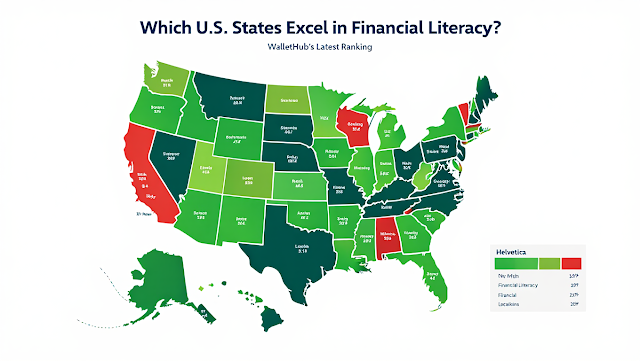

Knowing how to manage money—think budgeting, saving, or dodging debt traps—is a skill not everyone masters. A new WalletHub study, released on April 8, 2025, ranks all 50 U.S. states and Washington, D.C., on financial literacy, spotlighting where residents handle their cash smartest. Using 17 metrics like credit scores, savings habits, and financial education, the report crowns some clear winners—and exposes a few laggards.

How They Measured It

WalletHub’s team crunched the numbers across two big buckets: knowledge and education (think high school finance courses and Google searches for money tips) and behavior (like sticking to budgets or paying bills on time). They pulled data from sources like TransUnion and the U.S. Census Bureau, scoring each state out of 100. The higher the score, the savvier the state.

The Top Performers

Utah snagged the No. 1 spot with a score of 79.12, thanks to its residents’ knack for saving and low credit card debt. Mandatory financial literacy classes in high schools didn’t hurt either. Right behind it, Virginia (76.45) flexed strong budgeting skills and solid credit scores, while Colorado (74.89) shone with high retirement savings rates. New Hampshire (74.23) and Minnesota (73.91) rounded out the top five, blending education with practical money habits.

Other standouts? New Jersey (73.67), Nebraska (73.12), Washington (72.98), North Carolina (72.45), and Iowa (71.89). These states mix book smarts—think finance googling—with real-world wins like low foreclosure rates.

The Strugglers

At the bottom, New Mexico lagged with a dismal 51.23, dragged down by spotty financial education and shaky credit habits. Alaska (54.67) and Mississippi (55.12) didn’t fare much better, with high debt loads and late payments plaguing residents. Nevada (56.34) and Oklahoma (57.89) also trailed, reflecting weaker savings and planning chops.

What’s Driving the Divide

WalletHub’s analysts point to education as a game-changer. States requiring personal finance in schools—like Utah and Virginia—tend to outshine those that don’t. Culture plays a role too: thrifty Midwest states like Nebraska often edge out spendier coastal ones. But it’s not all rosy up top. Even high-ranking states face gaps, like Colorado’s middling credit card debt rank despite its savings prowess.

Why It Matters

Financial literacy isn’t just trivia—it shapes everything from homeownership to retirement. With 78% of Americans living paycheck to paycheck (per a 2024 survey), and student debt topping $1.7 trillion, mastering money is more urgent than ever. States at the bottom could learn from the leaders: more education and better habits might lift their scores—and their residents’ wallets.

WalletHub’s takeaway? “Knowledge is power, but applying it is what counts.” Whether you’re in savvy Utah or struggling New Mexico, the data’s a nudge to brush up on the basics—your bank account might thank you.