A U.S. appeals court on Friday said the Trump administration could temporarily implement a ban on diversity, equity, and inclusion programs at federal agencies and businesses with government contracts, which had been blocked by a judge.

With so much chaos and uncertainty in the job market, I want leaders and their teams to advocate boldly and more directly.

I wish this @WSJ article on being passed up for promotions could have been punchier. Some key points are missing.

Want a promotion? This is about the relationship you have with your manager. That person is the reason you didn't get promoted.

If we assume that you have the hard and soft skills, the EQ, have shown your contributions to help the org hit its goals, and you've asked for a promotion, then you didn't get promoted because of your boss.

Many people miss this: the path to promotion doesn’t start when you ask for a promotion. It starts the moment you take the job.

Do you start asking for a promotion on day one? Of course not.

But it's a relationship you're building with someone who has to know how to advocate for you and wants to do so.

You need to learn (fast) if your manager:

-Is interested in hearing about your successes

-Is building relationships with their peers

-Is learning from you

-Is recognized for developing talent

Learn about this person. Train them to learn about you. Train them to build a relationship with you.

A weak boss = a stalled career.

If they aren’t advocating for you, I think they're holding you back.

Convenience stores are one of the clearest, yet often overlooked, economic indicators. When consumer behavior shifts at the pump or checkout, it’s a real-time signal of broader financial pressures—often faster and more telling than traditional surveys. As Doug Haugh highlighted, the latest data shows a sharp drop in c-store sales, signaling deeper concerns about discretionary spending and consumer sentiment. But beyond just a dip in snack and cigarette sales, this shift could have lasting implications for industry consolidation, pricing strategies, and operational resilience.

Convenience stores have long been an underappreciated economic barometer—a canary in the coal mine for consumer sentiment. They serve as the everyday person's “third place,” making them uniquely positioned to reflect shifts in discretionary spending.

Several key trends emerge. C-stores operate at a premium, but when “convenience” gives way to “cost,” foot traffic declines. More customers are now pumping gas and leaving without stepping inside—a stark reversal of industry efforts spanning decades.

The performance gap between major chains (Circle K, 7-Eleven, Wawa, Inc.) and independents will widen. Historically, downturns accelerate consolidation, and we may be entering another wave. Well-capitalized players will strengthen their position while smaller operators struggle. C-stores are now the dominant brand, with fuel names offering diminishing differentiation beyond pricing.

Expect this trend to persist—if not accelerate—in a downturn. Expansion from chains like Casey's, QuikTrip, and Buc-ee's, Ltd.’s may cool, with capital spend deferred until conditions favor acquisitions.

Macroeconomic signals reinforce the concern. Rising consumer debt, savings depletion, and default rates point to fragility. Policymakers must balance spending constraints carefully—history shows government stimulus fuels inflationary cycles, creating volatility.

Operational optimization will be critical. Sophisticated players—7-Eleven being a standout—will lean into cost efficiency, pricing strategy, and value-driven innovation. High-traffic locations will remain resilient, but smaller sites (under 250,000 gallons/month) will struggle. Those who own both fuel and retail will have more pricing leverage, while fuel-only operators face constraints.

The aggressive push for EV infrastructure is also pulling back, as automakers and policymakers temper expectations. This puts greater emphasis on operators with high-volume locations and multi-product dispensers (MPDs), which remain best positioned to capture demand. Those reliant on low-margin fuel or single-revenue streams will feel the most pressure.

The C-store industry has been here before. Those with scale, strategy, and discipline will weather the storm, but the warning signs are flashing—another economic cycle is unfolding.

Always nice to end a volatile week on a high note! Below are the key points from our latest CIO Alert covering today’s rally (full report below).

-Stocks rallied sharply on Friday following news that a government shutdown might be avoided, although equities remain down for the week.

-While we don’t view today’s news on the shutdown as a big economic positive, it provides some optimism about the ongoing reconciliation process that will decide tax cuts and spending decisions for years to come.

-Overall, we view the economic backdrop as supportive of an equity market recovery. The labor market remains healthy, which should underpin solid consumer spending.

-We believe the negative survey sentiment is largely overdone, while the significant downward move in the Atlanta Fed GDPNow tracker is mostly being distorted by a larger trade deficit (due to a surge in gold imports).

-Our core message remains to stay invested in stocks, with a focus on the US, AI, and power and resources. Although hedging exposure and remaining diversified will be key as downside risks have increased and tariff-related volatility likely won’t go away in the near term.

The vote came after Senate Democrats spent several days agonizing over whether to back a bill they disliked or torpedo it and trigger the first government shutdown since 2019.

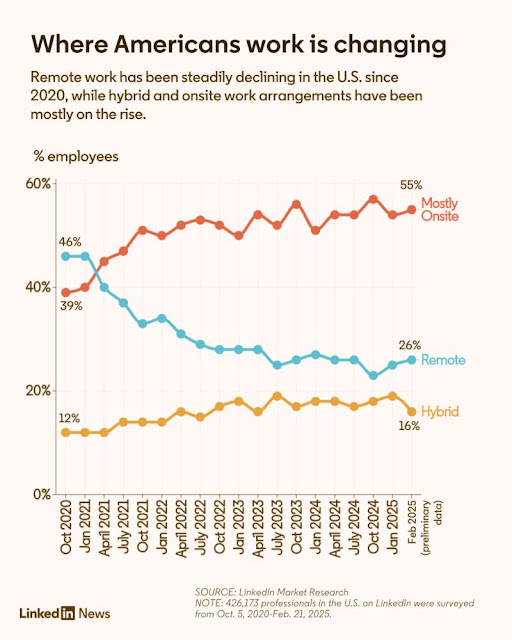

It's been five years since the pandemic forced many professionals to stay home and spurred organizations to experiment with a primarily remote workforce. But many workplaces that went remote have since swung back around: LinkedIn's latest Workforce Confidence survey shows the rate of remote work in the U.S. has been steadily declining since 2020. Meanwhile, hybrid and onsite work arrangements are both mostly on the rise.

Remote employment was at its height in late 2020; 46% of employees were remote in October 2020, while 12% were hybrid and 39% were working mostly onsite. Since then, the rate of remote work has dropped to 26% this February. Hybrid work is up, but still far from eclipsing onsite employment: Just 16% of workers have hybrid schedules today, while more than half (55%) are mostly onsite.

How important is flexibility to you in deciding where to work? What other factors do you weigh the most when considering a new role?

The latest one comes courtesy of Reuters, who claims this new model, supposedly codenamed E41 will be a smaller Model Y, costing 20% less. Translating that into English, this means a premium C-SUV with an entry price of around €35k (using Model Y's entry price in Germany).

Curiously, this figure is considerably lower than what we see in the premium C-SUV segment today and falls bang in the middle of the C-SUV price range.

Obviously we need to be careful with rumors - and many rumors about Tesla have proven wrong in the past. However, if Reuters got it right, this seems like the typical downsizing exercise the German 3 played decades ago. It would be easy to see this model as a good source for additional volume.

However, this may not come without its challenges. One needs to see how far does Tesla go with the 'low cost' treatment... In addition, there is also a possibility this car would partially cannibalize Model Y sales, which would not be intended by the brand.

In any case, it should take just a few months longer until we get to see the real deal, providing timelines don't slide.

I recently opened Netflix and tried to watch "Saturday Night," only to realize it was unavailable on my ad-supported plan. I could upgrade and get access to additional shows and better quality, but that would cost $10 more a month. This is premiumization at its finest.

For years, streaming giants Netflix, Max, and Disney+ were not profitable due to high content costs and user churn. However, 2024 was a game-changer. These companies turned the tables, making profits and focusing on investor happiness. But it's the consumers who are paying the price.

From Netflix raising prices to Spotify considering a new premium plan, the trend is clear - more exclusive content for a higher subscription fee. This model is working, thanks to the tiered pricing strategy.

As Professor Z. John Zhang from Wharton says, tiered pricing democratizes access. It's a choice - those willing to pay more, get more.

The question is, how long can the average consumer keep up?

Share your thoughts below or get in touch to discuss how these changes are impacting the industry.