confident in their ability to find their credit report. Smaller majorities say the same about creating a monthly budget to manage their finances (59%), creating a plan to pay off debt (57%) or saving money (56%).

By contrast, just 27% express confidence in their ability to create an investment plan to build wealth.

Americans’ confidence in these skills varies by income, race, and age:

- U.S. adults with upper incomes are more likely than those with middle or lower incomes to say they are confident in their ability to do each of these things.

- White adults are more likely than Black, Hispanic or Asian adults to say they are confident they can find their credit report, create a monthly budget and create a plan to pay off debt.

- Adults ages 50 and older are more likely than those 18 to 49 to have confidence in their ability to do each task except create an investment plan. Across age groups, similarly, small shares express confidence they can do that.

In addition, about one in five U.S. adults (21%) are confident in their ability to execute every financial skill we asked about. Americans with upper incomes (40%) are more likely to say this than those with middle (20%) or lower incomes (13%).

Meanwhile, 13% of Americans are not confident in their ability to do any of these money management skills. Hispanic (21%), Asian (21%), and Black adults (17%) are more likely than White adults (8%) to say this. And 22% of those with lower incomes say this, compared with fewer than 10% of those with middle or upper incomes (9% and 5% respectively).

Where do Americans learn about personal finances?

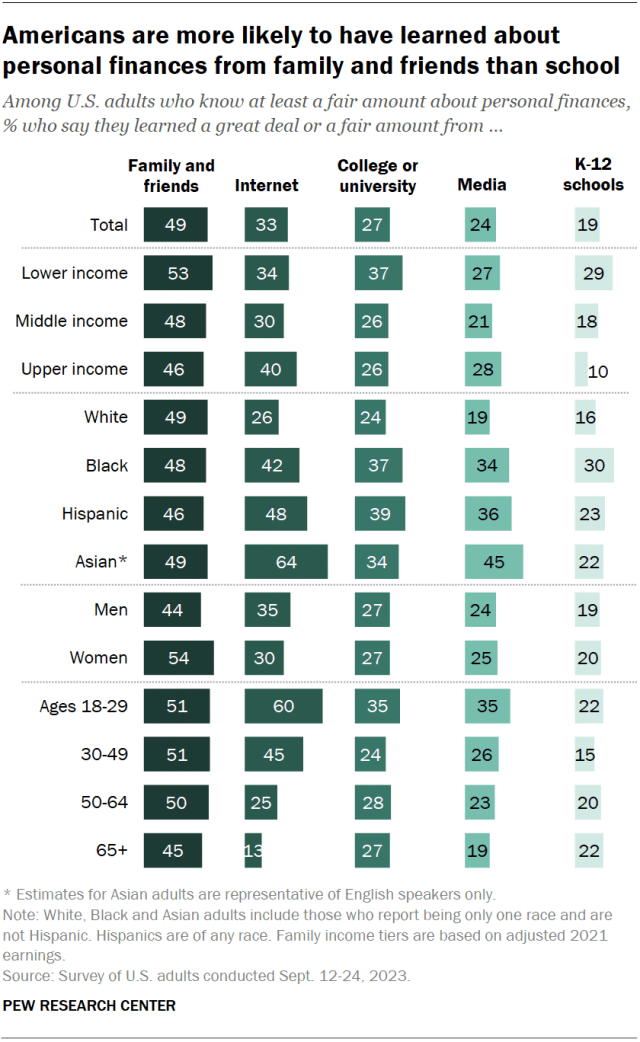

In recent years, more experts have called for greater financial education during high school to help students prepare for their futures. Relatively few Americans have learned about this in school, our survey finds.

Among U.S. adults who are knowledgeable about personal finances, 49% say they learned a great deal or a fair amount about personal finances from family and friends. That is the highest share for any source we asked about. About a third or fewer learned about personal finances from other sources such as:

- The internet (33%)

- College or university (27%)

- Media such as the news, documentaries, or books (24%)

- K-12 schools (19%)

Learning about personal finances from family and friends is a relatively common experience across all major demographic subgroups. But there are notable differences for some other sources.

Internet

- Asian adults (64%) are more likely than Hispanic (48%), Black (42%), or White adults (26%) to say they learned a great deal or a fair amount about personal finances from the internet.

- Adults ages 18 to 49 are more likely than those 50 and older to have learned about personal finances from the Internet (50% vs. 19%).

Media

- Asian (45%), Hispanic (36%) and Black adults (34%) are all more likely than White adults (19%) to have learned about personal finances from media.

- Younger adults are more likely than older adults to have learned about personal finances from the media (29% vs. 21%).

K-12 schools

- Adults with lower incomes (29%) are more likely than those with middle (18%) or upper incomes (10%) to say they learned about personal finances from K-12 schools.