The U.S. economy has gotten off to a rocky start in 2025 — and President Donald Trump's rapid-fire announcements on tariffs, spending cuts, and mass federal layoffs are adding to the tumult. A decent February jobs report shows the labor market is holding up. But for how long?

Job growth was weaker than expected in February as the Trump administration began to slash the federal workforce.

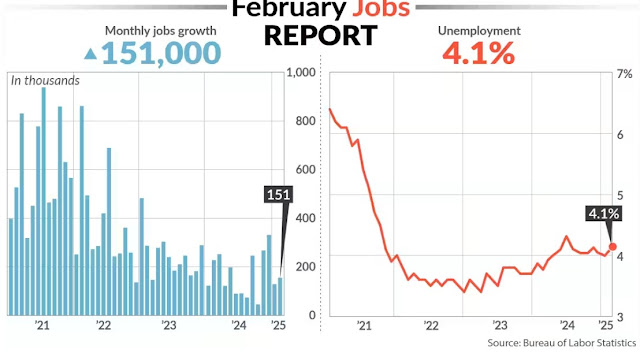

Nonfarm payrolls increased by a seasonally adjusted 151,000 on the month, better than the downwardly revised 125,000 in January but less than the 170,000 consensus forecast from Dow Jones, the Labor Department’s Bureau of Labor Statistics reported Friday. The unemployment rate edged higher to 4.1%.

The report comes amid efforts from Elon Musk’s Department of Government Efficiency to pare down the federal government, starting with buyout incentives and including mass firings that have impacted multiple departments.

Though the reductions likely won’t be felt fully until the coming months, the efforts are beginning to show. Federal government employment declined by 10,000 in February though government payrolls overall increased by 11,000, the BLS said.

Health care led the way in job creation, adding 52,000 jobs, about in line with its 12-month average. Other sectors posting gains included financial activities (21,000), transportation and warehousing (18,000), and social assistance (11,000).

On wages, average hourly earnings increased 0.3%, as expected, though the annual increase of 4% was a bit softer than the 4.2% forecast.

Stock market futures moved higher following the report while Treasury yields were lower.

Maria Bartiromo on a weaker than expected February jobs report: "The jobs picture is weakening. Weaker than expected jobs again in the month of February tells you that the Fed is gonna cut rates!" pic.twitter.com/fBsFnEwCoN

— Aaron Rupar (@atrupar) March 7, 2025

"It's a Goldilocks print," RSM economist @joebrusuelas says on the February jobs report. "We really only need to add about 100,000 to 150,000 jobs a month to keep the employment stable. That's exactly what happened." pic.twitter.com/aYlE7iAScR

— Yahoo Finance (@YahooFinance) March 7, 2025