Mexican President Claudia Sheinbaum announced plans to implement retaliatory measures after former US President Donald Trump declared intention to impose 25% tariffs on Mexican imports. The announcement comes as part of broader tariff actions targeting Canada and China as well.

## Key Points of Mexico's Response

Sheinbaum instructed Economy Minister Marcelo Ebrard to execute "Plan B," which includes:

- Implementation of counter-tariffs against US goods

- Non-tariff measures (specifics not disclosed)

- Continued emphasis on diplomatic solutions

The Mexican president stressed the importance of cooperation on key issues:

- Security collaboration

- Migration management

- Addressing the fentanyl crisis

## Current Cooperation Efforts

Mexico has demonstrated commitment to bilateral cooperation through:

- Setting up border shelters to assist with deportation efforts

- Seizing 40 tons of drugs in four months

- Proposing a joint working group for security and health matters

## Economic Impact Assessment

The proposed US tariffs pose significant risks to Mexico's economy:

- Over 80% of Mexican exports go to the US

- Annual bilateral trade approaches $800 billion

- Potential 30% drop in total exports predicted

- Foreign direct investment ($36 billion in 2023) could be affected

### Potential Economic Consequences

Economists project severe implications:

- Possible "severe recession" if tariffs persist beyond one quarter

- Mexican peso could reach record lows against the dollar

- Barclays analysts predict peso weakening to 24.5 per dollar

- Automotive industry particularly vulnerable to production shifts

## Implementation Timeline

The tariff schedule includes:

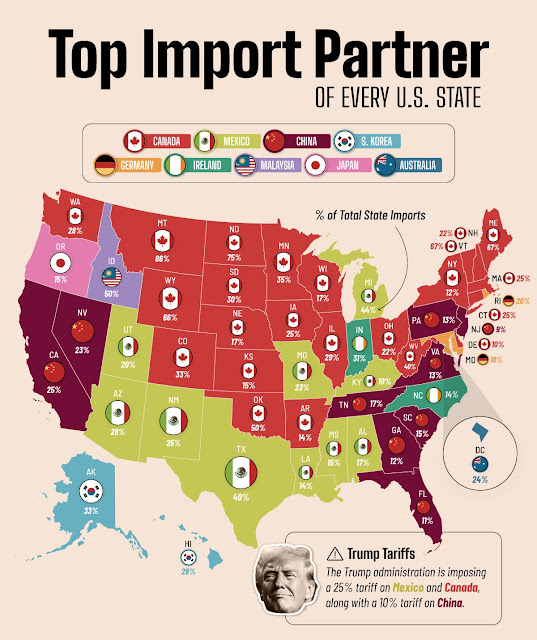

- 25% on Mexican goods

- 25% on most Canadian goods

- 10% on Canadian energy

- 10% on Chinese imports

- All tariffs set to begin Tuesday at 12:01 a.m.

## Market Response

Financial markets have already reacted:

- Mexican peso declined 2% this week

- Increased uncertainty about bilateral trade relations

- Concerns about USMCA agreement stability

## Business Impact

Industry experts anticipate significant changes:

- US companies likely to diversify supply chains

- Potential shift away from Mexican suppliers

- Higher prices for US consumers on various goods including cars, electronics, and food products

- Continued but reduced dependence on Mexican imports

The situation remains fluid, with possible room for negotiation before the Tuesday deadline. Both nations acknowledge the importance of their trade relationship while preparing for potential economic disruption.

From an ice cream parlor in California to a medical supply business in North Carolina to a T-shirt vendor outside Detroit, U.S. businesses are bracing to take a hit from the taxes President Donald Trump imposed Saturday on imports from Canada, Mexico and China — America’s three biggest trading partners.

The levies — 25% on Canadian and Mexican and 10% on Chinese goods – will take effect Tuesday. Canadian energy, including oil, natural gas and electricity, will be taxed at a lower 10% rate.

Mexico’s president immediately ordered retaliatory tariffs and Canada’s prime minister said the country would put matching 25% tariffs on up to $155 billion in U.S. imports. China did not immediately respond to Trump’s action.

The Budget Lab at Yale University estimates that Trump’s tariffs would cost the average American household $1,000 to $1,200 in annual purchasing power.

Gregory Daco, chief economist at the tax and consulting firm EY, calculates that the tariffs would increase inflation, which was running at a 2.9% annual rate in December, by 0.4 percentage points this year. Daco also projects that the U.S. economy, which grew 2.8% last year, would fall by 1.5% this year and 2.1% in 2026 “as higher import costs dampen consumer spending and business investment.’’

“I feel bad about always having to raise prices,’’ said co-owner Zach Davis. “We were looking forward to inflation coming down, the economy stabilizing in 2025 ... Now with the tariffs, we may be back at it again.’’

Trump tariffs, Davis said, threaten to drive up the cost of the mostly made-in-China refrigerators, freezers and blenders he’ll need if Penny Ice Creamery goes ahead with plans to add to its six shops. He still has painful memories of the extra equipment costs the company had to absorb when Trump slapped massive tariffs on China during his first term.

The new tariffs will also raise the price of a customer favorite — sprinkles — which Penny Ice Creamery imports from a company in Whitby, Ontario. Tacking a 25% import tax on even something as small as that can damage a small business like his.

“The margins are so slim,’’ he said. “Being able to offer that add-on can maybe generate an additional 10 cents in profit per scoop. If a tariff wipes that out, that can really be the difference between being profitable and being break-even and even being underwater by the end of the year.’’

In Asheville, North Carolina, Casey Hite, CEO of Aeroflow Health, expects to take a hit because his company gets more than half its supplies — including breast pumps — from Chinese manufacturers, providing them to American patients through insurance plans. Aeroflow Health gets paid by insurers at pre-negotiated rates, put in place before Trump decided on his tariffs.

Hite said the tax on Chinese imports would hit the company’s finances, forcing it either to purchase cheaper and lower-quality products or pass higher costs along via higher health insurance premiums. Those might take two years to materialize, Hite said, but eventually they would hit consumers’ budgets.

“It will impact the patients,” Hite said. “In time, patients pay more for the products.”

Even the made-in-USA absorbent incontinence pads Aeroflow Health buys aren’t safe from Trump’s import taxes. They may include pulp from tariff target Canada and plastics and packaging from China, according to the Aeroflow Health, which warns of “turbulences” from the tariffs.

“Is this going to affect our business? You bet it is,’’ said Linda Schlesinger-Wagner, who owns skinnytees, a women’s apparel company in Birmingham, Michigan, north of Detroit, that imports clothing from China. She said the 10% tax would increase her costs, though she plans to absorb the extra expense instead of passing it along to customers.

“I don’t like what’s going on,’’ she said, referring to the broader impact of the tariffs. “And I think people are going to be truly shocked at the pricing they’re going to see on the cars, on the lumber, on the clothes, on the food. This is going to be a mess.’’

William Reinsch, a former U.S. trade official now with the Center for Strategic and International Studies, said that many companies that stocked up on imported goods ahead of time to avoid the tariffs. They will be able to draw on their piled-up inventories for weeks or a couple of months, delaying their customers’ pain.

George Carrillo, CEO of the Hispanic Construction Council, an industry advocacy group, said construction companies have been hoarding materials in anticipation of Trump’s actions, but he worries about the possibility of inflation spiking in three to six months.

“Once that inventory starts to get low, we’re going to start feeling the effects,” Carillo said in a phone interview Saturday, ahead of the announcement. “Developers and general contractors need to keep up with the pace and they’re going to start buying more products and it’s going to be at a higher price point.”

All that will be exacerbated by an emerging immigration crackdown that is already spooking the construction industry’s labor pool, he said.

“You put tariffs and you put workforce instability, it’s going to create major delays in projects. It’s going to create an increase in prices because of the lack of availability,” Carrillo said.

Then there are the industries that don’t have the luxury of stockpiling, including supermarkets whose farm products will spoil. So the tariff impact will show up on grocery shelves within days.

“You don’t stockpile avocados,’’ Reinsch said. “You don’t stockpile cut flowers. You don’t stockpile bananas.’’

In the tomato trading hub of Nogales, Arizona, produce vendor Rod Sbragia, who followed his father into the business nearly four decades ago, worries that the import levies will force some distribution companies out of business and “would be detrimental to the American consumer, to the choices they have at the supermarket.”

Sbragia voted for Trump in the past three elections and calls himself a “staunch Republican.” The president, he said, must not have been properly advised on the matter.

“When we’re worried about cost to consumers, inflationary pressures and the overall health of our population,’’ he asked, “why are we going to make it more difficult to get access to fresh fruits and vegetables?”

American farmers are also likely to get caught in Trump’s trade tussle with Canada, China and Mexico. The president’s supporters in rural America make a tempting target for retaliatory tariffs. That is what happened in Trump’s first term when other countries, notably China, slapped back against the president’s tariffs with levies of their own on things like soybeans and pork. In response, Trump spent billions in taxpayer money to compensate them for lost sales and lower prices.

Many farmers are now counting on the president to come through and protect them from reprisals.

“The Trump administration provided a safety net,” said former tobacco grower Lee Wicker, deputy director of the North Carolina Growers Association, a collection of 700 farms that lawfully brings in foreign temporary laborers to work the fields through a federal visa program. Many of the association’s farmers “trust him that he’s going to take care of anybody who’s hurt by the tariffs, and that’s really all that we can ask for.”

Tariffs are a tax on imports

Tariffs are typically charged as a percentage of the price a buyer pays a foreign seller. In the United States, tariffs are collected by Customs and Border Protection agents at 328 ports of entry across the country.

U.S. tariff rates vary: They are generally 2.5% on passenger cars, for instance, and 6% on golf shoes. Tariffs can be lower for countries with which the United States has trade agreements. For example, most goods can move among the United States, Mexico, and Canada tariff-free because of Trump’s US-Mexico-Canada trade agreement.

Mainstream economists are generally skeptical of tariffs, considering them a mostly inefficient way for governments to raise money and promote prosperity.

There’s much misinformation about who actually pays tariffs

President Donald Trump, a proponent of tariffs, insists that they are paid for by foreign countries. In fact, importers — American companies — pay tariffs and the money goes to the U.S. Treasury. Those companies, in turn, typically pass their higher costs on to their customers in the form of higher prices. That’s why economists say consumers usually end up footing the bill for tariffs.

Still, tariffs can hurt foreign countries by making their products pricier and harder to sell abroad. Foreign companies might have to cut prices — and sacrifice profits — to offset the tariffs and try to maintain their market share in the United States. Yang Zhou, an economist at Shanghai’s Fudan University, concluded in a study that Trump’s tariffs on Chinese goods inflicted more than three times as much damage to the Chinese economy as they did to the U.S. economy.

What has Trump said about tariffs?

Trump has said tariffs will create more factory jobs, shrink the federal deficit, lower food prices, and allow the government to subsidize childcare.

“Tariffs are the greatest thing ever invented,’’ Trump said at a rally in Flint, Michigan, during his presidential campaign.

As president, Trump imposed tariffs with a flourish — targeting imported solar panels, steel, aluminum, and pretty much everything from China.

“Tariff Man,” he called himself.

Trump has promised even more and higher tariffs in his second term.

The United States in recent years has gradually retreated from its post-World War II role of promoting global free trade and lower tariffs. That shift has been a response to the loss of U.S. manufacturing jobs, widely attributed to unfettered free trade and an increasingly powerful China.

Tariffs are intended mainly to protect domestic industries

By raising the price of imports, tariffs can protect home-grown manufacturers. They may also serve to punish foreign countries for committing unfair trade practices, like subsidizing their exporters or dumping products at unfairly low prices.

Before the federal income tax was established in 1913, tariffs were a major revenue driver for the government. From 1790 to 1860, tariffs accounted for 90% of federal revenue, according to Douglas Irwin, a Dartmouth College economist who has studied the history of trade policy.

Tariffs fell out of favor as global trade grew after World War II. The government needed vastly bigger revenue streams to finance its operations.

In the fiscal year that ended Sept. 30, the government collected around $80 billion in tariffs and fees. That’s a trifle next to the $2.5 trillion that comes from individual income taxes and the $1.7 trillion from Social Security and Medicare taxes.

Still, Trump wants to enact a budget policy that resembles what was in place in the 19th century.

Tariffs can also be used to pressure other countries on issues that may or may not be related to trade. In 2019, for example, Trump used the threat of tariffs as leverage to persuade Mexico to crack down on waves of Central American migrants crossing Mexican territory on their way to the United States.

Trump even sees tariffs as a way to prevent wars.

“I can do it with a phone call,’’ he said at an August rally in North Carolina.

If another country tries to start a war, he said he’d issue a threat:

“We’re going to charge you 100% tariffs. And all of a sudden, the president or prime minister or dictator or whoever the hell is running the country says to me, ‘Sir, we won’t go to war.’ ”

Economists generally consider tariffs self-defeating

Tariffs raise costs for companies and consumers that rely on imports. They’re also likely to provoke retaliation.

The European Union, for example, punched back against Trump’s tariffs on steel and aluminum by taxing U.S. products, from bourbon to Harley-Davidson motorcycles. Likewise, China responded to Trump’s trade war by slapping tariffs on American goods, including soybeans and pork in a calculated drive to hurt his supporters in farm country.

A study by economists at the Massachusetts Institute of Technology, the University of Zurich, Harvard, and the World Bank concluded that Trump’s tariffs failed to restore jobs to the American heartland. The tariffs “neither raised nor lowered U.S. employment’’ where they were supposed to protect jobs, the study found.

Despite Trump’s 2018 taxes on imported steel, for example, the number of jobs at U.S. steel plants barely budged: They remained right around 140,000. By comparison, Walmart alone employs 1.6 million people in the United States.

Worse, the retaliatory taxes imposed by China and other nations on U.S. goods had “negative employment impacts,’’ especially for farmers, the study found. These retaliatory tariffs were only partly offset by billions in government aid that Trump doled out to farmers. The Trump tariffs also damaged companies that relied on targeted imports.

If Trump’s trade war fizzled as policy, though, it succeeded as politics. The study found that support for Trump and Republican congressional candidates rose in areas most exposed to the import tariffs — the industrial Midwest and manufacturing-heavy Southern states like North Carolina and Tennessee.

President Donald Trump on Saturday signed an order to impose stiff tariffs on imports from Mexico, Canada and China, drawing swift retaliation and an undeniable sense of betrayal from the country’s North American neighbors as a trade war erupted among the longtime allies.

The Republican president posted on social media that the tariffs were necessary “to protect Americans,” pressing the three nations to do more to curb the manufacture and export of illicit fentanyl and for Canada and Mexico to reduce illegal immigration into the U.S.

The tariffs, if sustained, could cause inflation to significantly worsen, threatening the trust that many voters placed in Trump to lower the prices of groceries, gasoline, housing, autos, and other goods as he promised. They also risked throwing the global economy and Trump’s political mandate into turmoil just two weeks into his second term.

Trump declared an economic emergency to place duties of 10% on all imports from China and 25% on imports from Mexico and Canada. Energy imported from Canada, including oil, natural gas, and electricity, would be taxed at a 10% rate. Trump’s order includes a mechanism to escalate the rates charged by the U.S. against retaliation by other countries, raising the specter of an even more severe economic disruption.

“The actions taken today by the White House split us apart instead of bringing us together,” Canadian Prime Minister Justin Trudeau said in a somber tone as he announced that his country would put matching 25% tariffs on up to $155 billion in U.S. imports, including alcohol and fruit.

He channeled the betrayal that many Canadians are feeling, reminding Americans that Canadian troops fought alongside them in Afghanistan and helped respond to myriad crises from wildfires in California to Hurricane Katrina.

“We were always there standing with you, grieving with you, the American people,” he said.

Mexico’s president also ordered retaliatory tariffs. China did not immediately respond to Trump’s action.

“We categorically reject the White House’s slander that the Mexican government has alliances with criminal organizations, as well as any intention of meddling in our territory,” Mexican President Claudia Sheinbaum wrote in a post on X while saying she had instructed her economy secretary to implement a response that includes retaliatory tariffs and other measures in defense of Mexico’s interests.

“If the United States government and its agencies wanted to address the serious fentanyl consumption in their country, they could fight the sale of drugs on the streets of their major cities, which they don’t do, and the laundering of money that this illegal activity generates that has done so much harm to its population.”

The premier of the Canadian province of British Columbia, David Eby, specifically called on residents to stop buying liquor from U.S. “red” states and said it was removing American alcohol brands from government store shelves as a response to the tariffs.

The tariffs will go into effect on Tuesday, setting up a showdown in North America that could potentially sabotage economic growth. A new analysis by the Budget Lab at Yale laid out the possible damage to the U.S. economy, saying the average household would lose the equivalent of $1,170 in income from the taxes. Economic growth would slow and inflation would worsen — and the situation could be even worse with retaliation from other countries.

Democrats were quick to warn that any inflation going forward was the result of Trump’s actions.

“You’re worried about grocery prices. Don’s raising prices with his tariffs,” Senate Democratic leader Chuck Schumer of New York wrote in a series of posts on X. “You’re worried about tomato prices. Wait till Trump’s Mexico tariffs raise your tomato prices,” read another. “You’re worried about car prices. Wait till Trump’s Canada tariffs raise your car prices,” read another.

A senior U.S. administration official, speaking on condition of anonymity to brief reporters, said the lower rate on energy reflected a desire to minimize disruptive increases in the price of gasoline or utilities. That’s a sign White House officials understand the gamble they’re taking on inflation. Price spikes under former President Joe Biden led to voter frustration that helped return Trump to the White House.

The order signed by Trump contained no mechanism for granting exceptions, the official said, a possible blow to homebuilders who rely on Canadian lumber as well as farmers, automakers, and other industries.

The official did not provide specific benchmarks that could be met to lift the new tariffs, saying only that the best measure would be fewer Americans dying from fentanyl addiction.

The order would also allow for tariffs on Canadian imports of less than $800. Imports below that sum are currently able to cross into the United States without customs and duties.

“It doesn’t make much economic sense,’’ said William Reinsch, senior adviser at the Center for Strategic and International Studies and a former U.S. trade official. “Historically, most of our tariffs on raw materials have been low because we want to get cheaper materials so our manufacturers will be competitive ... Now, what’s he talking about? He’s talking about tariffs on raw materials. I don’t get the economics of it.’’

With the tariffs, Trump is honoring promises that are at the core of his economic and national security philosophy. But the announcement showed his seriousness around the issue as some Trump allies had played down the threat of higher import taxes as mere negotiating tactics.

The president is preparing more import taxes in a sign that tariffs will be an ongoing part of his second term. On Friday, he mentioned imported computer chips, steel, oil, and natural gas, as well as copper, pharmaceutical drugs, and imports from the European Union — moves that could essentially pit the U.S. against much of the global economy.

Trudeau warned of economic pain as the tariffs take effect and encouraged Canadians to “choose Canadian products and services rather than American ones.” But he also voiced optimism in the enduring relationship between the two countries.

“It is going to have real consequences for people, for workers on both sides of our border. We don’t want to be here. We didn’t ask for this, but we will not back down in standing up both for Canadians and for the incredibly successful relationship between Canada and the United States,” Trudeau said.

Canada is hitting back against U.S. President Donald Trump‘s tariffs with counter-tariffs worth $155 billion.

“Tonight, I am announcing Canada will be responding to the U.S. trade action with 25 percent tariffs against a $155 billion worth of American goods,” Prime Minister Justin Trudeau said on Saturday in an address to the nation.

Trudeau said this will include immediate tariffs on $30 billion worth of goods as of Tuesday, followed by further tariffs on $125 billion worth of American products in 21 days to “allow Canadian companies and supply chains to seek to find alternatives.”

Speaking to reporters, Trudeau said he has been reaching out to Trump since his inauguration but has not had the chance to speak to the American president yet.

Trudeau said Canada’s response “will be far reaching and include everyday items such as American beer, wine and bourbon, fruits and fruit juices, including orange juice, along with vegetables, perfume, clothing, and shoes.”

He said the list of tariffed goods will include major consumer products like household appliances, furniture, and sports equipment, and materials like lumber and plastics.

Canada’s response could also include non-tariff measures centered around the supply of critical minerals or energy procurement.

Asking Canadians to stand in solidarity with each other, Trudeau said, “In this moment, we must pull together.”

Trudeau urged Canadians to buy local.

“There are many ways for you to do your part. It might mean checking the labels at the supermarket and picking Canadian-made products. It might mean opting for Canadian rye over Kentucky bourbon, or forgoing Florida orange juice altogether,” he said.

Trudeau added, “It might mean changing your summer vacation plans to stay here in Canada and explore the many national and provincial parks, historical sites and tourist destinations our great country has to offer.”

Speaking in Ottawa, Trudeau also addressed the American people, warning them that Trump’s actions would put their jobs in jeopardy and raise costs south of the border.

He also made an emotional appeal by evoking the Canada-U.S. relationship.

“From the beaches of Normandy to the mountains of the Korean Peninsula, from the fields of Flanders to the streets of Kandahar, we have fought and died alongside you,” he said.

U.S. President Donald Trump signed an executive order imposing tariffs on Canadian and Mexican goods, he said in a statement on Saturday.

“I have implemented a 25% Tariff on Imports from Mexico and Canada (10% on Canadian Energy), and a 10% additional Tariff on China,” Trump said in a statement.

Trump’s executive order states that the tariffs will go into effect at 12:01 am Eastern on Tuesday, Feb. 4.

On Saturday, Trudeau chaired a cabinet meeting and hosted a virtual meeting with the provincial and territorial premiers. He also spoke with Mexican President Claudia Sheinbaum.

Trump said he was imposing tariffs because of “the major threat” of fentanyl crossing into the United States.

“We need to protect Americans, and it is my duty as President to ensure the safety of all. I made a promise on my Campaign to stop the flood of illegal aliens and drugs from pouring across our Borders, and Americans overwhelmingly voted in favor of it,” Trump said in his statement.

Trudeau reacted in a brief statement on social media.

“The United States has confirmed that it intends to impose 25% tariffs on most Canadian goods, with 10% tariffs on energy, starting February 4. I’ve met with the Premiers and our Cabinet today, and I’ll be speaking with President Sheinbaum of Mexico shortly.”

He added, “We did not want this, but Canada is prepared. I’ll be addressing Canadians later this evening.”

In a social media post in Spanish, Mexican President Claudia Sheinbaum said, “We categorically reject the White House’s slander against the Mexican government of having alliances with criminal organizations, as well as any intention of intervention in our territory.”

She added, “I propose to President Trump that we establish a working group with our best public health and security teams. Problems are not resolved by imposing tariffs, but by talking.”

This comes after weeks of Trump repeatedly warning Mexico and Canada — two of the United States’ top trading partners — that he will impose tariffs if the two countries do not end fentanyl trafficking and the flow of migrants across the U.S. border.

He has also complained about deficits in trade after both countries took steps to boost security.

The executive order also has a clause meant to deter Canada from retaliating.

“Should Canada retaliate against the United States in response to this action through import duties on United States exports to Canada or similar measures, the President may increase or expand in scope the duties imposed under this order to ensure the efficacy of this action,” the order read.

Conservative leader Pierre Poilievre called on the federal government to recall Parliament to pass an aid package and hit the U.S. with retaliatory “dollar-for-dollar tariffs.”

“That means targeting U.S. products that we can make ourselves, buy elsewhere, or do without. For example, we must retaliate against American steel and aluminum, as Canadians can make those vital products at home,” he said in a statement.

NDP Leader Jagmeet Singh said in a statement, “Today, Donald Trump has unleashed tariffs on Canada that will hurt all of us – and Americans. Now is a time for Canadians to stand strong and stand together. Our values and our solidarity will not crumble in the face of Donald Trump’s economic attack.”

How premiers are responding

Alberta premier Danielle Smith said her province will “work collaboratively with our federal government and fellow provinces on a proportionate response to the imposed U.S. tariffs.”

She added, “Alberta will, however, continue to strenuously oppose any effort to ban exports to the U.S. or to tax our own people and businesses on goods leaving Canada for the United States. Such tactics would hurt Canadians far more than Americans.”

Ontario Premier Doug Ford said he was “extremely disappointed.”

“Canada now has no choice but to hit back and hit back hard,” he said in a statement.”

“The coming days and weeks will be incredibly difficult. Trump’s tariffs will devastate our economy. They’ll put 450,000 jobs at risk across the province. Every sector and region will feel the impact.”

Nova Scotia Premier Tim Houston announced a range of retaliatory measures at the provincial level. He said Nova Scotia will limit access to provincial procurement for American businesses. As of Monday, the cost of tolls at the Cobequid Pass will double for commercial vehicles from the United States.

He also directed the Nova Scotia Liquor Corporation to remove all alcohol from the United States from their shelves as of Tuesday.

British Columbia Premier David Eby said, “It is a declaration of economic war.”

“Effective today, I have directed BC Liquor stores to stop buying American liquor,” he said.

Other premiers also reacted sharply to the news.

“I join Canadians across the country condemning the unjustified tariffs the U.S. introduced on Canadian products,” said Newfoundland and Labrador Premier Anthony Furey, urging Canadians to buy local.

Manitoba Premier Wab Kinew said, “So Trump built a wall, but it’s a wall targeting us. Trump’s tariff tax is an attack on Canada and who we are.”

The Canadian Chamber of Commerce called news of the tariffs “profoundly disturbing.”

“Tariffs will drastically increase the cost of everything for everyone: every day these tariffs are in place hurts families, communities, and businesses,” Candace Laing, the chamber’s CEO and president, said in a statement.

Experts have warned that tariffs by the United States and counter-tariffs from Canada could put inflationary pressure on both economies. For certain goods like fresh fruits and vegetables, prices could start rising almost immediately, economists warned.

Former Bank of Canada governor and Liberal leadership candidate Mark Carney said in a statement that he supports “dollar-for-dollar retaliatory tariffs aimed where they will be felt the hardest in the United States but will have the least impact in Canada.”

“At the same time, we need a coordinated strategy to boost investment and to support our Canadian workers through what will be a difficult moment,” he said.

“Over the medium term, if we can no longer rely on American neighbors, we must diversify our trading relationships and build new sources of jobs and growth based on our immense resources, our talented people, and their innovation and industry.”

Liberal leadership candidate Chrystia Freeland, the former federal finance minister, urged the government to impose $200 billion worth of retaliatory tariffs.

“I would include on that list 100 percent tariffs on Teslas. I would include on that list tariffs on whiskey, cheese, on dairy from the U.S. so that those Wisconsin dairy farmers who voted for Trump see themselves on the list, call up the White House, and say, ‘Wait a minute, this is not what we voted for. We did not vote to lose our jobs and lose our markets.'”

Trudeau had warned the United States of a “forceful but reasonable immediate response.”

A day before that looming measure, Trudeau met with the Committee on Internal Trade, made up of premiers and federal officials under the Canadian Free Trade Agreement, in Toronto on Friday.

In his opening remarks before the meeting, Trudeau said Canada is in a “critical moment” after Trump doubled down on his threat Thursday, saying that a 25 percent tariff on goods coming from Canada and Mexico would be imposed on Saturday.

“If the president does choose to implement any tariffs against Canada, we’re ready with a response — a purposeful, forceful but reasonable immediate response,” Trudeau said.

“It’s not what we want but if he moves forward, we will also act,” he added. “We’re ready for whatever scenario comes forward.”

Is Canada heading for a recession?

Tu Nguyen, an economist at RSM Canada, said U.S. tariffs and a response from Canada could likely see the Canadian economy contract by two per cent – a sharp contrast to the projected 1.8 per cent growth rate for 2025.

She said Canada could head into a recession, including job losses and inflation.

“They (tariffs and counter-tariffs) would also lift inflation from the current 2 per cent to a 2.7 per cent headline number, as some of the increased costs from tariffs are passed onto Canadian consumers,” she said.

Nguyen said Canada will likely see lower demand for “all goods and services like new cars, dining out and entertainment.”

The auto sector in the U.S., Canada, and Mexico will be particularly hard hit, she said, with the industry losing out to competitors in Europe and Asia.

“The scenario in which economic damage is minimized is one in which a trade agreement is negotiated, putting an end to tariffs. The longer tariffs and retaliation continued, the more fractured and uncompetitive the three countries’ economies became — and the more economic pains consumers would feel from higher prices, fewer goods available, and fewer jobs,” she said.