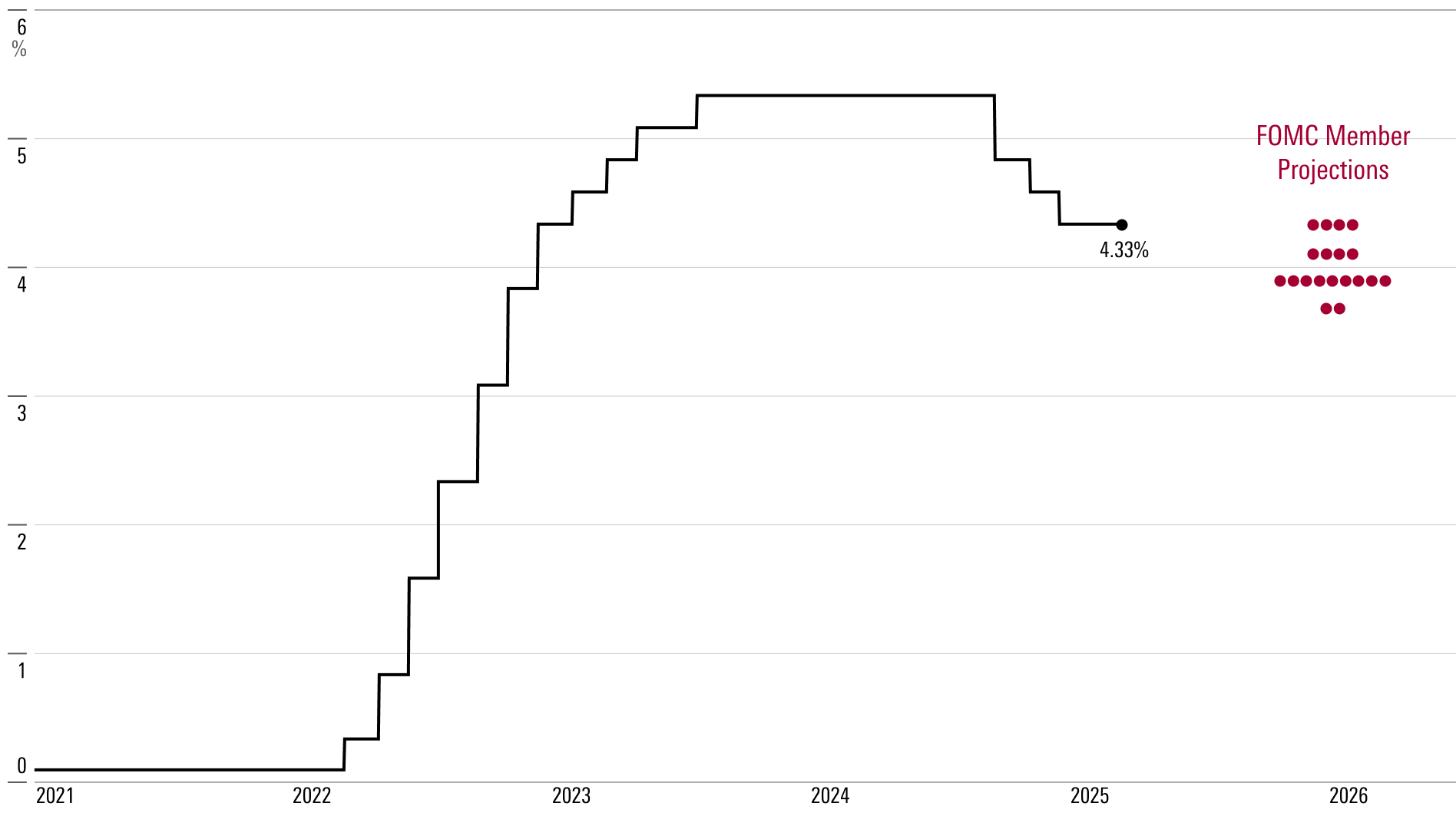

As widely expected, the Federal Reserve kept interest rates unchanged at Wednesday’s meeting. The federal-funds rate has been in the target range of 4.25%-4.50% since last December. The central bank cut by 1 percentage point from September to December 2024. That follows the period from July 2023 to September 2024, when rates were at 5.25%-5.50%. That rise from near 0% during the covid-19 pandemic constituted the largest rate hike in over 40 years.

Even with the downward adjustment last autumn, rates are still well above the prepandemic (2017-19) average of 1.7%. That divergence sets the expectation that the Fed will eventually enact further cuts. If the neutral interest rate is anywhere near its low prepandemic level, continued healthy economic growth will require lower rates.

But the timing of further cuts has been thrown into confusion by sticky inflation, especially the threat of a shock from tariff hikes. Additionally, changes in fiscal policy and regulation could be macroeconomically significant.

The FOMC stuck to its median projection of two rate cuts for 2025, followed by two more in 2026—unchanged from projections released last December. When pressed to substantiate the committee’s thinking, Fed Chair Jerome Powell essentially threw up his hands in exasperation. Given the near impossibility of anticipating where tariff policy will go, he rhetorically quipped, “What would you write down?” He suggested the extreme uncertainty around tariffs led many members to simply default to their existing forecasts.

All this should lead us to treat the FOMC forecast with a grain of salt. If further large tariffs are locked in place, the bank may throw its 2025 plan out the window.

Federal Funds Rate: Historical Data and FOMC Projections

Powell did provide a reasonable justification for the committee’s base case. The prospect of tariffs and some residual inflation stickiness in the opening months of the year has led the expected core PCE inflation in the fourth quarter of 2025 to rise to 2.8% year over year from 2.5%. Meanwhile, expectations for real GDP growth dipped to 1.7% from 2.1%, and the Fed isn’t expecting the inflationary impact of tariffs to persist. Altogether, that calls for an unchanged path for the federal funds rate.

But as Powell is fully aware, tariffs could have larger, longer-lasting inflationary impacts than current Fed projections incorporate. He acknowledged that it’s “too soon to say” whether tariffs’ impact on inflation could persist beyond a one-time shock, which depends on how much inflationary expectations are unanchored from the Fed’s 2% target.

Our take is that outside of China, the tariff threat should prove more fizzle than pop. Conditional on that, we expect inflation to run below the Fed’s projection in 2025, which is why we call for a full three rate cuts in 2025. Continued deceleration in economic growth and inflation should then lead to four more cuts in 2026.

The Fed doubled down on the wait-and-see approach following the March FOMC meeting. Keeping rates unchanged isn’t surprising, but participants’ assessments of risks shifted dramatically since December last year.

In the Summary of Economic Projection, the FOMC participants indicated they expect higher inflation, slower real GDP growth, and higher unemployment in 2025. The revisions to the outlook suggest rising pains for households this year.

⚖️ What’s striking is their near unanimity in their assessments of risks — a notable shift from December last year:

- 18 out of 19 participants indicated downside risks to real GDP growth

- 17 out of 19 participants indicated upside risk to the unemployment rate

- 18 out of 19 participants indicated upside risks to core PCE inflation

While the "median" of the participants still expect two cuts by the end of 2025, the probability of additional rate cuts this year has gone down. Four participants expect no change, an increase from one in the previous meeting.

The economic outlook is getting cloudier fast. Holding steady seems to be the right approach, but forecasts are meant to change as new information becomes available. The Fed will have a chance to adapt as uncertainty stemming from fiscal and trade policies gradually clears.

The Federal Reserve opted to maintain its key interest rate at 4.25% - 4.5% during its March session. Although the rates are steady for now, the Fed reiterated its anticipation of two rate reductions in 2025, aligning with earlier forecasts.

The market reacted favorably, with the Dow Jones Industrial Average experiencing a notable uptick post-announcement. Fed Chair Jerome Powell highlighted that any future policy shifts will hinge on economic factors, such as inflation patterns and overall market health.