Amid low unemployment nationwide, U.S. workers are feeling good about their level of job security, and relatively few expect to look for a new job in the coming months, according to a new Pew Research Center survey.

At the same time, only half of workers say they are extremely or very satisfied with their job overall. And a much smaller share are highly satisfied with their pay – 30%, down from 34% last year.

The survey, conducted Oct. 7-13 among 5,273 employed U.S. adults, explores how workers see various aspects of their jobs, including how they assess the importance of certain skills and their own opportunities for further training.

Key findings

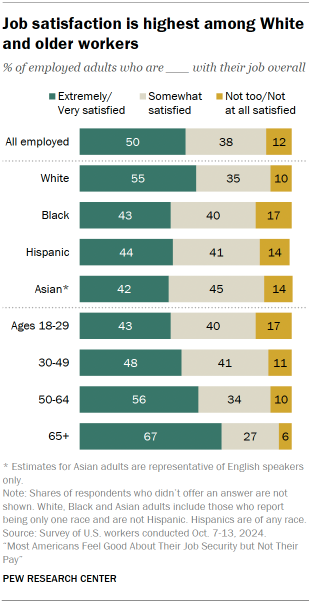

White and older workers are among the most satisfied with their jobs overall.

- 55% of White workers say they are extremely or very satisfied, compared with 44% of Hispanic workers, 43% of Black workers, and 42% of Asian workers.

- Among workers ages 65 and older, two-thirds say they are highly satisfied with their job. Just 43% of workers ages 18 to 29 say the same.

- Workers with middle and upper family incomes are more likely than those with lower incomes to express high levels of job satisfaction (53% and 54% vs. 42%).

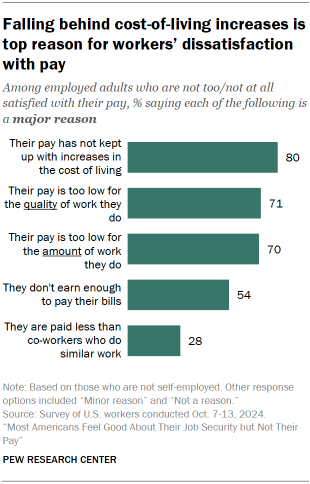

Among the 29% of workers who are not too or not at all satisfied with their pay, the top reason given is that their wages haven’t kept up with increases in cost of living.

- Large shares also say their pay is too low for the quality (71%) or amount (70%) of work they do.

- 54% say a major reason they are dissatisfied is that they don’t earn enough to pay their bills.

- Lower-income workers who are dissatisfied with their pay are far more likely than those with middle and upper incomes to cite the fact that they don’t earn enough to pay their bills (69% vs. 51% and 30%).

- Large majorities of workers across all family income levels say their pay hasn’t kept up with cost-of-living increases.

Half of workers think of their current job as a career, while 15% say it’s a stepping stone to one. About a third (35%) say it’s just a job to get them by.

- 58% of workers with lower incomes say their job is just something to get them by, compared with 31% of those with middle incomes and 17% of those with higher incomes.

- Workers aged 18 to 29 are less likely than those in older age groups to say they see their job as a career. Still, a majority of young workers say their job is either a career or a stepping stone.

- Half of the workers ages 65 and older say their job is just something to get them by, larger than the shares of workers ages 50 to 64 (34%), 30 to 49 (31%), and 18 to 29 (38%) who say the same.

Most workers (69%) feel that they have a great deal or a fair amount of job security.

Another 17% say they have some job security, and 13% say they have little or none.

- 75% of White workers say they have at least a fair amount of job security, compared with smaller majorities of Asian (62%), Black (58%) and Hispanic (57%) workers.

- While about seven in ten or more upper- and middle-income workers say they have a great deal or a fair amount of job security (78% and 71%), a smaller share of lower-income workers (54%) say the same.

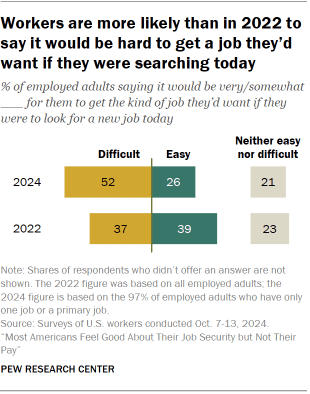

Workers are now much more likely than in 2022 to say it would be difficult for them to get the kind of job they’d want if they were to look for a new one.

- 52% of workers say this would be difficult, compared with 37% in 2022.

- Workers ages 18 to 29 (58%) and those with lower incomes (62%) are especially likely to say this would be difficult for them.

- As was the case in 2022, most workers (63%) say they’re unlikely to look for a new job in the next six months.

Most workers (70%) say they currently have the education and training they need to get ahead in their job or career, while 30% say they need more education and training.

- Regardless of whether they say they need it, 51% say they have received training in the past 12 months, while a similar share (49%) say they have not.

- Among workers who say they need more education and training, 28% say learning on the job would be the best way for them to get it. About a quarter say completing a certificate program (24%) or getting more formal education (24%) would be the best way.

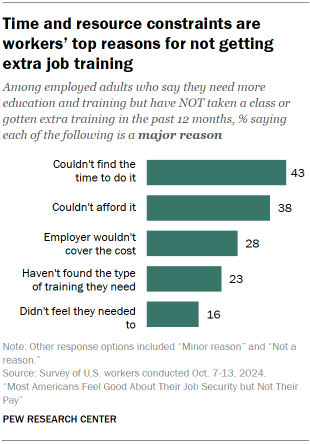

Among workers who need training but didn’t get any in the last year, many point to time and resource constraints as major reasons for not doing so.

- 43% say they couldn’t find the time, 38% say they couldn’t afford it and 28% say their employer wouldn’t cover the cost.

- 41% of workers with lower incomes and 43% of those with middle incomes who say they need but did not get training say they couldn’t afford it. Only 11% of upper-income workers say the same.

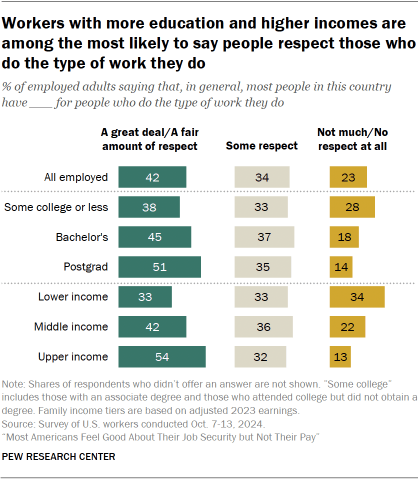

About four-in-ten workers (42%) say most Americans have a great deal or a fair amount of respect for people who do the type of work they do.

- Workers with less education and lower incomes – and those whose jobs involve manual or physical labor – are among the least likely to say most Americans have a lot of respect for people who do their type of job.

- At the same time, the majority of workers across education and income levels regardless of the type of work they do say their supervisors, co-workers, and clients or customers treat them with respect all or most of the time.

What work looks like today

In addition to the survey findings, the report uses government data to examine labor market changes in recent decades.

Among the key trends:

- In 2023, the unemployment rate was 3.6%, one of the lowest in the past 70 years.

- Job tenure data shows that workers are not job-hopping more than in the past.

- Wages are up compared with 2000 after adjusting for inflation.

- The shares of workers who are Asian, Hispanic, immigrants, or have at least a bachelor’s degree have grown significantly since 2000. This reflects broader changes in the U.S. population overall.

What do you think the survey says?

"All that glitters is not gold" is a saying that our bank accounts never much cared for. Who would turn down gold, right? Well, thankfully, when gold is not an option, the working class among us still has some pretty precious things to hold on to.

Reddit user u/thesecretpotato69 asked the people to name a few things only we have, and the answers were eye-opening.

With over 5,000 comments accumulated in just a few days, we took it on ourselves to pick out five things we can always hold on to.

A lawn mower

Free time

A garage fridge

Economy airline tickets

Medical debt

The UK job market faces an uncertain start to 2025 as employers are holding the line on their hiring plans for the new year, according to the latest ManpowerGroup Employment Outlook Survey.

The survey showed overall hiring intentions for Q1 (January – March) 2025 are stagnant. The Net Employment Outlook, a measure of business hiring confidence, stood at +28%, unchanged since last quarter and a decrease by one percentage point on the year. The Outlook is calculated by surveying 2,000+ UK businesses about their recruitment plans for the next business quarter.

ManpowerGroup’s data shows of the businesses who plan to hire, the volume of employers intending to hire for business growth has been almost static across 2024. While employers’ appetite to hire remains strong, their confidence to go ahead and make new appointments is stalling and not translating into action.

Michael Stull, managing director of ManpowerGroup UK, said in a press release, “Businesses have been paralyzed by the recent budget announcement, just as they were post-COVID. There is a strong appetite to grow, but the new government’s actions have thrown the labor market into yet another period of uncertainty. Businesses have been waiting to see signs of the economy kicking into gear, but the government has yet to give businesses the confidence to go ahead with growth plans.”

“Our analysis shows the increase in National Insurance contributions could cost employers as much as 33% more for each lower wage worker from April next year. With dissatisfaction rising on this issue, we’re expecting wage growth to decline next year as the changing costs are indirectly passed onto employees,” added Stull.

Meanwhile, ManpowerGroup’s survey of employee perspectives, Global Talent Barometer, recently found that one in four UK employees feel at risk of unemployment in the next six months; 24% believe they are likely to be forced to leave their current job in the next six months, and 25% are not confident they could find another job that met their needs in the next six months.

“The needs of employees and employers are diverging, with clashes around flexibility and wage negotiations. But they also share common ground in holding their nerve; both sides standing still before making any definitive plans for the New Year,” Stull continued.

Job vacancies on Indeed have fallen faster in the UK than in other similar countries over the past year, reports Reuters. Indeed’s data showed that as of 29 November, there were 23% fewer jobs advertised on its platform in the UK compared with a year earlier, a sharper decline than the 14% drop shown in official data, which covers the August to October period. Job vacancies were 12% lower than before the COVID-19 pandemic.

Indeed economist Jack Kennedy told Reuters, “The balance of power has certainly swung towards employers as the labour market has softened, as evidenced by the fall in job postings, decline in signing bonuses, easing wage growth and rising zero hours contract postings.”

Meanwhile, France saw a 22% annual decline, while other comparable countries, including the US, Germany, Ireland, Canada and Australia, had fallen in a range of 5% to 15%.

Indeed’s UK data showed a steady fall in vacancies through 2024, but businesses’ concerns about hiring have become sharper since the October budget announcement. “Employers will likely continue with caution when it comes to hiring in 2025,” Indeed stated.