The November jobs report painted a mixed picture of the US labor market. While headline job growth rebounded, underlying trends revealed potential vulnerabilities.

Positive Signs:

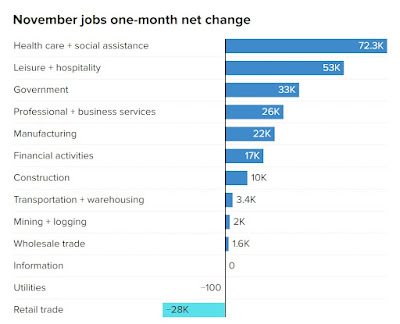

- Strong Job Growth: The economy added 227,000 jobs in November, surpassing expectations. This surge was primarily driven by the recovery from hurricane and strike disruptions in October.

- Wage Growth: Average hourly earnings increased by 0.4% in November, indicating continued wage pressure. However, this could be a concern for the Federal Reserve, as it might hinder their efforts to bring down inflation.

Negative Signs:

- Rising Unemployment: The unemployment rate ticked up to 4.2%, suggesting a potential weakening in labor market conditions.

- Declining Labor Force Participation: The number of people in the labor force decreased, indicating that some individuals may have become discouraged and stopped looking for work.

- Weakening Prime-Age Employment: The employment rate for 25- to 54-year-olds has declined for two consecutive months, falling below pre-pandemic levels.

Implications for the Fed:

While the strong job growth number might suggest a resilient labor market, the underlying trends indicate potential challenges. The Fed may still opt for a rate cut in December to mitigate the risk of economic slowdown. However, the outlook for 2025 remains uncertain, as the Fed will need to balance the need to control inflation with the risk of a weakening labor market.

Overall, the November jobs report highlights the complexity of the current economic landscape. While the headline numbers may appear positive, it is crucial to consider the underlying trends to gain a more accurate picture of the labor market's health.