Novartis to Invest $23B in U.S.-Based Infrastructure

Swiss pharmaceutical giant Novartis has announced a significant investment of $23 billion to expand its manufacturing and research operations in the United States over the next five years.

This initiative aims to ensure that all key Novartis medicines for U.S. patients are produced domestically, enhancing supply chain resilience and supporting the company’s growth in the U.S. market.

Key Highlights of the Investment:

Facility Expansion: The investment will fund the development of ten facilities, including seven new sites. This encompasses six new manufacturing plants nationwide and a new research and development hub in San Diego, California.

Job Creation: Novartis anticipates creating approximately 1,000 new jobs within the company and around 4,000 additional jobs across the U.S.

Product Focus: The new facilities will enhance the production of various pharmaceutical products, including biologics, small molecules, and radioligand therapies, particularly in oncology, immunology, neuroscience, and cardiovascular, renal, and metabolic diseases.

Strategic Locations: Two of the new manufacturing sites will be located in Florida and Texas, focusing on next-generation cancer therapies.

This substantial investment aligns with the U.S. government’s emphasis on strengthening domestic pharmaceutical manufacturing. While Novartis CEO Vas Narasimhan acknowledged that potential tariffs on imported drugs were a consideration, he clarified that they were not the primary driver behind the expansion. Vas Narasimhan

The move reflects Novartis’s commitment to bolstering its U.S. presence and ensuring a robust, localized supply chain for its key medicines. It also underscores the company’s focus on innovation and its dedication to meeting the healthcare needs of U.S. patients through enhanced research and manufacturing capabilities

Novartis

Vas Narasimhan

At first glance, this tariff war might seem like a loud, political move. But when you look closer, there’s more to it. Here’s how it could affect the real estate market:

For years, the U.S. has had to face more trade barriers than most other countries.

For example, the EU charges 10% on imports of U.S. cars, while the U.S. has only been charging 2.5% on its auto imports.

That could be why you don’t see many Cadillacs in Europe, but plenty of BMWs in the U.S.

That’s just one example of many that have led to a loss of countless good-paying manufacturing jobs here in the U.S.

Take steel mills, for example. Steel mills that used to exist here in places like Chicago are gone. Much of that production moved overseas, where labor is cheaper, and countries like China subsidize their manufacturing to make it more efficient.

What these tariffs aim to do is level the playing field.

If it becomes more expensive to import, companies will have more reason to manufacture their products here instead of shipping from abroad.

For example, car manufacturers might find it cheaper to build a plant in the U.S. than to pay higher tariffs.

That means more jobs will be created.

And ultimately,

More jobs = more demand for housing

Especially in areas like the Midwest and the South, where a lot of these manufacturing plants are likely to be built or repurposed.

We were already seeing momentum before the tariff announcements:

▶︎ Taiwan Semiconductor Manufacturing Company has pledged an additional $100 billion investment on top of their initial $65 billion commitment made last year to expand chip manufacturing facilities in the U.S., bolstering domestic semiconductor production.

▶︎ Novartis, the Swiss pharmaceutical giant,t plans to invest $23 billion to develop and expand ten facilities in the U.S., including six new manufacturing plants. This initiative is expected to create over 4,000 U.S. jobs.

▶︎ Eli Lilly announced plans to invest $27 billion to build four new manufacturing plants in the U.S. over the next five years. This is in addition to the $4.5 billion investment announced last year.

▶︎ Apple is planning to invest $500 billion in the U.S. over the next four years in various sectors.

Why is all of this happening now?

There are many reasons, but COVID made it clear how vulnerable our supply chains are. It showed how much we rely on other countries to produce products we use every day.

One of the primary goals now is to address this vulnerability:

To build more here, so we’re not caught off guard again.

And personally, I’m not so much interested in the political noise or how abrupt the execution may have been.

I’m watching where the capital is flowing, where the jobs are being created, and where new demand for housing could emerge.

If it brings manufacturing jobs back to the U.S., that’s going to help the real estate markets I’m looking at.

For years, the U.S. has had to face more trade barriers than most other countries.

For example, the EU charges 10% on imports of U.S. cars, while the U.S. has only been charging 2.5% on its auto imports.

That could be why you don’t see many Cadillacs in Europe, but plenty of BMWs in the U.S.

That’s just one example of many that have led to a loss of countless good-paying manufacturing jobs here in the U.S.

Take steel mills, for example. Steel mills that used to exist here in places like Chicago are gone. Much of that production moved overseas, where labor is cheaper, and countries like China subsidize their manufacturing to make it more efficient.

What these tariffs aim to do is level the playing field.

If it becomes more expensive to import, companies will have more reason to manufacture their products here instead of shipping from abroad.

For example, car manufacturers might find it cheaper to build a plant in the U.S. than to pay higher tariffs.

That means more jobs will be created.

And ultimately,

More jobs = more demand for housing

Especially in areas like the Midwest and the South, where a lot of these manufacturing plants are likely to be built or repurposed.

We were already seeing momentum before the tariff announcements:

▶︎ Taiwan Semiconductor Manufacturing Company has pledged an additional $100 billion investment on top of their initial $65 billion commitment made last year to expand chip manufacturing facilities in the U.S., bolstering domestic semiconductor production.

▶︎ Novartis, the Swiss pharmaceutical giant,t plans to invest $23 billion to develop and expand ten facilities in the U.S., including six new manufacturing plants. This initiative is expected to create over 4,000 U.S. jobs.

▶︎ Eli Lilly announced plans to invest $27 billion to build four new manufacturing plants in the U.S. over the next five years. This is in addition to the $4.5 billion investment announced last year.

▶︎ Apple is planning to invest $500 billion in the U.S. over the next four years in various sectors.

Why is all of this happening now?

There are many reasons, but COVID made it clear how vulnerable our supply chains are. It showed how much we rely on other countries to produce products we use every day.

One of the primary goals now is to address this vulnerability:

To build more here, so we’re not caught off guard again.

And personally, I’m not so much interested in the political noise or how abrupt the execution may have been.

I’m watching where the capital is flowing, where the jobs are being created, and where new demand for housing could emerge.

If it brings manufacturing jobs back to the U.S., that’s going to help the real estate markets I’m looking at.

While seemingly brushing aside the US tariff war with the "there is no market acceptance for US goods exported to China" comment, China is redoubling its effort to position itself vis-a-vis the rest of the world as the dependable and responsible economic partner.

Its immediate focus is on redirecting international trade, technology, and institutional relationships toward China while also stepping up efforts to develop an alternative international payment architecture.

The longer the current global configuration persists, the higher the probability of China's efforts gaining traction, further undermining the post-WW2 global order with the US at its core.

Its immediate focus is on redirecting international trade, technology, and institutional relationships toward China while also stepping up efforts to develop an alternative international payment architecture.

The longer the current global configuration persists, the higher the probability of China's efforts gaining traction, further undermining the post-WW2 global order with the US at its core.

🚨 Navigating the Shifting Sands of U.S.-China Trade Relations 🌍

China's recent tariff adjustments have sent ripples through the global economy. The increase to 125% on U.S. goods is more than just a number—it's a strategic move with multilayered implications.

➡️ Here's my take:

1. Beyond Economics: This isn't solely about trade; it's about geopolitical positioning. China aims to showcase its economic resilience and self-reliance in a rapidly changing world.

2. Supply Chain Realities: While decoupling is a buzzword, the intricate dependencies in global supply chains mean a swift exit is unrealistic.

3. Opportunity for Innovation: Disruptions often spur innovation. Businesses must adapt by exploring new markets, technologies, and partnerships.

China's recent tariff adjustments have sent ripples through the global economy. The increase to 125% on U.S. goods is more than just a number—it's a strategic move with multilayered implications.

➡️ Here's my take:

1. Beyond Economics: This isn't solely about trade; it's about geopolitical positioning. China aims to showcase its economic resilience and self-reliance in a rapidly changing world.

2. Supply Chain Realities: While decoupling is a buzzword, the intricate dependencies in global supply chains mean a swift exit is unrealistic.

3. Opportunity for Innovation: Disruptions often spur innovation. Businesses must adapt by exploring new markets, technologies, and partnerships.

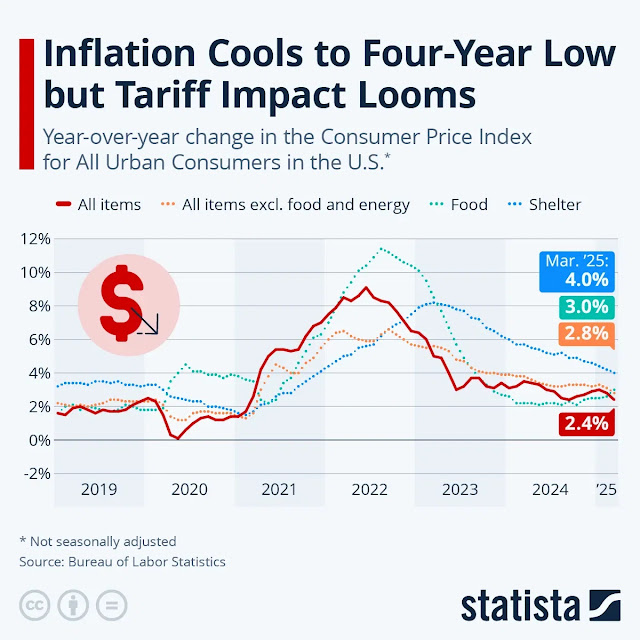

Jerome Powell’s impressive soft landing only leads to more hard choices. The Federal Reserve chairman’s feat leading an effort to tame runaway U.S. inflation, which dipped to 2.4% as of March, without inducing a recession, is in jeopardy of coming undone because of President Donald Trump’s trade war. Having channeled his hero Paul Volcker, who oversaw the central bank under Presidents Jimmy Carter and Ronald Reagan, to subdue prices, Powell may yet get an opportunity to use his ideas on stagflation, too.

Economic tension has been mounting. Before Trump backtracked on tariffs, temporarily reducing many of them to 10% on Wednesday, investors were anticipating cheaper money. Futures markets signaled the probability of a full percentage point reduction in the benchmark federal funds rate this year, to a range of 3.25% to 3.5%. The outcome clashed with most broker estimates. Nomura’s team, for one, was forecasting just one cut, and not until December.

The White House is also applying pressure. Ahead of Trump’s so-called Liberation Day, he was goading Powell to lower borrowing costs. “He is always ‘late,’” the president posted on social media, “but he could now change his image, and quickly.”

Powell pushed back. The tariffs were higher than anticipated, Powell said last week, and they could spark “persistent” inflation beyond the initial price shock. His colleagues on the Federal Open Market Committee agreed. Chicago Fed President Austan Goolsbee called the levies on U.S. imports a “negative supply shock” with unclear effects, while Fed governor Adriana Kugler spoke of the “essential” task of keeping inflation expectations anchored. In other words, make sure consumers don’t get spooked and create a self-fulfilling prophecy.

The comments suggest the Fed is wary of acting before the data becomes clearer. When inflation flared at the end of the last year, Powell also endured criticism for having cut interest rates in November. Now, with the March consumer price index dropping to its lowest level since 2021, there will be fresh howls for the FOMC to act.

There are many scenarios for Powell to consider. If debt investors sustain their revolt against Washington’s unpredictability and apply a risk premium to U.S. Treasuries, the Fed may be pressed into buying them to help keep U.S. coffers full. Trump also could try to fire Powell, which would force him to defend the central bank’s independence more forcefully while simultaneously contending with any market misgivings.

Although Trump largely folded on tariffs, for now, they remain more than high enough to weigh on growth and aggravate prices, especially with a 145% rate on goods from China, the third-largest U.S. trading partner, in place. Any signs of stagflation will send Powell back to the Volcker playbook.

In the 1970s, oil supply shocks helped spark broader inflation and crimped economic output. Instead of tackling prices, the Fed under Chairman Arthur Burns yielded to political pressure from President Richard Nixon and kept interest rates low, an unsuccessful strategy that achieved neither stronger economic output nor price stability.

When Volcker took over in 1979, the central bank pushed interest rates beyond 20% at the expense of growth and employment. It led to a painful recession, but one that eventually stabilized public perceptions and restored GDP expansion. Powell speaks of the example often.

Economists, on average, are not expecting the U.S. economy to have grown much, if at all, in the first quarter, and JPMorgan analysts anticipate a recession this year. Investors are scared, with the CBOE Volatility Index, or the VIX, trading at levels only seen during the 2008 financial crisis and the pandemic. The dollar is weakening, bond yields are rising, and tariffs remain a looming inflationary threat. Powell will be keeping his Volcker guide close.

U.S. inflation eased to 2.4% in March, the lowest annual rate since 2021, the U.S. Bureau of Labor Statistics said on April 10.

President Donald Trump urged Federal Reserve Chairman Jerome Powell on April 4 to cut the benchmark federal funds rate amid a growth scare over the White House's widespread tariffs.

Trump on April 9 abruptly reversed course on part of his trade war, temporarily dialing back levies on goods from many countries for 90 days to allow room to negotiate lower trade barriers. He also increased the duty on Chinese goods to 145%.

Donald Trump has suspended U.S. tariffs above 10% on imports from countries other than China. Investors let out a collective sigh of relief. Still, the events of recent weeks show that the president is serious about pushing the interests of his political base at the expense of Wall Street. His administration is also promising to reduce the U.S. trade and fiscal deficits. Trump’s policies pose an existential threat to the American bubble economy. As Japan discovered three decades ago, there’s no easy escape.

A bubble economy is one in which the financial sector crowds out the real economy. Asset prices become severely inflated and detached from their underlying fundamentals. Companies are managed to maximise financial returns rather than market share. As asset prices rise, capital gains replace genuine savings. A bubble economy is sustained by continuously rising debt, which is mostly used for financial purposes rather than investment. Credit growth also boosts corporate profits.

The United States meets that description. The contribution of its finance, insurance, and real estate sector to GDP has doubled since 1945, while that of manufacturing has shrunk by more than half. In recent years, U.S. stocks have traded at near record valuation levels. By the end of last year, aggregate household wealth stood at 5.7 times GDP, far above its long-term average. Savings are around half their long-term average level. Last year, total debt (private, public and financial) exceeded $100 trillion, more than three times U.S. national income. Companies and private equity firms spend trillions of dollars on share repurchases and leveraged buyouts, but corporate investment has been relatively weak.

Capital inflows into the United States have helped to sustain the bubble economy. Foreigners currently own $57 trillion of U.S. financial assets, according to Federal Reserve data. Their purchases of American financial securities have kept down bond yields and raised stock prices. Capital inflows have helped to finance the U.S. government’s massive fiscal deficits. These deficits in turn have boosted aggregate demand, contributing directly and indirectly to record U.S. corporate profits, according to John Hussman of Hussman Funds.

America’s bubble economy is politically troubled. Its financial gains have been unequally distributed. Household wealth may be close to an all-time high but, as Treasury Secretary Scott Bessent has pointed out, the top 10% of Americans own 88% of U.S. equities while the bottom 50% are mired in debt. Furthermore, what the former hedge fund manager calls the “highly financialized economy” has not been conducive to strong wage growth. Sending manufacturing jobs offshore was good for corporate profit margins but hurt blue-collar workers.

The bubble economy is inherently fragile. Debt cannot indefinitely continue to rise faster than income. Sooner or later, fiscal deficits must be reined in, or the country will go bust. In Bessent’s view, the U.S. has become addicted to government spending. A “detox period” is necessary he says. Stephen Miran, chairman of the Council of Economic Advisers, believes that large capital inflows into the United States have resulted in a continuously overvalued dollar, which has hurt competitiveness and is responsible for its large trade deficits. Tariffs are intended to reverse these pressures.

Neither Trump nor his economic advisers explicitly acknowledge that they are trying to pop the bubble economy. But that’s what their actions amount to. As Julien Garran of MacroStrategy Partnership points out in his latest note, if Trump is serious about unwinding the long-running squeeze on blue-collar workers, this means unwinding decades of policies that have been super-friendly to financial capital.

The labour share of national income will have to rise at the expense of corporate profits. Reining in fiscal deficits would also hurt corporate profits. Slapping tariffs on imports and forcing more companies to manufacture in the United States puts further pressure on bottom lines. If corporate profits shrin,k then the stock market, which is still trading at a historically elevated valuation, could have much further to fall. Once capital gains are replaced by losses, households will have to save more, further depressing aggregate demand. A vicious cycle could replace the virtuous one that kept the bubble economy afloat.

Richard Duncan of MacroWatch fears that reduced foreign demand for American securities could push up long-term U.S. interest rates. He is also concerned about a potential run on the dollar as foreigners reduce their holdings of U.S. financial securities.

A singular advantage of issuing the world’s reserve currency is that the United States has long been able to run vast trade and fiscal deficits without losing the market’s confidence. Yet earlier this week, yields on U.S. Treasury bonds spiked. The bond market rout raised concerns that the Trump administration could be facing its own “Truss moment”, a reference to the short-lived administration of British Prime Minister Liz Truss, whose large projected fiscal deficits triggered a collapse in the UK gilts market in September 2022.

Bessent expects a “smooth transition” as policies shift to favour Main Street at the expense of Wall Street. Recent market turmoil suggests otherwise. Besides, the experience of Japan suggests that restructuring a bubble economy is a fraught process.

During the second half of the 1980s, Japanese real estate and stocks rose to extreme valuations. Debt surge, and financial engineering enhanced corporate profits. Towards the end of the decade, policymakers in Tokyo decided to change course. The Bank of Japan hiked interest rates to burst the bubble. A senior official told the Washington Post that “the real productive economy won’t be hurt. Land and wealth won’t disappear, but phony wealth will.” This was wishful thinking. The collapse of Japan’s bubble economy was followed by several banking crises and two “lost decades” of economic growth.

At the beginning of this year, the U.S. stock market accounted for 64.4% of the total world value according to the UBS Global Returns Yearbook. By coincidence, Japan’s stock market in 1988 accounted for the same share of the MSCI EAFE Index, which tracks stocks in developed countries in Europe, the Middle East, and the Asia-Pacific region. Over the following decade, Japan’s weight in the benchmark dropped by more than two-thirds. Investors in U.S. stocks should take note.

Unconventional times may call for conventional investment solutions. And with widespread tariff anxiety continuing to fuel extreme volatility in financial markets, these certainly qualify as unconventional times. This morning’s economic data releases only add to the swirl of uncertainty, with the Producer Price Index (PPI) showing more good news on the inflation front but the University of Michigan’s Consumer Sentiment Index sinking like a stone as inflation expectations soared to levels not seen since the early 1980s, and a deteriorating consumer outlook flashed “multiple warning signs that raise the risk of recession,” according to the survey release. Bottom line: Expect market volatility to remain elevated while these fears persist.

Even the “good” inflation prints - both today’s PPI and yesterday’s CPI - reflected a “bad” development: Cooling prices are being driven by plummeting demand for energy amid mounting concern that tariffs will lead to a global economic slowdown.

Even the “good” inflation prints - both today’s PPI and yesterday’s CPI - reflected a “bad” development: Cooling prices are being driven by plummeting demand for energy amid mounting concern that tariffs will lead to a global economic slowdown.

Although the Trump administration reigned in “Liberation Day” tariff levels for nearly all countries (ex-China), we think a universal 10% levy could add 1% to the core PCE Price Index (the Federal Reserve’s preferred inflation barometer) in 2025, and deliver a -1.5% hit to GDP.

I had the opportunity to address these topics on yesterday‘s edition of Bloomberg TV “Markets.” Special thanks to host Vonnie Quinn for inviting me to participate in the discussion on how policy uncertainty may affect the economy and financial markets, and where investors may want to consider deploying cash in these unconventional times: To higher-quality, defensive areas that traditionally have proved resilient during periods of sticky inflation, slowing economic growth and broader market downturns. Dividend growth stocks and municipal bonds are among the asset classes we currently favor.

U.S. Customs and Border Protection says it has fixed a glitch in its computer system that left authorities unable to collect tariffs for more than 10 hours. According to Customs, the entry codes that allow shippers to apply for duty-free status temporarily stopped functioning. The snafu came as businesses, shippers, and officials alike are scrambling to adjust to swiftly evolving trade policies.

What a week in markets! I think I captured all our emotions watching this week’s price action in the pic below. I joined Bloomberg TV’s The Close with Alix Steel and Scarlet Fu yesterday to share some thoughts on what we’re seeing, and how investors can think about positioning in this evolving environment.

Here are a few key takeaways from the conversation:

➡️ Uncertainty remains high: We’re still navigating an environment of slow growth and persistent inflation — stagflation risks are in play, so positioning for volatility is key

➡️ ETFs play a critical role: In the last week, ETFs accounted for as much as 42% of total equity market trading volume, offering flexibility and access during volatility

➡️ Record fixed income ETF volumes: Bond ETFs saw record turnover, underscoring their role in providing liquidity during this week’s market stress

➡️ Long-duration bonds no longer provide the same diversification: With the long end of the bond market not reliably diversifying equity risk, we believe investors should consider new ways to build diversification into their portfolios

➡️ Defend and diversify: In this kind of environment, it’s important to think about portfolio resilience. That means considering hedges like gold, minimum volatility strategies, and market-neutral strategies

Here are a few key takeaways from the conversation:

➡️ Uncertainty remains high: We’re still navigating an environment of slow growth and persistent inflation — stagflation risks are in play, so positioning for volatility is key

➡️ ETFs play a critical role: In the last week, ETFs accounted for as much as 42% of total equity market trading volume, offering flexibility and access during volatility

➡️ Record fixed income ETF volumes: Bond ETFs saw record turnover, underscoring their role in providing liquidity during this week’s market stress

➡️ Long-duration bonds no longer provide the same diversification: With the long end of the bond market not reliably diversifying equity risk, we believe investors should consider new ways to build diversification into their portfolios

➡️ Defend and diversify: In this kind of environment, it’s important to think about portfolio resilience. That means considering hedges like gold, minimum volatility strategies, and market-neutral strategies

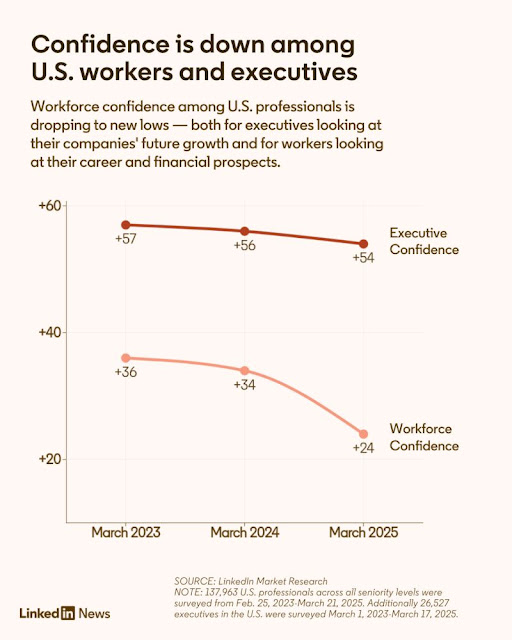

Economic uncertainty means employees and executives alike are feeling less confident about their futures.

According to the latest findings of LinkedIn's Workforce Confidence survey and Executive Confidence survey, optimism is down across the org chart — both for leaders considering their companies' future growth and for employees weighing their career and financial prospects.

The drop in confidence from last year to this year is most dramatic for professionals overall. Worker confidence (which is scored on a scale from -100 to +100 and includes workers at all seniority levels) dropped two points from its March 2023 reading of +36, and another 10 points from 2024 to the present. Scoring is based on factors like how confident workers feel in their abilities to hold onto their jobs or find a new one, to keep progressing in their careers, and to keep improving their financial situations.

Meanwhile, leaders' confidence in their companies has also been dropping: from +57 in March 2023 to +56 in 2024, and down to +54 today. Executive confidence is scored based on how business leaders feel about the future of their organizations, including profitability and the ability to attract the right talent.

Do these findings line up with what you’d expect? What steps are you taking to stay motivated on the job and plan your next career moves?

According to the latest findings of LinkedIn's Workforce Confidence survey and Executive Confidence survey, optimism is down across the org chart — both for leaders considering their companies' future growth and for employees weighing their career and financial prospects.

The drop in confidence from last year to this year is most dramatic for professionals overall. Worker confidence (which is scored on a scale from -100 to +100 and includes workers at all seniority levels) dropped two points from its March 2023 reading of +36, and another 10 points from 2024 to the present. Scoring is based on factors like how confident workers feel in their abilities to hold onto their jobs or find a new one, to keep progressing in their careers, and to keep improving their financial situations.

Meanwhile, leaders' confidence in their companies has also been dropping: from +57 in March 2023 to +56 in 2024, and down to +54 today. Executive confidence is scored based on how business leaders feel about the future of their organizations, including profitability and the ability to attract the right talent.

Do these findings line up with what you’d expect? What steps are you taking to stay motivated on the job and plan your next career moves?

Tesla is no longer taking orders in China for two U.S.-made car models amid an escalating trade war between the two countries. While the Model S sedan and Model X sport utility vehicle represent just “a fraction” of Tesla’s sales in China, per Bloomberg, their removal adds to the company’s already precarious position in the country as it loses market share to local rival BYD. Tesla CEO Elon Musk has advocated for free trade.

When Samsung Electronics (005930.KS) chairman Jay Y. Lee met Vietnam's prime minister in July, and he had a simple message to convey.

"Vietnam's success is Samsung's success, and Vietnam's development is Samsung's development," Lee told Pham Minh Chinh, pledging long-term investment to make the country its biggest manufacturing base for display products.

Since the South Korean conglomerate entered Vietnam in 1989, it has poured billions of dollars into expanding its global manufacturing footprint beyond China. Many of its peers followed after U.S. President Donald Trump placed tariffs on Chinese goods in his first term.

The pioneering move has made Samsung Vietnam's biggest foreign investor and exporter.

About 60% of the 220 million phones Samsung sells each year globally are made in Vietnam, and many are destined for the U.S., where Samsung is the No. 2 smartphone vendor, according to research firm Counterpoint.

Now, that reliance on Vietnam threatens to backfire as Hanoi is racing to negotiate with the Trump administration to lower a punishing potential 46% tariff that has exposed the vulnerability of the Southeast Asian country's export model.

While Vietnam and Samsung won a reprieve this week after Trump paused the rate at 10% for 90 days, Reuters interviews with more than a dozen people, including at Samsung and its suppliers, show the company would be a primary victim should higher U.S. tariffs take effect in July.

"Vietnam is where we produce most of our smartphones, but the tariffs (initially) came out much higher than expected for the country, so there's a sense of confusion internally," said a Samsung executive, who, like some others, was granted anonymity to discuss a sensitive subject.

Even if the two countries reach an agreement, Vietnam's roughly $120 billion trade surplus with the U.S. has put it in the sights of a U.S. administration targeting such imbalances. Hanoi hopes to get the duties reduced to a range of 22% to 28%, if not lower, Reuters has reported.

Amid the uncertainty, Samsung and its suppliers are considering adjusting production, said four people familiar with the matter. That could involve increasing output in India or South Korea, though such steps would be costly and time-consuming, they said.

Samsung declined to comment about how it is navigating the tariff threat. It has said previously it would respond flexibly to U.S. tariffs with its global supply chain and manufacturing footprints.

Vietnam's foreign and industry ministries also didn't reply to requests for comment.

Samsung's rival Apple (AAPL.O) faces an even bigger challenge at least in the short term, as Trump's tariffs on Chinese imports have increased to 145%. Apple imports around 80% of iPhones sold in the U.S. from China, according to Counterpoint. Apple didn't reply to a request for comment.

LOSING LOW-COST APPEAL

The tariff fear is the latest cloud over the manufacturing landscape in Vietnam, which has become a popular destination for companies looking to diversify amid China-U.S. tensions.

But the boom has contributed to power supply problems. Vietnam has also increased its effective tax rate on large multinationals in line with OECD-led global standards, which some companies complained came without adequate compensation for the loss of earlier tax incentives.

Further, the influx of foreign companies tightened the supply of skilled workers and increased wage costs, according to several South Korean firms based in Vietnam. One person described the situation as "very serious".

Mounting pressures could cost Vietnam investment appeal relative to other countries, according to some economists.

"Vietnam's loss could be India's gain," Nomura economists said in a note.

India wants to move quickly on a trade deal with the U.S., a government official said on April 10. The two countries agreed in February to work on the first phase of a deal to be concluded late this year.

Vietnam has already made concessions to the U.S., including increasing imports. It was among the first countries to announce the start of trade talks with the Trump administration after the moratorium on "reciprocal" tariffs.

But foreign manufacturers are nervous.

Ko Tae-yeon, chairman of the Korea Chamber of Business in Vietnam, said that initially there was "panic" about Trump's tariffs.

Some had made plans to cut staff at local factories, he said, without specifying. In light of Trump's pause, companies were now in "wait and see mode", added Ko, who is director general of Heesung Electronics, a supplier of LG Display.

Samsung has not made a decision on how to respond to the Vietnam tariffs given Trump's changing approach, but one option is to produce some U.S.-bound smartphone models at its factory in the South Korean city of Gumi, two of the people said.

Four people said Samsung could boost production in India, but it would first need to expand its smartphone supply chain there, as India can currently handle only around 20% of Samsung's total output.

BMI Research, a subsidiary of Fitch Solutions, estimates that electronics products account for roughly 45% of Vietnam's exports to the U.S., and major producers like Samsung would likely reduce production in anticipation of a decline in demand.

Samsung also makes TVs, home appliance,s and device screens in Vietnam. Its exports amounted to around $54 billion last year, around 15% of Vietnam's total, government estimates show.

As Samsung weighs its options, worries are rippling through factory floors.

"I am afraid they may cut everything," said Nguyen Thi Hao, a 39-year-old worker at a Samsung plant in Thai Nguyen, north of Hanoi.

Investors hoping for an end to wild market swings were reminded on Thursday that fallout from U.S. President Donald Trump's shifting tariff plans remains a threat to earnings and the economy, and could deal yet more punishment to equities.

Relief over Trump's move on Wednesday to pull back on some of his heftiest global tariffs proved somewhat short-lived. Investors were unsettled by the escalating trade battle with China, the second-biggest provider of U.S. imports, while the president's 90-day pause on hefty levies elsewhere meant the tariff cloud was not going away anytime soon.

"The worst-case scenario on trade has been avoided, but it's not all as fine and dandy as we'd like it to be," said Michael Brown, senior research strategist at Pepperstone. "We've built in 90 days' worth of humongous uncertainty now."

The S&P 500 (SPX) down 3.5% on Thursday, after falling more than 6% during the session. A day earlier, the benchmark index soared 9.5%, which was its biggest one-day rise since October 2008 during the heart of the financial crisis. It is now down 14.3% from its February 19 record high.

While Trump's move on tariffs opens the door to de-escalation, "that's not going to happen overnight," said Angelo Kourkafas, senior investment strategist at Edward Jones.

Volatility spiked higher again on Thursday, with the Cboe Volatility Index (VIX) rising to as much as nearly 55 points, more than three times its median long-term level. The index, known as Wall Street's "fear gauge", in the past week has delivered some of its most elevated readings since the start of the COVID-19 crisis five years ago.

The stock market has seen enormous swings since Trump announced his sweeping tariffs on April 2. On Wednesday, the S&P 500's 10.7% intraday range marked the fifth-largest one-day swing in at least the last fifty years. That stunning market rebound came after the index had been on the brink of confirming a bear market, sliding nearly 20% from its February high.

Investors who may have regretted not selling earlier in the market's decline could have been taking advantage of Wednesday's huge gains to unload holdings on Thursday, said Sameer Samana, head of global equities and real assets at the Wells Fargo Investment Institute.

[1/3]A trader works on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., April 11, 2025. REUTERS/Brendan McDermid Purchase Licensing Rights

The selloff "shows you how many people are thinking, we're just not sure what is going to happen next, so we're going to just take the money and run," Samana said.

ECONOMY WORRIES REMAIN

Even as Trump eased back on the harshest trade measures for now, investors still worried about the fallout for the economy.

"The drag from trade policy is likely to be somewhat less than before... (but) we still think a contraction in real activity later this year is more likely than not," JPMorgan analysts said.

Despite the 90-day pause, the fact that there is a baseline 10% tariff and other tariffs such as those on autos remain in place is not a good scenario, said Adam Hetts, global head of multi-asset at Janus Henderson.

"Recession risk is much, much higher now than it was a couple weeks ago," Hetts said. He is advising investors to cut stock holdings and buy more investment-grade sovereign bonds as tariffs threaten to slow global growth.

As companies start reporting quarterly results in the coming days, investors are bracing for executives to offer little clarity about their outlooks because of the uncertain trade environment.

In light of the sweeping tariffs, any details from companies about their supply chains and investment plans will be valuable, said Marta Norton, chief investment strategist at retirement and wealth services provider Empower. Any earnings disappointments posed a risk for stocks, Norton said, especially in light of the new trade regime corporations now face.

"There's room for downside surprise," Norton said.

.webp)